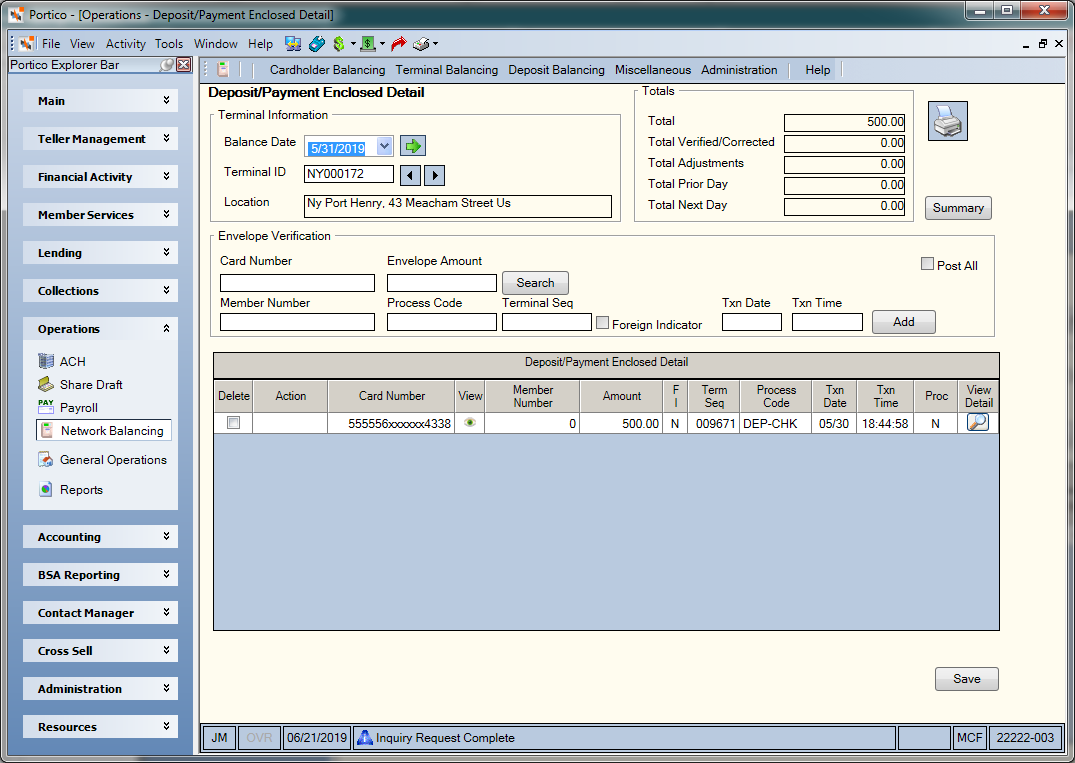

Verifying and Posting Deposits

The Deposit/Payment Enclosed Detail window lets you verify, add, and post deposits. The Deposit/Payment Enclosed Detail window displays a detailed list of all deposits that occurred for a specific business date at each ATM terminal. Before you can post a deposit you must verify the deposit by comparing the amount listed on the Deposit/Payment Enclosed Detail window with the actual amount in the envelope.

To access the Deposit/Payment Enclosed Detail window, click Network Balancing within the Operations menu on the Portico Explorer Bar. On the Network Balancing top menu bar, click Deposit Balancing, then click Deposit/Payment Enclosed Detail.

How do I? and Field Help

Click the Balance Date down arrow to select the business date from the pop-up calendar or enter a date in MM/DD/YYYY format. Then, click the green arrow to view the deposits that occurred for that date.

The Terminal ID field displays the unique ID that identifies the ATM terminal (Length: 9 alphanumeric). Click the left and right arrows to scroll through all the ATM terminals. The location of the ATM terminal appears below the terminal ID.

Before you can post a deposit you must verify the deposit by comparing the amount listed on the Deposit/Payment Enclosed Detail window with the actual amount in the envelope. The Envelope Verification group box lets you search for a specific deposit, verify the deposit, add a deposit if necessary and post a deposit.

To search for a deposit, enter the card number associated with the deposit in the Card Number field (Length: 19 numeric). The card number associated with the deposit or payment. This number consists of the ISO number, a filler (if the ISO number is only 16 digits), and the number specified in the Account ID field on the ATM Card Maintenance dialog box. All digits of the card number will be masked, except for the first 6 digits and last 4 digits of the number. To view a member’s card number, users must be assigned to the Portico – User Can View PAN security group. You can also add the Portico – User Can View PAN permission to a credit union-defined security group using the Security Group Permissions – Update window.

Then, enter the amount enclosed in the envelope in the Envelope Amount field (Length: 9 numeric including decimal). Click Search. If the cardholder number is found and the envelope amount matches the amount listed, Portico will display the matching record at the top of the list. Click Save to verify the deposit. If the envelope amount does not match the amount listed, Portico will display the record that matches the cardholder number at the top of the list, highlight the record, and display a message that the transaction needs to be corrected. If an incorrect card number is entered, the error message CARD NUMBER DEPOSIT/PAYMENT ENCLOSED RECORD DOES NOT EXIST appears.

The following information appears in the Deposit/Payment Enclosed Detail grid. Click the printer icon to print the information in the Deposit/Payment Enclosed Detail grid.

| Column Heading | Description | ||

|---|---|---|---|

|

Delete |

Select the Delete check box and click Save to delete a deposit on the Deposit/Payment Enclosed Detail window. |

||

|

Action |

Click the down arrow and select:

|

||

|

Card Number |

The cardholder number associated with the original transaction. This number consists of the ISO number, a filler (if the ISO number is only 16 digits), and the number specified in the Account ID field on the ATM Card Maintenance dialog box. All digits of the cardholder number will be masked, except for the first 6 digits and last 4 digits of the number. To view a member’s cardholder number, users must be assigned to the Portico – User Can View PAN security group. You can also add the Portico – User Can View PAN permission to a credit union-defined security group using the Security Group Permissions – Update window. Length: 19 numeric |

||

|

View |

Portico partially masks cardholder numbers. You can click the icon button to display a pop up window containing the cardholder number. Portico will log each time a user clicks the icon button to view a cardholder number in the View Sensitive Data Audit report. The Portico – User Can View PAN security permission is required to view a cardholder number. |

||

|

The member number associated with the original transaction. Length: 12 numeric |

|||

|

Amount |

The amount of the transaction. Length: 12 numeric including decimal |

||

|

Indicates if the transaction was processed by a foreign cardholder. If N, the transaction was processed by an on-us cardholder. Y - Foreign Cardholder N - On-Us Cardholder |

|||

|

The sequence number associated with the ATM transaction. This number comes from the CNS reports, the host ATM reports, and the member's receipts. Length: 6 numeric |

|||

|

The transaction code associated with the network transaction. The system will use this code to determine which Host system transaction to use when posting the transaction through the Network ATM Maintenance window. The letter R following the ATM transaction code indicates that the transaction is a reversal transaction. The following table shows the ATM code and the description for that transaction:

|

|||

|

The local date based on the terminal where the transaction actually occurred. Length: 4 numeric / Format: MMDD |

|||

|

The local time based on the terminal where the transaction actually occurred. Length: 6 numeric / Format: HHMMSS |

|||

|

Proc |

The transaction’s current status code. The valid values are: A - The deposit/payment enclosed has been manually added and is considered a next day deposit/payment enclosed item. The transaction amount will be added to the Next day total on the 5Deposit/Payment Enclosed Detail window. V - The deposit/payment enclosed has been verified. The amount enclosed in the envelope matches the amount entered at the ATM terminal. C - The deposit/payment enclosed has been corrected. The amount in the envelope did not match the amount keyed at the machine and the Deposit Correction window was used to correct the members account. P - The deposit/payment enclosed has been posted to the general ledger. R - The deposit/payment enclosed has been reversed. |

||

|

View Detail |

Click the icon button in the View Detail column to display the Deposit Correction window and correct the deposit. |

Verifying a Deposit

After you have confirmed that the amount displayed on the Deposit/Payment Enclosed Detail window is the actual amount of the deposit or payment in the envelope, click the Action down arrow and select Verify. Then, click Save to verify the deposit. A V will appear in the Proc column to indicate that the deposit was verified.

Adding a Deposit

To add a deposit to the Deposit/Payment Enclosed Detail window, enter the card number, envelope amount, member number, process code, transaction date and transaction time in the blank fields in the Envelope Verification group box. Click Add. An A will appear in the Proc column field to indicate that the deposit was added to the Deposit/Payment Enclosed Detail window.

Un-Verifying a Deposit

To un-verify a deposit on the Deposit/Payment Enclosed Detail window, click the Action down arrow and select un-Verify. Then, click Save.

Deleting a Deposit

To delete a deposit on the Deposit/Payment Enclosed Detail window, select the Delete check box and click Save. Only deposits that were manually added may be deleted.

Posting a Specific Deposit

To post a specific deposit on the Deposit/Payment Enclosed Detail window, click the Action down arrow and select Post. Then, click Save. Portico will post the amount of the deposit to the general ledger accounts listed on the ATM Network Settlement Rules window. A P will appear in the Proc column to indicate that the deposit has been posted. A deposit must be verified before it can be posted.

Posting All Deposits

To post all deposits listed on the Deposit/Payment Enclosed Detail window, select the Post All check box and click Save (Keyword: PS). Portico will post the total amount of the deposits to the general ledger accounts listed on the ATM Network Settlement Rules window. A P will appear in the Proc column of each deposit to indicate that the deposits have been posted.

Correcting a Deposit

To correct a deposit or payment that does not match the actual amount in the envelope, enter the card number in the Card Number field and the actual amount enclosed in the envelope in the Envelope Amount field. Click Search. The deposit in error will appear at the top of the list. Click the icon button in the View Detail column to display the Deposit Correction window and correct the deposit.

Click Summary to display the Deposit/Payment Summary dialog box and view the total count and amount of all on-us deposit/payment enclosed amounts, all foreign cardholder deposit/payment enclosed amounts, and next day deposit information.

The Totals group box displays the totals for the selected ATM terminal and business date:

- Total - The total amount of deposits and payments for a specific ATM terminal.

- Total Verified/Corrected - The total amount of deposits and payments for a specific ATM terminal that have been verified or corrected.

- Total Adjustments - The total amount of corrections made to members accounts. This is the total of the actual amounts entered to adjust member accounts to reflect the correct deposit payment amount.

- Total Prior Day - The total amount of deposits and payments received after the previous business day's cut-off time.

- Total Next Day - The total amount of deposits and payments received after the business day cutoff time.

: To post the deposits, Portico will use the Transactions - Teller Sales/General Ledger tab to post the deposits to the designated general ledger accounts.

- Financial Transaction Register Report 420

- Terminal Depository Detail Report TD11

Portico Host: 58D