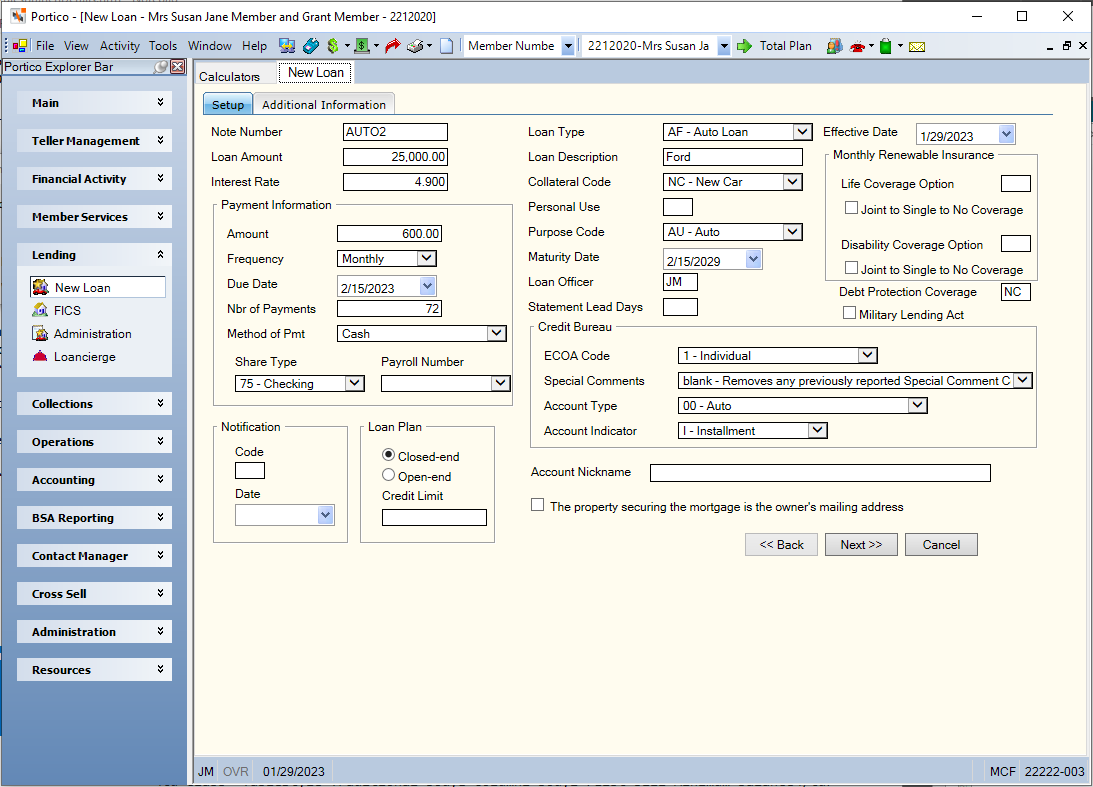

Setting Up the New Loan

The New Loan - Setup tab establishes a new loan for a member. If the individual receiving the loan is not a credit union member, add the individual as a new member using New Member & Services before completing the New Loan - Setup tab. To access the New Loan - Setup tab, select New Loan in the Lending menu on the Portico Explorer Bar. Then, select the Setup tab.

How do I? and Field Help

To set up a new loan, complete the following fields:

| Field | Description | ||

|---|---|---|---|

|

The specific number assigned to this loan. The note number is unique and identifies a specific loan for this member. Length: 6 alphanumeric |

|||

|

The principal amount due on the loan. Length: 12 numeric including decimal |

|||

|

The annual interest rate used to calculate the interest due on the loan. Interest due is based on the loan principal for a specified time period. The interest rate can be equal to or greater than zero but less than 36.500. The value must be 0.00 for loans that support 360-day interest. Any change to this field can impact loan calculations or delinquency. Length: 6 numeric including decimal Keyword: IR |

|||

|

Click the down arrow to select the specific type of loan. |

|||

|

The description of the loan. Length: 17 alphanumeric |

|||

|

The credit union-defined collateral code which can be used for reporting purposes. This field can be customized using the Customized Fields window. Length: 2 alphanumeric Keyword: CL |

|||

|

The credit union-defined purpose code which can be used for reporting purposes. This field can be customized using the Customized Fields window. Length: 2 alphanumeric Keyword: PC |

|||

|

The credit union-defined code which can be used for reporting purposes. Length: 1 alphanumeric Keyword: PU |

|||

|

Click the down arrow to select a date from the pop-up calendar or accept the default teller date. Dividend and interest calculations are based on this date. While future effective dating is not allowed on most transactions, you can specify a future effective date on the Truth-In-Lending dialog box. Also, effective dating into a prior dividend period is not allowed. If you access the Truth-In-Lending dialog box for an existing loan, the date in the Date Interest Last Calculated field on the Loans - Interest/Charges tab will appear in this field. Keyword: ED |

|||

|

The maturity date or final payment due date of the loan, indicating when the loan should be paid off. The Truth in Lending window calculates this date, but does not automatically update this field. Click the down arrow to select the maturity date from the pop-up calendar or enter the date in MM/DD/YYYY format. For those loan types using Late Charge Method W, Wisconsin Late Charges, the maturity date will be used so that no late charges will be calculated and taken for the final loan due date or any payments thereafter. For mortgage loans, the system produces the Mortgage Loans Maturing Report 626 based on this date. If you do not complete this field, you will not receive the 626 Report. Keyword: MD |

|||

|

The loan officer who approved the loan. The valid values are credit union-defined. Length: 2 alphanumeric Keyword: LO Security Permissions/Groups: Loans - Field - Loan Officer - Maintain/Lending - Manager and Lending - Officer |

|||

|

The number of days prior to the loan’s payment due date used to calculate the date when the following can occur:

The Statement Lead Days field will initially be blank. You can enter a value or leave the field blank to use the default value defined on the Loan Profiles – Account Information tab and Loan Profiles – Recalculations tab. You can change the Statement Lead Days field for a specific loan as needed if the loan payment frequency is monthly or greater. If the loan payment frequency is less than monthly, the following rules apply:

If the value in the Statement Lead Days field is greater than the number of days in the month, statements will be generated and recalculation will occur on the loan payment due date. The process will not occur before the loan’s previous payment due date. For example, if the Statement Lead Days field is 30, loans with a March 15 due date will have statements generated and recalculation occur on February 15th which is 28 days before March 15th. A loan type may support loan billing statements where the Statement Lead Days field is 00. A value of 00 indicates that the loan type does not support cyclical recalculation and that loan billing statements will be produced at month end. For mortgage loan statements, the value must be greater than 00. The valid values are: 00 – 31 Length: 2 numeric |

|||

|

The scheduled payment amount on the loan. Changes to this field can impact delinquency calculations. Length: 9 numeric including decimal Keyword: SP |

|||

|

Click the down arrow to indicate the payment time interval on the loan. On monthly (360 day) interest loans, the frequency field must be Monthly. The valid options are: 0 - Term or one time payment 1 - Weekly 3 - Bi-weekly 5 - Semi-monthly 6 - Semi-annually 7 - Monthly - system default on a new loan 8 - Annually 9 - Quarterly Weekly and Bi-weekly are not valid for a loan type with payment type 007 and calculation options of B, F or P. Single Pmt / Term is not valid for all payment type 007 loans. Changes to this field can impact delinquency calculations. Keyword: PF |

|||

|

Click the down arrow to select the date the first scheduled payment is due from the pop-up calendar or enter the date in MM/DD/YYYY format. The date is advanced when a full payment is made against the loan. The Frequency field determines the next payment due date. On monthly (360 day) interest loans, the Due Date field must be on the first day of the month. Changes to this field can impact delinquency calculations. If you access the Truth-In-Lending dialog box for an existing loan, the due date from the Loans - Payment tab will appear in this field. Keyword: PD |

|||

|

The number of scheduled payments remaining to pay off the loan. This field is automatically reduced for each full payment made. The valid value may range from zero through 999. Length: 3 numeric Keyword: NP |

|||

|

Click the down arrow to indicate the method of payment for the loan. The system default is specified on the Credit Union Profile - Loans tab. The valid options are: C - Cash P - Payroll deduction. System default. S - Payroll deduction. The New Loan - Payroll Information tab appears automatically if a payroll record exists for the member and you did not specify a new payroll number in the Payroll Number field or a share type in the Shares field. The New Loan - Payroll Information tab appears even if the frequency of the loan payment and the payroll are not the same. A - Automatic transfer. The Supported field in the Auto Transfer section on the Credit Union Profile - Loans tab must specify Y. The default value for the Method of Pmt field is specified in the Payment Method field on the Credit Union Profile - Loans tab. Keyword: PI |

|||

|

The share type to be assigned to the member's payroll deduction record, the share type to be accessed by the automatic transfer program, or the payroll excess share type. Click the Share Type down arrow to select the share account. You only need to specify a share type for a payroll-paid loan if the member does not currently have a payroll deduction record established for the payroll specified in the Payroll Number field. The Method of Pmt field must specify A - Automatic Transfer if the payment is to be made by automatic transfer. If you do not specify a share type, the system defaults to the member's lowest-numbered share type for automatic transfers. The morning after the transfer activity occurs, the system lists all members with automatic transfers on the 266 Report. The system will deposit any amount remaining after distributions are made to the specified share type if the member does not have an 099 priority code. If the member has an 099 priority code, the system will post the excess shares to the member and account specified. Keyword: PS |

|||

|

If you selected Payroll Deduction in the Method of Pmt field, click the Payroll Number down arrow to select the payroll group number. If the payroll does not exist for the member, click the Share Type down arrow to select the share account that should be used in conjunction with the payroll. Length: 3 numeric |

|||

|

The credit union-defined code specifying the purpose of the notify date. Length: 1 alphanumeric Keyword: NF |

|||

|

Click the down arrow to select the credit union-defined notify date from the pop-up calendar or enter the date in MM/DD/YYYY format. The notify date appears on the Loan Notification Report 702. The date can be used for notification and reviews. For example, open-end collateral reviews, credit limit reviews and single interest insurance reviews. Keyword: ND |

|||

|

Select the Closed-end option or Open-end option to indicate whether the loan is a closed or open-end loan. The system default is specified in the Plan Code field on the Credit Union Profile - Loans tab. Keyword: PL |

|||

|

The maximum loan balance allowed on the loan. This is a whole dollar field with no decimal. If the credit limit is not entered on a new loan, the system will default to the loan balance if the Open-end option is selected and blank if the Closed-end option is selected. On an open-end loan, the loan balance is not allowed to exceed the credit limit. An override teller ID can perform an advance on any loan. The Adjust Credit Limit check box on the Loan Profiles – Account Information tab determines whether the credit limit will be decreased by the loan advance amount. The credit limit can be a negative amount if an advance is made that is greater than the current credit limit. If the Adjust Credit Limit check box is not selected on the Loan Profiles – Account Information tab for the loan type, Portico will allow you to enter a value that is less than the loan balance, including 0.00. Length: 9 numeric Keyword: LM |

|||

|

Click the down arrow to select the ECOA code that indicates how a loan is reported to the credit bureau. The valid options are: 0 - Omit from credit bureau reporting 1 - Individual (this individual has contractual responsibility for this account and is primarily responsible for its payment) 2 - Joint Contractual Liability (account for which both customer and joint borrower are contractually liable) 5 - Co-maker or Guarantor (not available when booking a new loan in Portico) 7 - Maker (co-maker liable if maker defaults) T - Terminated (not available when booking a new loan in Portico) W - Commercial / Business. Be sure to set the Address Indicator to B if W is selected. (not available when booking a new loan in Portico) X - Deceased (not available when booking a new loan in Portico) Z - Delete Customer (not available when booking a new loan in Portico) If the ECOA Code field is T, X or Z, the loan will be reported to the credit bureau one last time before no longer being reported. For Courtesy Pay loans, only values 0 and 1 are valid. The Metro 2 format is used to report consumer loans and borrowers to the credit bureaus. If the loan has an ECOA Code of W - Commercial/Business, Portico will report the first borrower with an address and an ECOA Code of 2, 5, T, X or Z in the base segment of the credit bureau transmission. If there is no borrower record with an address, the owner will be reported in the base segment of the credit bureau transmission and the loan will appear in the Exceptions section of the 350 Report. An ECOA Code of W is intended to be used when a consumer is personally liable for a business account and reported on the J2 Segment - Associated Consumer – Different Address. Keyword: RA Reporting Analytics: Loan ECOA Code (Loan folder > Loan Base query subject and Month-end Information > Loan Month-End > ME Loan Base query subject) |

|||

|

Select the Associated Credit Bureaus, Inc. Special Comment Code. This description is used in conjunction with the Status field to further define the account for credit bureau reporting. The valid options are: Blank - Removes any previously reported special comment code B - Account payments managed by Credit Counseling Service C - Paid by co-maker H - Loan assumed by another party I - Election of remedy M - Account closed at credit grantor's request O - Account transferred to another lender S - Special Handling. Contact credit grantor for additional info V - Adjustment pending AB - Debt being paid through insurance AC - Paying under a partial or modified payment agreement AH - Purchased by another lender AI - Recalled to military active duty AM - Account Payments Assured by Wage Garnishment AN - Account acquired by RTC/FDIC AO - Voluntarily surrendered, then redeemed AP - Credit line suspended AS - Account closed due to refinance AT - Account closed due to transfer AU - Account paid in full for less than the full balance AV - First payment never received AW - Affected by natural disaster AX - Account paid from collateral AZ - Redeemed repossession BA - Transferred to recovery. Requires Status code 71-97 BB - Full termination/status pending. Requires account type 3A (Auto Lease) or 13 (Lease) BC - Full termination/obligation satisfied. Requires account type 3A (Auto Lease) or 13 (Lease) BD - Full termination/balance owing. Requires account type 3A (Auto Lease) or 13 (Lease) BE - Early termination/status pending. Requires account type 3A (Auto Lease) or 13 (Lease) BF - Early termination/obligation satisfied. Requires account type 3A (Auto Lease) or 13 (Lease) BG - Early termination/balance owing. Requires account type 3A (Auto Lease) or 13 (Lease) BH - Early termination/insurance loss. Requires account type 3A (Auto Lease) or 13 (Lease) BI - Involuntary repossession. Requires account type 3A (Auto Lease) or 13 (Lease) BJ - Involuntary repossession/obligation satisfied. Requires account type 3A (Auto Lease) or 13 (Lease) BK - Involuntary repossession/balance owning. Requires account type 3A (Auto Lease) or 13 (Lease) BL - Credit card lost or stolen BN - Paid by company who originally sold the merchandise BO - Foreclosure proceedings started BP - Paid through insurance. Requires Status code 13 or 61-65 and a current balance of 0.00. BS - Prepaid Lease - Consumer Paid In Advance BT - Principal deferred/interest payment only CH - Guaranteed/Insured CI - Account closed due to inactivity CJ -– Credit line no longer available in repayment phase. Not valid for account statuses 13 and 61-65. CK - Credit line reduced due to collateral depreciation CL - Credit line suspended due to collateral depreciation CM - Collateral released by creditor/balance owing. Not valid for account statuses 13 and 61-65. CN - Loan modified under a federal government plan CO - Loan Modified CP - Account in Forbearance CS - Used by Child Support Agencies Only when reporting collection accounts (No actual comment displays) DE - Debt extinguished under state law. Not valid for account statuses 13 and 61-65. After Portico reports the loan in the credit bureau transmission, stop reporting the loan by changing the ECOA code to 0. ZZ - Internal - Stops charged off loans from being paid off on the 632 Report Keyword: RR Reporting Analytics: CB Special Comment Code (Loan folder > Credit Bureau query subject and Month-end Information > Loan Month-End > ME Credit Bureau query subject) |

|||

|

Click the down arrow to select the account type reported to the credit bureau. The codes are provided by Associated Credit Bureaus, Inc. Types marked obsolete are no longer supported. The valid options are:

Keyword: RT Reporting Analytics: CB Account Type (Loan folder > Credit Bureau query subject and Month-end Information > Loan Month-End > ME Credit Bureau query subject) |

|||

|

Click the down arrow to indicate the type of account associated with this loan type. The system uses the option selected in this field for credit bureau reporting and to identify transactions for Shared Service Center users. The system default is specified on the Loan Profiles - Account Information tab for the loan type. The valid options are: C - Credit Card I - Installment L - Line of Credit M - Mortgage Keyword: RI |

|||

|

The personal nickname specified by the member to identify the loan. Length: 38 alphanumeric |

|||

|

The property securing the mortgage is the owner’s mailing address |

The property securing the mortgage is the owner’s mailing address check box is automatically selected if the Mortgage/Real Estate check box is selected on the Loan Profiles - Account Information tab. If the property securing the mortgage loan is not the owner's address, you will clear the check box. You can enter the address that should appear in box 8 of the 1098 Mortgage Interest Statement on the New Loan - Mortgage Loan Information tab or Loans - Mortgage Info tab. If The property securing the mortgage is the owner’s mailing address check box is changed from not checked to checked, the property address or legal description will remain on the Loans - Mortgage Info tab. |

||

|

The type of credit life insurance or group loan protection coverage. The Credit Life Insurance check box in the Insurance section on the Credit Union Profile – Loans tab indicates whether Portico calculates and posts credit life insurance (CLI) during the month-end back-office cycle. The Contract field in the Insurance group box on the Loan Profiles – Additional Information tab specifies the type of Credit Life Insurance contract available for this loan type. On member-pay insurance loan types that are not covered, leave this field blank. If the Contract field in the Insurance group box on the Loan Profiles – Additional Information tab indicates group-pay loan protection (option 1, 2, 3), the Life Coverage Option field on the New Loan – Setup tab defaults to the code in the Protection field in the Insurance group box on the Loan Profiles – Additional Information tab. The valid options are: Group-pay Loan Protection: Valid codes for the FIRST digit are: 0 = Member is not qualified 1 = Personal loan 2 = Real estate loan 3 = Charged-off loan 4 = Other type of loan Valid codes for the SECOND digit are: 0 = Loan is covered 1 - 9 = Loan disqualified - credit union-defined A - F = Loan disqualified - credit union-defined Member-pay Loan Protection: Valid codes for the FIRST digit are: 0=No coverage 1=Single Life-loan add-on - owner 2=Single Life-share withdrawal - owner 3=Joint Life-loan add-on - owner 4=Joint Life-share withdrawal - owner 5=Excess Credit Life - loan add-on 6=Excess Credit Life - share withdrawal E=Single Life - loan add-on - co-borrower F=Single Life - share withdrawal - co-borrower G=Joint Life-loan add-on - 2 co-borrowers H=Joint Life-share withdrawal - 2 co-borrowers The SECOND digit must be blank. Note: The above codes are valid only if Portico calculates and posts the premiums. If Portico sends a transmission to the insurance company who then calculates and returns a transmission to Portico for posting, use the codes provided by the insurance company. Note: If a value of E, F, G, or H is chosen for insurance coverage on the New Loan –Setup tab, the New Loan - Borrower Information tab will automatically appear for the borrower's information to be completed. The loan will not book without the borrower information. If the Credit Life Insurance is member-pay or member and credit union-pay, Portico uses the 485 Report. If you pay the entire premium for the Credit Life Insurance (group-pay), Portico calculates and posts the premiums using the Group Loan Protection Insurance Report 480. The total premium payment for a loan is calculated by multiplying the loan's insurable balance by the appropriate premium rate. The rate used depends on the type of coverage for the loan, single life or joint life. To determine the member’s premium payment, Portico calculates the total premium for the loan, multiplies it by the credit union's percentage (if any), rounds to the nearest cent and subtracts this credit union-paid amount from the total premium. The premium can be paid by share withdrawal or loan add-on:

The 580 and 584 Report Rules contain the processing criteria for CLI premiums calculated by the insurance company. Length: 2 alphanumeric Keyword: LP |

|||

|

Select the Joint to Single to No Coverage check box to select Joint to Single to None CLI coverage. When one of the borrowers has reached maximum age, the coverage will automatically change to single coverage. If the second borrower reaches maximum age before coverage is completed, then premiums are no longer calculated and posted. The New Loan - Borrower Information tab will automatically appear to enter the co-borrower's information including the birth date (required). If not selected, when the owner of the loan reaches maximum age, coverage is no longer calculated and posted. For loans coded with a Life Coverage Option of G or H, the system will no longer calculate and post premiums when the first borrower flagged on the Loan Borrowers/References dialog box reaches maximum age. (System default.) Keyword: LF |

|||

|

The type of credit disability insurance coverage on the loan. The valid options are: 0 - No coverage. System default. 1 - Single CDI - loan add-on-owner 2 - Single CDI - share withdrawal-owner 3 - Single CDI - mbr disabled, premium waived - owner 4 - No coverage - disqualified E - Single CDI - loan add-on - co-borrower F - Single CDI - share withdrawal - co-borrower H - Single CDI - mbr disabled, premium waived - co-borrower J - Joint CDI - loan add-on - owner K - Joint CDI - share withdrawal - owner M - Joint CDI - both disabled, premium waived - owner T - Joint CDI - loan add-on - 2 co-borrowers V - Joint CDI - share withdrawal - 2 co-borrowers W - Joint CDI - both disabled, premium waived - 2 co-borrowers Note: The above codes are valid only if Portico calculates and posts the premiums. If Portico sends a transmission to the insurance company who then calculates the premiums and returns the transmission to Portico for posting, use the codes provided by the insurance company. Note: If a value of E, F, H, T, V, or W is chosen for insurance coverage on the New Loan –Setup tab, the New Loan - Borrower Information tab will automatically appear for the borrower's information to be completed. The loan will not book without the borrower information. The 130 Report Rules contain the processing criteria for CDI premiums calculated and posted by Portico. The 580 and 581 Report Rules contain the processing criteria for CDI premiums calculated by the insurance company. Members may make premium payments by either share withdrawal or loan add-on and may change the payment method at any time.

Length: 1 alphanumeric Keyword: DC |

|||

|

Select the Joint to Single to No Coverage check box to select Joint to Single to None CDI coverage. When one of the borrowers has reached maximum age, the coverage will automatically change to single coverage. If the second borrower reaches maximum age before coverage is completed, then premiums are no longer calculated and posted. The New Loan - Borrower Information tab will automatically appear to enter the co-borrower's information including the birth date (required). If not selected, when the owner of the loan reaches maximum age, coverage is no longer calculated and posted. For loans coded with a Disability Coverage Option of T, V, or W, the system will no longer calculate and post premiums when the first borrower flagged on the Loan Borrowers/References dialog box reaches maximum age. (System default.) Keyword: CF |

|||

|

The type of debt protection coverage on the loan. Debt protection codes are determined during your implementation. The Debt Protection checkbox on the Credit Union Profile - Loans tab must be selected to see the Debt Protection field on the New Loan - Setup tab and the Loan Insurance tab. Keyword: DB | Length: 2 alphanumeric Reporting Analytics: Debt Protection Code (Loan – Loan Base and Month-end Information – Loan Month-end – ME Loan Base) |

|||

|

Select the Military Lending Act check box if the loan should comply with the Military Lending Act. Keyword: ML Reporting Analytics: Military Lending Act (Loan – Loan Base and Month-end Information – Loan Month-end – ME Loan Base) |

To ensure that the base credit bureau information is available for future reporting, a credit bureau record is built for new loans regardless of the ECOA Code value defined on the New Loan - Setup tab. The credit bureau record is built using the following default values:

| Field | Default |

|---|---|

| Special Comment Code | Blank |

| Account Type | Blank |

|

Account Indicator |

use the default value for the loan type from the Loan Profile |

|

Status Code |

11 |

|

Delinquency History |

Blank |

Select Next to continue setting up the loan. The Additional Information tab appears.

The New Loan - Additional Information tab lets you set up additional loan options.

| Field | Description |

|---|---|

|

Select this checkbox to display the New Loan – Split Rates / Skip Payments / Recalculation / Home Equity / Interest Plus / Promotion Rates tab and set up split rate interest, skip payments, minimum payment recalculation, draw period expiration, and promotional loan rates. |

|

|

Select this checkbox to display the New Loan – Miscellaneous Loan Information tab and set up additional insurance amounts, credit and bankruptcy score, paper grade, and pool ID. |

|

|

Select this checkbox to display the New Loan - Refinance/Fees tab and refinance an existing loan and charge a fee. |

|

|

Select this checkbox to display the New Loan - Pledges tab and set up a pledge. |

|

|

Select this checkbox to display the New Loan - Mortgage Loan Information tab and set up mortgage loan information. |

|

|

Select this checkbox to set up nonrefundable fees to be charged for originating the loan and then amortized over the life of the loan. This checkbox should be selected if the new loan proceeds will be used for refinancing existing loans and/or collecting fees, or if the nonrefundable fees charged for originating the loan will be amortized over the life of the loan. The system will automatically display the New Loan - Fee Amortization Setup tab. |

|

|

Select this checkbox to display the New Loan - Borrower Information tab and record borrower information. |

|

|

Select this checkbox receive a pop-up reminder to enter the collateral information. |

|

|

Select this checkbox to retain history from real estate loans for IRS reporting purposes. This flag prevents real estate loans from being purged before reporting. Keyword: RE |

|

|

Select the Default for loan type option to use the system default is specified on the Loan Profiles - Account Information tab for the loan type. Select the D (due date) option for Delinquency Method D. Select the B (amortization schedule) option for Delinquency Method B. Delinquency Method B is the acceptable method for calculating delinquency on closed-end loans with a term greater than 15 years. Delinquency Method B recognizes the time value of money. There is a significant difference in the calculations. Method B uses an amortization schedule; therefore, the delinquency calculation compares the principal balance of the loan's current status to the amortization schedule. If the actual loan balance is greater than the loan balance of the amortization schedule, the loan is considered delinquent. Once it is determined there are principal funds in arrears, the delinquent interest is added to the balance to arrive at the total delinquent amount, which is the true time value of money. Keyword: MH |

|

|

Select the Check option if the loan proceeds are to be disbursed by multiple checks using the Check Writer dialog box. The Check Writer dialog box will automatically appear. Select the Cash option if the loan proceeds are to be disbursed by cash. Select the All or portion to Shares checkbox to disburse some or all of the loan proceeds to the member's share account. |

Select Next to continue setting up the loan.

Select Back to go back to the previous tab. Select Cancel to stop setting up the loan.

When you complete the new loan setup, the New Loan – Transaction Summary tab displays a summary of the new loan information.

If the loan funds were deposited to a share account, the deposit is listed in the second box. If the loan funds will be disbursed by check, select Check Writer to display the Check Writer dialog box and generate a credit union check.

Select Collateral to open the Collateral Information dialog box and add the collateral types.

Select Finish to finish setting up the new loan.

- DEBIT 701XXX Loan principal general ledger account specified on the Loan Profiles - Account Information tab

- If the funds are disbursed by check, CREDIT 731XXX Checks disbursed general ledger account specified on the Open tab

- If the funds are disbursed by cash, CREDIT 739200 Teller disbursed general ledger account

- If the funds are disbursed to shares, CREDIT 901XXX Share general ledger account specified on the Share Profiles - Account Information tab

- If the new loan refinanced one or more loans, CREDIT 701XXX Loan principal general ledger accounts specified on the Loan Profiles - Account Information tab for the refinanced loan types

- If miscellaneous charges are assessed, CREDIT XXXXXX Miscellaneous general ledger account

- New Loans Report 080

- Financial Transaction Register Report 420

The Balancing and Close tab reflects the following information:

- Adds the total loan amount to the Loans Disbursed Amount field

- Adds the cash disbursed amount to the Cash Disbursed Amount field

- Subtracts the cash disbursed amount from the Currency Balance Amount and Drawer Balance Amount fields

- Adds the check disbursed amount to the Checks Disbursed Amount field

- Adds the amount transferred to a share account or a general ledger account or used to refinance a loan to the Transfers/JV Amount field and adds one to the Transfers/JV count field

Use the Loan Type Change dialog box to change an incorrect loan type.

To reverse the transaction on the same day, perform the Reversals - Same Day Reversals tab.

For a prior-day correction, perform the Adjustments - Loan Payment from General Ledger tab, update the Loans tab, and/or perform the Reversals - Prior Day Loan Reversal tab.

It may be necessary to complete other journal voucher entries if you completed any of the optional windows when you set up the new loan. Using journal voucher entries prevents distortion of the current day balances in the teller activity totals.

You can also pay off the loan using the Loan Payoff dialog box and the check or cash disbursed.

Portico Host: 601