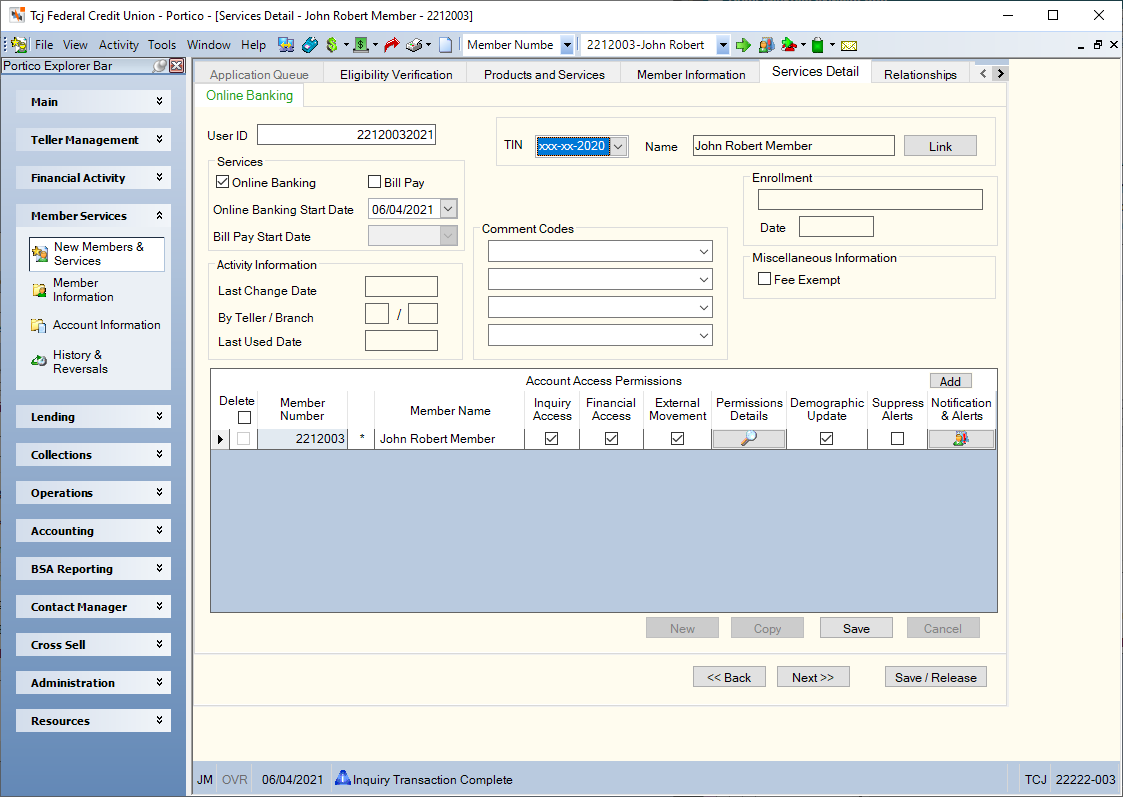

Services Detail: Setting Up Online Banking and Bill Pay

The Online Banking/Bill Pay tab lets you set up the member's Online Banking and Bill Pay options.

How do I?

Complete the following steps to set up a member's online banking and bill pay options.

- Enter a new online banking user ID in the User ID field. The Virtual Branch Options section on the Credit Union Profile - Self-Service tab defines the parameters allowed when creating a Virtual Branch user ID.

- The Online Banking checkbox will automatically be selected. You can select the Bill Pay checkbox to provide a Virtual Branch Bill Pay service to the online banking user.

- If the Online Banking checkbox is selected, select the Online Banking Start Date down arrow to select the date the customer signed up for Online Banking from the pop-up calendar or enter a date in MM/DD/YYYY format. The date can be up to 45 days in the future. If left blank, the system date appears in this field.

- If the Bill Pay checkbox is selected, select the Bill Pay Start Date down arrow to select the date the customer signed up for Bill Pay from the pop-up calendar or enter a date in MM/DD/YYYY format. The date can be up to 45 days in the future. If left blank, the system date appears in this field.

This field is disabled if you use CheckFree with Virtual Branch.

- Select the Comment Codes down arrow to select the credit union-defined comment code.

- Select the Fee Exempt checkbox if the member is exempt from online banking fees.

- Select the Quicken Direct checkbox if the member has access to Online Banking through Quicken Direct. This checkbox only appears if the Quicken field is Y on the 945 Report Rules.

- The TIN dropdown list will automatically list the names and taxpayer IDs of the online banking user's existing account relationships. To link account relationships by taxpayer ID to the user's online banking profile, select the taxpayer ID number of our online banking user from the TIN dropdown list. Then, select Link. The accounts that the online banking user is associated with appear in the Account Access Permissions grid. Beneficial owner relationships will not appear. If you created a new user ID by copying an existing user ID, you can delete or unlink any relationships.

- Select Save to save your changes. When you add a member to online banking or modify the member options, the updated information is automatically forwarded to Virtual Branch in the Portico nightly back-office cycle.

When setting up a member for online banking, you can link the member to his/her relationships by account ownership or taxpayer ID number. Linking will give the online banking user access to related accounts, based on the account relationship.

- Inquiry access provides the ability to view account details on share, loan, credit card, and certificate accounts.

- Financial access can provide the ability to transfer to, transfer from, or transfer to and from share, loan, and credit card accounts.

- External Movement access allows you to restrict activities related to “external money movement” services like ACH, A2A, and wire transfers.

- Demographic Update access provides the ability to change the Address Line 1, Address Line 2, City, State, Zip, Country, Home Phone, Work Phone, Date of Birth, Email 1, Email 2, and Email 3 fields.

- Select the Suppress Alerts checkbox if Portico should suppress the electronic notice information in the alert file to Virtual Branch. The Virtual Branch user will not receive an alert when an electronic notice is produced. Members can also choose to turn off alerts by using Virtual Branch.

Linking by account ownership or taxpayer ID number also streamlines maintenance to Virtual Branch when a member makes changes to their accounts and account relationships:

- When a member opens new accounts, the accounts are automatically added to the list of accounts that can be accessed.

- When a member closes an account, the closed account is available for online viewing access until purged from Virtual Branch, but financial transactions will no longer be permitted.

- When an existing account relationship is removed, all account access based on that relationship is removed from Virtual Branch.

- When a member adds a relationship to an additional account, Portico adds the account relationship with the default permissions listed in the following table:

| Relationship Indicator | Linking Adds to Online Banking |

Default Inquiry Access | Default Financial Access |

Default Demographic Update |

Default Suppress Alerts | Default External Money Movement |

|---|---|---|---|---|---|---|

|

A - Authorized Signer |

X |

X |

X |

X |

|

X |

|

B - Sibling Beneficiary |

|

|

|

|

|

|

|

C - Child Beneficiary or Grandchild Beneficiary |

|

|

|

|

|

|

|

D - Custodian |

|

|

|

|

|

|

|

E - Executor of Estate Account |

X |

X |

X |

X |

|

X |

|

F - Power of Attorney |

X |

X |

X |

X |

|

X |

|

I - In Trust For |

|

|

|

|

|

|

|

J - Joint Owner |

X |

X |

X |

X |

|

X |

|

K - Successor Custodian |

|

|

|

|

|

|

|

L - Club Account |

|

|

|

|

|

|

|

O - Other Beneficiary |

|

|

|

|

|

|

|

P - Parent Beneficiary |

|

|

|

|

|

|

|

R - Successor Trustee |

|

|

|

|

|

|

|

S - Spouse Beneficiary |

|

|

|

|

|

|

|

T - Trustee |

X |

X |

X |

X |

|

X |

|

U - Uninsurable |

|

|

|

|

|

|

|

X - Owner of Funds (grantor, plan participant, minor or ward) |

|

|

|

|

|

|

Member accounts with relationship indicators of Authorized Signer, Executor, Power of Attorney, Joint Owner, and Trustee are added to an online banking user when you link by taxpayer ID. Access to member accounts with relationship indicators that are not added by default can be manually added to an online banking user.

Financial access is granted only if the member has accounts that support financial access. If the member is a business and is not the primary owner of the account, then financial access is not granted. If the member is a business and is the primary owner of the account, and the accounts support financial activity through online banking, then financial access is granted.

If the taxpayer ID of the online banking user matches the taxpayer ID of another member, the matching member will be granted full access permissions to the online banking user's accounts.

You can modify the default access permissions that the online banking user has to the member's accounts on the Permissions dialog box. Select the Permission Details button for a member to display the Permissions dialog box.

Click Next to continue with the next the step of the application or click Save/Release to save the application for completion at a later date. Click Back to move back to the previous tab.

Select here to view field help.