Recording Non-Member Interest and Dividends and Real Estate Proceeds

The Non–Member Year End dialog box lets you record U.S. Savings Bonds interest or dividends for a non-member for the 1099-INT notice and record non-member proceeds for real estate transactions for the 1099-S notice. To access the Non–Member Year End dialog box, under Member Services on the Portico Explorer Bar, click Account Information. The Overview tab appears on top. Locate the member using the search tool on the top menu bar. Click the down arrow to select the search method, then enter the search criteria. Click the green arrow or press ENTER to locate the member. Click the Misc. Requests tab. Click the Non-Member Year End button.

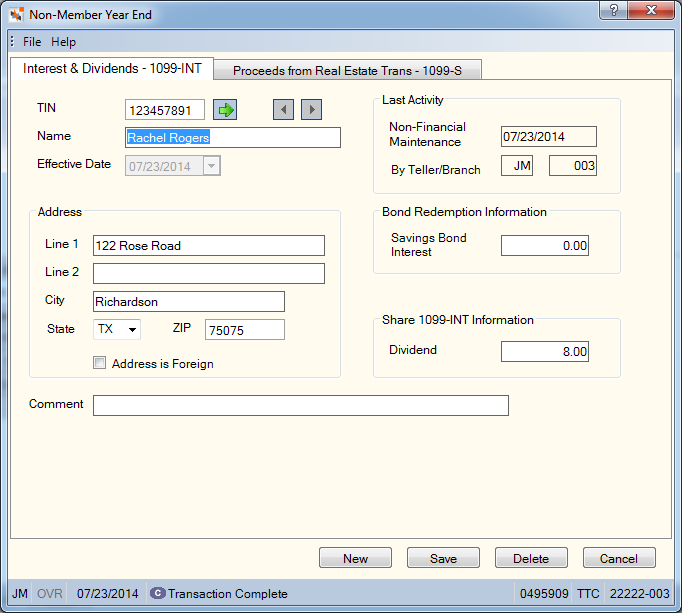

The Interest & Dividends - 1099-INT tab lets you record, track and maintain information for non-members to be used in 1099-INT reporting. This tab can be used for savings bond redemption for non-members. When a non-member redeems saving bonds using the Bond Redemption tab, the taxpayer ID number (TIN), savings bond interest amount, name, and address are recorded on the Interest & Dividends - 1099-INT tab. This tab can also be used for share dividends paid for non-members. When a non-member is paid dividends from a share account, the Interest & Dividends - 1099-INT tab can be used to record the taxpayer ID number (TIN), name and address information and the amount of the dividend.

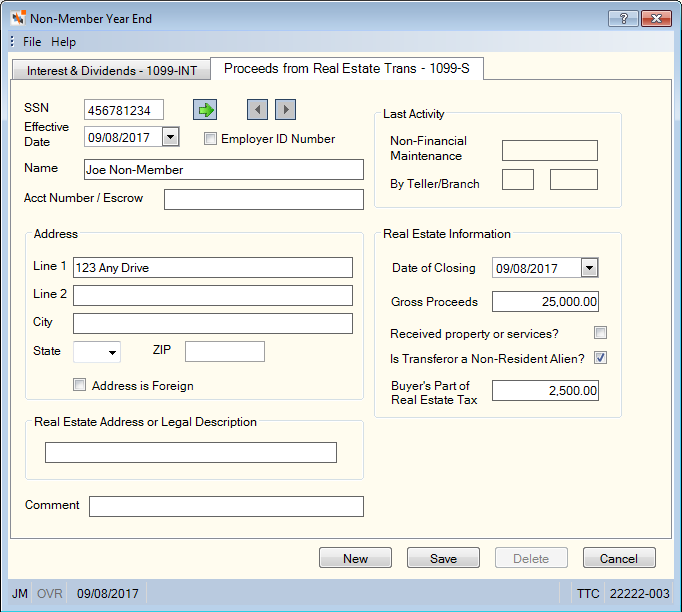

You can enter real estate transaction information on the Proceeds from Real Estate Trans – 1099-S tab. This information will be used to generate the 1099-S Notice. The 1099-S Notices Report 121 generates notices on hard copy, Nautilus Essentials and the IRS transmission file. The 121 Report will also generate a credit union report listing the 1099-S notices produced.

How do I? and Field Help

On the Interest & Dividends - 1099-INT tab, enter the non-member's taxpayer ID number in the TIN field (Length: 9 numeric) and click the green arrow. Any existing interest or dividend distribution records for the non-member will appear. Click the left and right arrows to scroll through the records.

To record US Savings Bonds interest or dividends for a non-member on the Interest & Dividends - 1099-INT tab, complete the following steps:

- Enter the non-member's taxpayer ID number in the TIN field (Length: 9 numeric). Do not enter the credit union taxpayer ID in this field. You must enter the non-member's taxpayer ID to correctly report this information to the IRS.

- In the Address group box, enter the non-member's street address.

- Enter the non-member's name in the Name field (Length: 23 alphanumeric).

- Click the Effective Date down arrow to select an effective date from the pop-up calendar or enter the date in MM/DD/YYYY format. You cannot change the effective date after you have saved the record. You must delete the record and re-add it using the correct date.

- To record U.S. Savings Bonds interest, enter the year-to-date interest the non-member received when redeeming savings bonds in the Savings Bond Interest field (Length: 8 numeric including decimal).

- To record dividends, enter the dividend amount in the Dividend field (Length: 11 numeric including decimal).

- If desired, enter any special comments in the Comment field (Length: 40 alphanumeric).

- Click Save to save the record.

On the Proceeds from Real Estate Trans – 1099-S tab, enter the non-member's taxpayer ID number in the SSN field (Length: 9 numeric) and click the green arrow. Any existing proceeds from real estate transaction records for the non-member will appear. Click the left and right arrows to scroll through the records.

To record proceeds from real estate transactions for a non-member on the Proceeds from Real Estate Trans – 1099-S tab, complete the following steps:

- Enter the non-member's taxpayer ID number in the SSN field (Length: 9 numeric). Select the Employer ID Number check box if the number entered is an employer ID number. The field label for the taxpayer ID number will change according to the type of taxpayer ID. Do not enter the credit union taxpayer ID in this field. You must enter the non-member's taxpayer ID to correctly report this information to the IRS.

- Click the Effective Date down arrow to select an effective date from the pop-up calendar or enter the date in MM/DD/YYYY format.

- Enter the non-member's name in the Name field (Length: 23 alphanumeric).

- In the Acct Number/Escrow field, enter the account number that received the real estate proceeds.

- In the Address group box, enter the non-member's street address.

- In the Real Estate Information group box, select the closing date from the pop-up calendar or enter the date in MM/DD/YYYY format in the Date of Closing field.

- Enter the gross proceeds from the sale in the Gross Proceeds field.

- If the seller received property or services in exchange for the real estate, select the Received property or services? check box.

- If the non-member address on the Proceeds from Real Estate Trans-1099-S tab is a foreign address, you may need to select the Is Transferor a Non-Resident Alien? check box.

- Enter the buyer's portion of real estate tax in the Buyer's Part of Real Estate Tax field.

- In the Real Estate Address or Legal Description field, enter the description of the property.

- If desired, enter any special comments in the Comment field.

- Click Save.

Click New to create a new record for a non-member. Click Delete to delete the record. Click Cancel to reject your changes and close the dialog box.

The Last Activity group box indicates the date the last non-financial maintenance was performed, the teller who performed the maintenance and the branch location associated with the teller.

The following table describes the fields in the Address group box.

| Address Field | Description |

|---|---|

|

Line 1 of the non-member's address. This field is optional. Length: 24 alphanumeric Keyword: A1 |

|

|

Line 2 of the non-member's address. This field is optional. If the Address is Foreign check box is selected, this field must contain the foreign city's name. Length: 24 alphanumeric Keyword: A2 |

|

|

The city where the non-member resides. If line 1 and/or line 2 of the address is entered, this field is required. If the Address is Foreign check box is selected, this field must contain the foreign country's name. Length: 18 alphanumeric Keyword: NC |

|

|

Click the down arrow to select the correct state abbreviation from the drop-down list. If line 1 and/or line 2 of the address is entered, this field is required. If the Address is Foreign check box is selected, enter the foreign country code in the State field. For Canada, enter the province code in the State field. Keyword: NS |

|

|

The postal ZIP Code for the address listed. For domestic addresses, the ZIP code must be either 5 or 9 digits. For foreign addresses, the ZIP code can be up to 10 characters. If the Address is Foreign check box is not selected:

If the Address is Foreign check box is selected:

Length: 9 numeric (10 alphanumeric if the Address is Foreign check box is selected.) Keyword: ZP Reporting Analytics: Foreign ZIP Code (All Joint Account Info subject in the Member Information folder) |

|

|

Select this check box if the address is foreign. If the Address is Foreign check box is selected, the foreign city's name must reside in the Address 2 field and the foreign country's name must reside in the City field. Enter the foreign country code in the State field. For Canada, enter the province code in the State field. Keyword: FF |

none

- Non-Member Bond Redemption Report 104

- Bond Redemption Report 845

- 1099-S Notices Report 121

To access the Non–Member Year End dialog box, users must be assigned to one of the following security groups or you can add these permissions to a credit union-defined security group using the Security Group Permissions – Update window.

| Permissions | Security Groups |

|---|---|

| MbrInfo - Non-Member Year End - View Only | Teller - Basic Teller - Advanced Member Services - User |

| MbrInfo - Non-Member Year End - Maintain | Member Services - User |

Portico Host: ALI, ALJ