ACH Origination Member and General Ledger Items

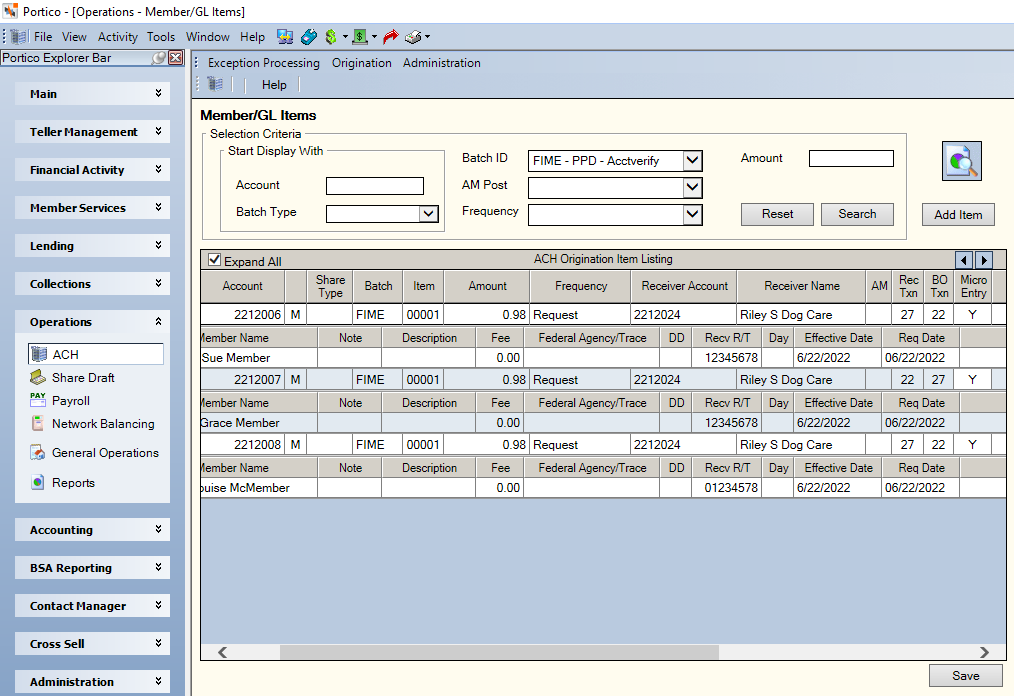

The Member/GL Items window lets you add, display, maintain, and delete an individual member item for ACH Origination. ACH items must have an associated batch header. Before you can add member items on the Member/GL Items window, you must establish a batch header on the Batch Maintenance window. To access the Member/GL Items window, on the Portico Explorer Bar, click ACH in the Operations menu. On the ACH top menu bar, click Origination, then click Member/GL Items to review existing items or click New Member/GL Item to add a new item.

How do I? and Field Help

You can display the list of member and GL items by item type, batch type, batch ID, AM posting status and amount.

- To display a specific GL or member account, in the Account field, enter the member number or general ledger followed by the branch. (Length 12 numeric for member number or 6 numeric for general ledger account number)

- To display the list by batch type, click the Batch Type down arrow and select Member or General Ledger to indicate the type of account.

- To display the items by batch ID, click the Batch ID down arrow to select the batch ID from the Batch Maintenance window.

- To display the ACH items that were posted or received an error in the early morning (AM) posting, click the AM Post down arrow to select the status of the ACH item.

- To display the ACH items based on dollar amount, enter the dollar amount of the ACH transaction in the Amount field (Length: 12 numeric). For ENR, the amount is 0.00.

- To search for ACH Origination items based on the frequency of the item, click the Frequency down arrow and select the frequency. Valid values are: Weekly, Biweekly, Semimonthly, Monthly, Quarterly, Annually, Request, or Same Day.

Click Search to display the member or general ledger items that meet the selection criteria. Click Reset to clear the fields in the Selection Criteria group box. Click the report retrieval icon to display the Report Retrieval dialog box and display the 173/173S Report in Nautilus Essentials.

To add a member item, click Add Item. The Member/GL Item - New window appears.

The ACH Origination Item Listing grid displays the individual member and general ledger items for ACH Origination. Select the Expand All check box to view all the ACH item details. Click the left and right arrows to scroll through the items. To maintain a member item, modify the fields as needed. Click Save to save the ACH item information.

| Field | Description |

|---|---|

| Del | To delete a member item, select the Del check box next to the member item and click Save. |

| Copy | To create a new item by copying an existing item, click the icon button in the Copy column to display the Member/GL Item - New window. |

|

Account |

The member's account number, or the general ledger account number followed by the branch. |

|

unlabeled |

G indicates a general ledger account. M indicates a member account number. |

|

Share Type |

The specific share type for posting directly to a specified share or share draft account. Required if the Frequency field is Same Day. |

|

Batch |

The batch ID from the Batch Maintenance window. Length: 4 alphanumeric |

|

Item |

The number of ACH record spaces available for this application. If a member or general ledger account has more than one return, the item count will be incremented for each new record added. |

|

Amount |

The dollar amount of the ACH transaction. For batch SEC code ENR, ACK, or ATX, the amount is 0.00. If your credit union uses the ACH Authorization Limit feature, the amount entered will be compared to the ACH authorization limit defined on the Security tab of the User Profile dialog box. If you do not have a user-defined limit, Portico will use the credit union-defined limit in the ACH Origination section on the Credit Union Profile - ACH/ Payroll tab. If the amount is greater than the authorization limit, Portico will display a remote override request. You must select a user with a limit greater than the transaction amount to approve the request. For same-day ACH item, the amount cannot exceed the amount specified in the Outgoing Credit Limit field or Outgoing Debit Limit field on the Credit Union Profile - ACH/Payroll tab. NACHA rules limit same-day ACH items to a maximum amount of $1,000,000. For micro-entries, the amount must be less than $1.00. Length: 11 numeric including decimal Keyword: AM |

|

Frequency |

Click the down arrow to select the frequency in which the member item is processed. Valid values are: Weekly, Biweekly, Semimonthly, Monthly, Quarterly, Annually, Request, or Same Day. For SEC codes ENR, ACK or ATX, the Frequency field must be one-time request. For micro-entries, the Frequency field must be Request or Same Day If the SEC code is TEL or WEB, the system will automatically assign a value on the outgoing file based on the frequency entered. For a one-time request, the file will send S for single entry. Any frequency other than a one time request will send a value of R for recurring entry. This is reported in the Discretionary Data field on the file. Any data entered in the Discretionary Data field will be replaced with the R or S for TEL and WEB SEC code transactions. For a same-day ACH origination items, outgoing items must be requested prior to 9:15 AM or 1:30 PM Central to be included in the FED file submission windows at 9:30 AM and 1:45 PM Central (10:30 AM and 2:45 PM Eastern). When you click Save to add a same-day outgoing credit item to the batch, Portico will determine if funds are available. If funds are not available, an error message will appear. Click OK to close the error message, then change the Amount field or Share Type field. If funds are available, Portico will place a hold (system-defined hold code $) on the share or share draft account with an expiration date of next day. The hold will be released automatically when the back-office cycle begins and the offsetting debit is actually posted to the member's account. When the hold is released, Portico will charge the fee amount specified in the Same Day Debit to Member field on the Credit Union Profile - ACH/Payroll tab to the member's account. Debit holds will be recorded on the Share Check Hold Activity Report 240 and in non-financial history with history code HF. Keyword: FR |

|

Receiver Account |

The account number at the receiving financial institution that will receive the offset to the member's activity at the credit union. This field is required . For ENR, enter the member's Social Security number. For a company, enter the taxpayer identification number in the first nine positions and the representative payee indicator in the tenth position. The valid values are: 1 - There is a representative payee 0 - There is not a representative payee A - Enrollee is a consumer B - Enrollee is a company Note: The person receiving the benefits is not always the member whose account the benefits will be deposited in. Be sure to use the correct Social Security number or taxpayer identification number. Length: 17 alphanumeric Keyword: RI |

|

Receiver Name |

The receiving account holder's name. A name must be entered in this field for Standard Entry Class code WEB . For Standard Entry Class code ENR, use the following format when typing the name of the person receiving the benefits: First Name - Characters 1-7 Last Name - Characters 8-22 For example, type Jonathon Member as JONATHOMEMBER and type Julie Member as JULIE MEMBER. Federal requirements dictate that the last name must always begin in position 8. If the receiver of benefits is a company (representative payee indicator = B), enter the company name starting in position 1. Length: 22 alphanumeric Keyword: NM |

| AM |

The status of the ACH item. All values are system generated based on maintenance or the results of the early morning (AM) posting that occurred after the previous day’s back-office cycle.

The effective date of the successfully posted items will be advanced according to the frequency of the item and the AM column will be set to blank in the 5:00 PM extract program. Reporting Analytics: Post AM Pass Flag (Origination Member Item subject in the ACH Origination folder) |

|

Rec Txn |

The required NACHA transaction code for the type of transaction to be sent to the receiving institution. The valid options are: 05 - Loan Advance 22 - Credit to share draft/checking - valid for micro-entries, valid receiving transaction for same-day outgoing ACH credit item 23 - Prenote or ENR of credit to share draft checking 24 - Acknowledgment to share draft/checking 27 - Debit to share draft/checking - valid for micro-entries, valid back-office transaction for Person-to-Person (P2P) credit transactions and same-day outgoing ACH debit items. 28 - Prenote of debit to share draft/checking - valid receiving transaction for micro-entries, frequency must be Request, and effective date must be 3 business days in the future. 32 - Credit to shares/savings - valid for micro-entries, valid receiving transaction for same-day outgoing ACH credit item 33 - Prenote or ENR of credit to shares/savings 34 - Acknowledgment to shares/savings 37 - Debit to shares/savings - valid for micro-entries, valid back-office transaction for Person-to-Person (P2P) credit transactions and same-day outgoing ACH debit items. 38 - Prenote of debit to shares/savings - valid receiving transaction for micro-entries, frequency must be Request, and effective date must be 3 business days in the future. 42 - Automated general ledger deposit (credit) - valid receiving transaction for same-day outgoing ACH credit item 43 - Prenotification of general ledger credit authorization 47 - Automated general ledger payment (debit) - valid back-office transaction for same-day outgoing ACH debit items. 48 - Prenotification of general ledger debit authorization 52 - Automated loan account deposit (credit) - valid receiving transaction for same-day outgoing ACH credit item 53 - Prenotification of loan account credit authorization 54 - Acknowledgment to loan 55 - Debit to loan (reversal only) Length: 2 numeric Keyword: TC |

|

BO Txn |

The NACHA transaction code that will determine how the transaction will be processed in the back office cycle. The valid options are: 05 - Loan Advance 22 - Credit to share draft/checking - valid for micro-entries, valid receiving transaction for same-day outgoing ACH credit item 23 - Prenote or ENR of credit to share draft checking 24 - Acknowledgment to share draft/checking 27 - Debit to share draft/checking - valid for micro-entries, valid back-office transaction for Person-to-Person (P2P) credit transactions and same-day outgoing ACH debit items. 28 - Prenote of debit to share draft/checking - valid receiving transaction for micro-entries, frequency must be Request, and effective date must be 3 business days in the future. 32 - Credit to shares/savings - valid for micro-entries, valid receiving transaction for same-day outgoing ACH credit item 33 - Prenote or ENR of credit to shares/savings 34 - Acknowledgment to shares/savings 37 - Debit to shares/savings - valid for micro-entries, valid back-office transaction for Person-to-Person (P2P) credit transactions and same-day outgoing ACH debit items. 38 - Prenote of debit to shares/savings - valid receiving transaction for micro-entries, frequency must be Request, and effective date must be 3 business days in the future. 42 - Automated general ledger deposit (credit) - valid receiving transaction for same-day outgoing ACH credit item 43 - Prenotification of general ledger credit authorization 47 - Automated general ledger payment (debit) - valid back-office transaction for same-day outgoing ACH debit items. 48 - Prenotification of general ledger debit authorization 52 - Automated loan account deposit (credit) - valid receiving transaction for same-day outgoing ACH credit item 53 - Prenotification of loan account credit authorization 54 - Acknowledgment to loan 55 - Debit to loan (reversal only) Length: 2 numeric Keyword: TC If the Rec Txn field is 22, 23, 32, 33, 42, or 52, the BO Txn field should be 27, 33, 37, 38, or 47. If the Rec Txn field is 27,28, 37, 38, or 47 the BO Txn field should be 22, 28, 32, 38, 42 or 52. If the Rec Txn field is 23 or 33 and the origination is ENR, the BO Txn field should be 23 or 33. If the Rec Txn field is 24 or 34 and the origination is ACK or ATX, the BO Txn field should be 24 or 34. If the Rec Txn field is 52, the BO Txn field should be 52. The loan draft ID is setup on the Loans - Loan Drafts tab. The loan note number is set up on the Member/GL Items window. On the Single Return Item window, ACH origination items with the ENR Standard Entry Class code cannot be returned. |

|

Micro Entry |

Indicates if the ACH item is a micro-entry. Micro-entries are ACH credits less than $1 and any offsetting ACH debits, used for the purpose of verifying a receiver’s account. |

| Payment Information |

The description of the Person-to-Person (P2P) transaction. NACHA Operating Rules recommend that each data element is separated with an asterisk and that the segment is ended with a backslash or tilde. Payment related information is not supported for general ledger credit transactions. Leave blank if the Frequency field is Same Day. Length: 80 alphanumeric Reporting Analytics: Payment Info (Origination Member Item query subject in ACH Origination folder) |

|

Member Name |

The name of the member associated with the member account number. |

|

Note |

The loan note number affected by the transaction. Only used with transaction code 52. For FICS loan payments, enter the note number of the mortgage loan. In addition, the Rec Txn field must be 27 or 37 and the BO Txn field must be 52 on the Member/GL Items window. |

|

Description |

The credit union-defined description of the ACH member item. If the batch SEC code is RCK, enter the check serial number in the Item Description field. This is a mandatory field for RCK standard entry class code. This field is optional for all other SEC codes. Length: 10 alphanumeric Keyword: DE |

|

Fee |

If your credit union currently charges an ACH origination fee for ACH credit or debits items (the Credit Fee Amount field or Debit Fee Amount field is greater than zero in the ACH Origination section on the Credit Union Profile - ACH/Payroll tab), and you manually enter a fee amount in the Fee Amount field, the member will be charged two fees:

You can only enter a fee amount for back-office transaction codes 22, 23, 32, 33, 42, 43, 52 and 53. Back-office transaction codes 22, 32, 42, and 52 will add a fee amount to the outgoing ACH item. If the outgoing ACH item has a back-office transaction code of 23, 33, 43, or 53, a fee amount can be entered, but the fee amount will not change the pre-note amount. If the Frequency field is Weekly, Biweekly, Semimonthly, Monthly, Quarterly, or Annually, the fee will be recurring. The sum of the ACH item and fee amount will be sent to the receiving financial institution. The Discretionary Data field will contain a default code of FE to indicate a fee amount was added. Note: The ACH Existing Indicator field on the Maintain GL Account window must be C or Y to credit fees entered on the Member/GL Items window to the GL account specified in the Fee GL Account field in the ACH Origination section on the Credit Union Profile – ACH/Payroll tab. Fees that are manually entered in the Fee field on the Member/GL Items window will not appear on the ACH Stop Pay Fees Report 169. Leave blank if the Frequency field is Same Day. Length: 6 numeric including decimal Keyword: OA |

|

Federal Agency/Trace |

Required for standard entry class codes ENR, ACK and ATX. For ENR, it indicates the name of the receiving federal agency for the US government. The valid options for ENR are:

For ATX and ACK, it indicates the item trace number of the original CCD or CTX transaction that is being acknowledged. Only the last 7 digits (including any leading zeroes) of the trace number on the 170 Report should be entered. Leave blank if the Frequency field is Same Day. Length 16: alphanumeric |

|

DD |

The optional Discretionary Data field indicates if the WEB or TEL entry is S-single entry or R-recurring entry. If the field is left blank for a WEB or TEL entry, Portico will enter S-single entry or R-recurring entry on the ACH format file based on the frequency. If the item is an outgoing ACH debit item with a Receiving Transaction field of 27, 28, 37, 38, 47, or 48 (back-office transaction codes of 22, 23, 32, 33, 42, 43, 52, or 53) and a fee amount is entered in the Fee Amount field, the Discretionary Data field will contain the value FE to indicate that a fee amount is included with the outgoing ACH debit transaction. The Discretionary Data field is not protected; the credit union may change the value in this field. Length: 2 alphanumeric Keyword: DD |

|

Recv R/T |

The receiving institution's route and transit number. This field is required, but not validated. For ENR, the route and transit numbers are as follows: 65506004 Social Security/Supplement Security 11173699 VA Benefit, Civil Service CSA, Civil Service CSF, Railroad Ret BD, Railroad Uisi Length: 8 numeric Keyword: RR |

|

Day |

The effective day for items scheduled with a semi-monthly, monthly, quarterly or annual frequency on the ACH origination record. You can change the Day field to update the Effective Date field to a new day during the item’s next origination cycle. For example, if an item has a current effective date of 09/06/2010, but you need to originate the item on the 10th of each month beginning in October, you can change the Day field from 6 to 10 prior to the 09/06/2010 origination cycle to ensure that the effective date will be updated to 10/10/2010. |

|

Effective Date |

Click the down arrow to select the beginning settlement date from the pop-up calendar or enter the date in MM/DD/YYYY format. The date must be greater than or equal to the current date for debit or credit items. The date must be fourteen days or more in the future for prenote items. For same-day ACH items:

If you change the Frequency field to Request to include an outgoing credit item in the 5:00 PM Central transmission, keep in mind that a hold is not placed on the member account for a one-time request, and there is a possibility that the offsetting debit to the member account may exception due to non-sufficient funds. Keyword: ED |

|

Req Date |

The date the ACH origination item was requested. The date will default to the teller's open date when the item is added. |

Portico Host: 461