Certificate Add-Ons and Surrenders

For more information about IRAs, see IRAs. For more information about Certificates, see Certificates.

You can add funds to a certificate or surrender a certificate from the Certificates - General tab or the Transactions - Certificates tab.

To access the Certificate Surrender dialog box or Certificate Add On dialog box from the Certificates - General tab, under Member Services on the Portico Explorer Bar, click Account Information. The Overview tab appears on top. Click the Certificates tab. Locate the member using the search tool on the top menu bar. Select the down arrow to select the search method, then enter the search criteria. Select the green arrow or press ENTER to locate the member. Click the Select a Certificate down arrow to select a certificate number and description. Then, click the green arrow.

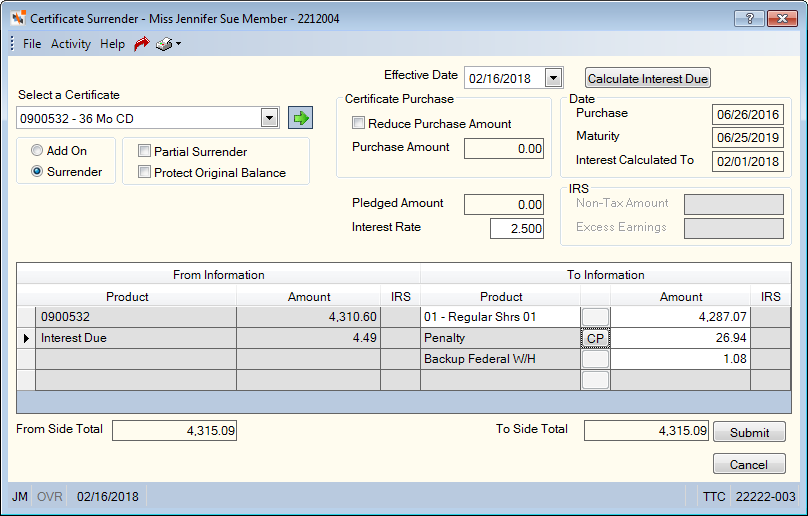

Click Surrender to open the Certificate Surrender dialog box.

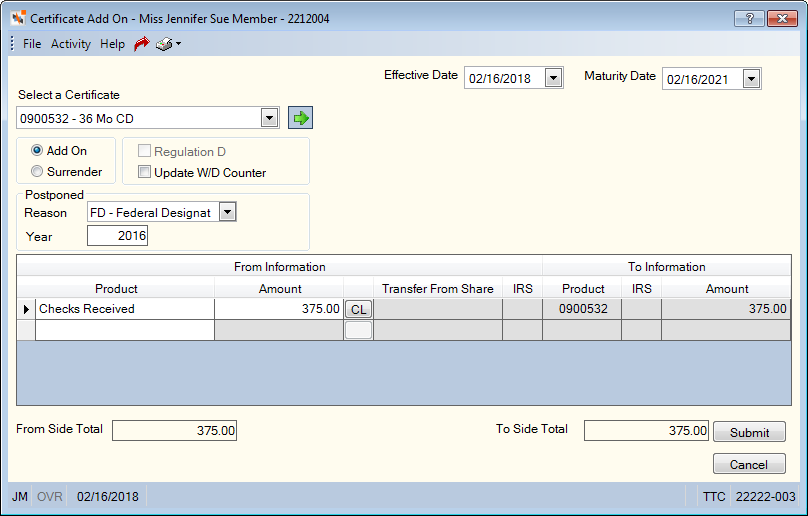

Click Add On to open the Certificate Add On dialog box.

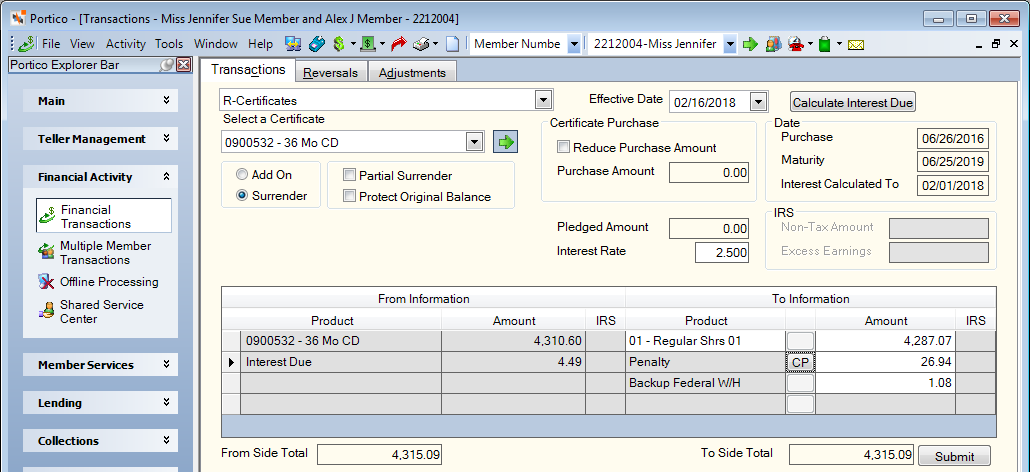

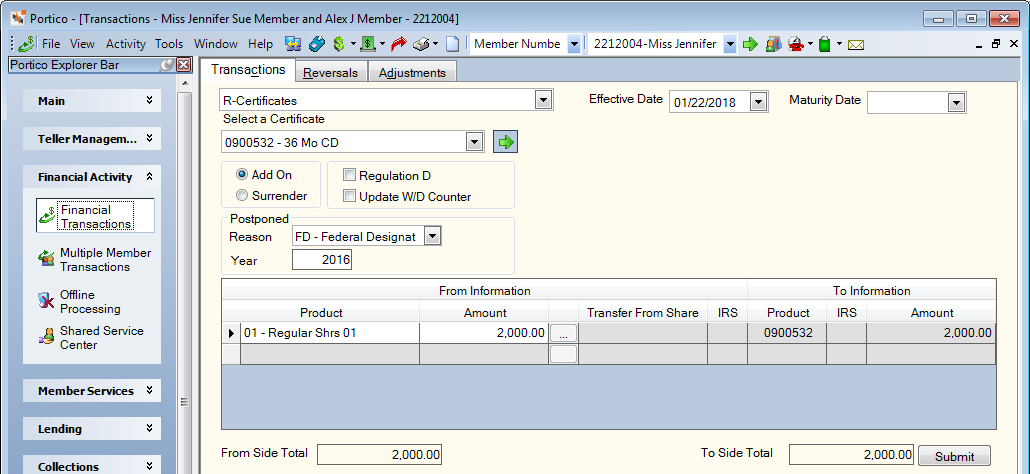

To access the Transactions - Certificate tab, under Financial Activity on the Portico Explorer Bar, click Financial Transactions. The Transactions tab appears on top. Locate the member using the search tool on the top menu bar. Select the down arrow to select the search method, then enter the search criteria. Select the green arrow or press ENTER to locate the member. On the Transactions tab, click the down arrow next to the first drop-down box and select R-Certificates.

Click the Select a Certificate down arrow to select a certificate number and description. Then, click the green arrow.

How do I? and Field Help

Click the Effective Date down arrow to select the effective date of the add-on or surrender from the pop-up calendar or enter the date in MM/DD/YYYY format.

Click the Add On option to add funds to an existing certificate, or click the Surrender option to surrender an existing certificate. Keyword: AS

Certificate Surrender

A certificate can be fully surrendered or partially surrendered. The following steps briefly describe the surrender process:

- Interest accrued on the certificate is calculated, the interest date is brought up to date, and the interest amount is temporarily added to the current certificate balance to result in the surrender value of the certificate.

- Any assessed penalty by the credit union is subtracted from the surrender value to result in the disbursal amount.

- The certificate is subtracted from the surrender value to result in the disbursal amount.

- The certificate is changed to C - closed. No further financial activity may occur on this certificate number for this member. The certificate will be dropped during the next purge processing.

Penalty plans supported by Portico for early surrender are a flat penalty amount that is calculated by your credit union or based upon header rules previously established for this certificate type.

You can produce a surrender quote or surrender a certificate and disburse the funds in cash, check, or to the members share account. You can also process a normal surrender in which the certificate has matured and an early surrender on an active certificate in which the credit union can assess penalties.

The message OVERRIDE IS REQUIRED TO SURRENDER BELOW PLEDGED AMOUNT appears when you attempt to surrender the certificate below the pledged amount. This allows you to adjust the surrender amount or enter a teller override code to surrender the certificate below the pledged amount. If an override code is used, the system will automatically reduce the pledged amount to equal the new current balance after the partial surrender. If an override code is not used, you must access the Pledge Information dialog box to adjust the pledge amount before the certificate can be partially surrendered.

The system stores, but does not pay, the amount of interest earned (dividends) in the Unpaid Interest field on the Certificates - Interest tab.

The amount surrendered can be all or a portion of the difference between the amounts displayed in the Purchase Amount and Certificate Balance fields on the Certificates - General tab. The difference between the amounts displayed in the Purchase Amount and Certificate Balance fields is the year-to-date dividend amount.

Complete the following steps to begin the process of surrendering a certificate.

- Click Calculate Interest Due to calculate the amount of interest due on the certificate.

- To surrender a portion of the certificate, select the Partial Surrender check box.

- Select the Protect Original Balance check box to protect the original certificate balance from a penalty. Partial penalties will be assessed, rather than affect the original balance. (Keyword: OP)

- Select the Reduce Purchase Amount check box to reduce the Purchase Amount field by the surrender amount including the penalty. The reduced amount will appear on the maturity notice (101 Report or 105 Report). The Purchase Amount field displays the original certificate purchase amount.

- The Pledged Amount field indicates the total amount of funds in this certificate account that have been pledged against loans (Length: 12 numeric including decimal/Keyword: GA). The system will automatically reduce this amount as loan payments are made if B or T appears in the Depledge field on the Loan Profiles - Account Information tab. If N appears in the Depledge field, you must use the Pledge Information dialog box to adjust or remove the pledged amount. To remove a pledge associated with a purged loan, type 0.00 in the Pledge Amount field and click Save.

- The Interest Rate field displays the current interest rate on the certificate. You can change this field if necessary (Length: 6 numeric/Keyword: RT)

- In the IRA Non-Tax Amount field, enter the amount of the transaction that is considered non-taxable if the account is an IRA (Length: 12 numeric including decimal).

- In the Excess Earnings field, enter the amount of the IRA distribution that is excess earnings. Excess earnings is the dividend amounts earned on excess contributions during a given tax year. This amount is taxable. Keyword: EA / Length: 12 numeric including decimal. Enter an amount in this field only if you are using one of the following IRA distribution codes: Removal of excess contributions for same year (Traditional - 8, 81 (with exception); Roth - 8J; Coverdell - 8M) or Removal of excess contributions for prior year (Traditional - P, P1 (With exception); Roth - PJ; Coverdell - PM).

- Use the Certificates Transaction Area to complete the surrender.

The Purchase Date field indicates the date the certificate was originally purchased or renewed (Keyword: PD). The certificate will begin earning interest from this date.

The Interest Calculated To Date field indicates the date interest was calculated to, but not including the specified date (Keyword: LP). Interest for the next interest period will begin earning from this date. If the Interest Calculated To Date and the Maturity Date are equal, the member will earn one day's interest.

Certificate Add-On

Complete the following fields to begin the process of adding funds to the certificate.

- The Maturity Date field indicates the last day the certificate will earn interest (Keyword: MD). The certificate will mature during the back-office cycle. This date should be one day less than the date on the member's actual certificate to allow for back-office processing. Reports and the member's statement will reflect this date plus one day. The maturity date cannot be equal to or less than the purchase date or less than the date interest was last calculated. When completing a certificate add on, click the down arrow to select a maturity date for the certificate add-on from the pop-up calendar or enter the date in MM/DD/YYYY format (Keyword: MD).

- For a certificate add-on, select the Regulation D check box to increment the member's Regulation D transfer counter on the Shares - Activity tab (Keyword: RD).

- Select the Update Withdrawal Counter check box to increment the share account's withdrawal counter (Keyword: WD). The number of withdrawals is stored in the Period-to-Date Withdrawals field on the Shares - Activity tab.

-

If you select IRS deposit code E, you must complete the Postponed Reason field and Postponed Year field.

- From the Postponed Reason drop-down list, select the reason for the postponed contribution. For IRA owners who were affected by a federally declared disaster area, the postponed code is FD. For qualifying Armed Forces members, use the appropriate code for the owners’ area of operations. The valid options are:

EO12744 - Arabian Peninsula

EO13119 – Federal Republic of Yugoslavia

EO13239 - Afghanistan

FD - Federal Designated Disaster Extension Contribution - In the Postponed Year field, enter the original year of the postponed contribution must be entered for each of the postponed contribution types. This cannot be the current year and can only be up to two years in the past. For example, if the current year is 2018, you can enter 2017 or 2016.

- From the Postponed Reason drop-down list, select the reason for the postponed contribution. For IRA owners who were affected by a federally declared disaster area, the postponed code is FD. For qualifying Armed Forces members, use the appropriate code for the owners’ area of operations. The valid options are:

- Use the Certificates Transaction Area to complete the certificate add-on.

Certificates Transaction Area

The Certificates Transaction Area lets you add funds to a certificate or surrender a certificate.

| Column Heading | Description |

|---|---|

|

For a certificate add on, click the down arrow to select cash received, check received, cross account transfer, or a member share/share draft account. For a certificate surrender, this column will display the certificate and interest. |

|

|

For a certificate add on, enter the amount that will be added to the certificate account. Length: 10 numeric including decimal. If you selected cross account transfer, the From Member column will appear. Enter the member number or click the member lookup button to open the Member Search window and locate a member. For a certificate surrender, this column will display the certificate amount and interest earned. Length: 12 numeric Keyword: AP |

|

|

For a certificate add on, depending on the From Product selected, the ... button can change to CR, CL, or ML. If you selected cash, the Cash Received dialog box will pop up automatically when the cursor is in the From Amount column. You can also access the Cash Received dialog box by clicking the CR button in the transaction area grid. You can activate the Cash Received dialog box on the User Profile – Popups tab. If you selected check, the Check Log dialog box will pop up automatically when the cursor is in the From Amount column. You can also access the Check Log dialog box by clicking the CL button in the transaction area grid. You can activate the Check Log dialog box on the User Profile – Popups tab. |

|

|

For a certificate add on, click the down arrow to select the share account. |

|

|

For a certificate add on, click the down arrow to select a valid IRA withdrawal code if the share account is an IRA account. For a certificate surrender, click the down arrow to select a valid IRA withdrawal code if the certificate is an IRA account. |

|

|

For a certificate add on, the certificate that will receive the funds will appear in this column. For a certificate surrender, click the Disbursal Choices down arrow to select cash, check or a member share/share draft account. Keyword: CS for share transfer |

|

|

For a certificate surrender, click the CP button to automatically calculate the surrender penalty. The Protect Original Balance check box on the Certificate Profiles - Account Information tab is not part of the overall penalty calculation. It is used to determine if the financial withdrawal can be completed. If the withdrawal would bring the certificate below the original purchase amount, the transaction will not complete. The penalty calculation is the same whether the Protect Original Balance check box is selected. Some examples: Scenario 1: Current balance = 52047.52/ Purchase amount = 54047.51/ Transaction amount = 2000.00/ If transaction amount = 2000.00 and Protect Original Balance check box is selected, the message E-PENALTY MAY NOT BE TAKEN FROM ORIGINAL CERT BALANCE will appear. Scenario 2: Current balance = 55047.51/ Purchase amount = 54047.51/ Transaction amount = 2000.00/ If transaction amount = 2000.00 and Protect Original Balance check box is selected, the penalty amount = 12.76. The partial surrender does not complete because the transaction would take the balance below the purchase amount. Scenario 3: Current balance = 55047.51/ Purchase amount = 54047.51 Any transaction amount less than 1000.40 will not calculate a penalty. A penalty is not calculated until the transaction amount is greater than or equal to 1000.40. Portico's Certificate Penalty Calculation for partial surrenders is as follows:

Keyword: CP |

|

|

For a certificate add on, if the certificate account is an IRA account, click the down arrow to select a valid IRA deposit code. For a certificate surrender, if the share account is an IRA account, click the down arrow to select a valid IRA deposit code. |

|

|

For a certificate add on, enter the amount to be added to the certificate account. For a certificate surrender, enter the disbursal amount. Length: 10 numeric including decimal |

|

|

Penalty Amount |

The penalty collected when all or part of a certificate is surrendered prior to the maturity date. Length: 8 numeric including decimal Keyword: PA |

|

Federal Withholding |

The Federal Withholding amount for this certificate. The system will look at the Federal Withholding Percent field on the IRA Profile dialog box to determine the percentage to use to calculate the IRA federal withholding. If the Federal Withholding Percent field displays 00.00, and the Federal Withholding check box is selected, the system will use the default rate of 10.00%. The system will multiply the percentage times the interest earned to calculate the IRA federal withholding amount. Length: 10 numeric including decimal Keyword: WH |

When the total amount of the From Side product codes equals the total amount of the To Side product codes, click Submit to complete the transaction.

Click Cancel to close the dialog box with out saving your changes.

The member account listing appears on the Overview tab, Transactions tab, and Adjustments tab.

| Certificate Add-On | |

|---|---|

|

General Ledger Effects |

|

|

Related Reports |

|

|

Teller Balancing Effects |

The Balancing and Close tab reflects the following information: For cash or check add-on:

For share transfer add-on:

The system calculates interest on the previous balance up to the effective date of the certificate add-on. The effective date of the certificate add-on appears in the Calculated To Date field on the Certificates - Interest tab. The original purchase amount and current balance reflect the add-on amount. The system applies interest calculated, but not paid, in the next dividend payment. A certificate add-on completed using a share transfer appears in the history for the share general ledger account for the certificate type. The member number appears with the share type. |

|

Correction Procedures |

For a same-day correction, use the Reversals - Same-Day Reversal By CAN tab to reverse the transaction. For a prior-day correction, use the Certificate Surrender dialog box to perform a partial surrender Use the date in the Calculated To Date field on the Certificates - Interest tab as the effective date to prevent the system from calculating and storing the interest in the Unpaid Interest field on the Certificates - Interest tab. Maintain the Certificates - General tab, if necessary. |

| Certificate Surrender | |

|---|---|

|

General Ledger Effects |

If paying the interest, the following general ledger effects occur:

If surrendering the certificate, the following general ledger effects occur:

If the certificate is an IRA, the following general ledger effect occurs:

If the certificate incurs a penalty, the following general ledger effects occur:

|

|

Related Reports |

|

|

Teller Balancing Effects |

The Balancing and Close tab reflects the following information: Cash Disbursal:

Check Disbursal:

Share Transfer:

|

|

Correction Procedures |

For a same-day correction, use one of the following methods to reverse the transaction:

For a prior-day correction, use one of the following methods to reverse the transaction:

|

Portico Host: 361, 363, 371, 372, 373, 375, 376