Purchasing a Money Order

The Money Orders tab lets you sell money orders and assess a fee for the money orders. The funds used to purchase the money orders can be from cash, checks, shares, or any combination of these.

The system will automatically calculate the fee based on the criteria specified on the Product Code Information window for the linked money order fee product code. The fee can be a fixed amount or a percentage of the total transaction amount. You can also split the money order fee between income and payable general ledger accounts. The bottom half of the Money Orders tab is a credit union-defined screen and can display different product code options for each teller.

To sell money orders, enter the amount and serial number for each money order. You only need to enter the serial number if the Forms Management check box is selected in the Products section on the Credit Union Profile - Products & Services tab. The system automatically calculates the fee amount and the total transaction amount and displays this information. You can then indicate the payment method.

To access the Money Orders tab, under Financial Activity on the Portico Explorer Bar, click Financial Transactions. The Transactions tab appears on top. Locate the member using the search tool on the top menu bar. Select the down arrow to select the search method, then enter the search criteria. Select the green arrow or press ENTER to locate the member.

On the Transactions tab, click the down arrow next to the first drop-down box and select M-Money Orders.

How do I? and Field Help

To verify a member using the Documents Presented as ID dialog box, click the Documents Presented as ID icon.

The Effective Date field will default to today's date. You can change the effective date by clicking the Effective Date down arrow to select a date from the pop-up calendar or entering a date in MM/DD/YYYY format (Keyword: ED). Dividend and interest calculations are based on this effective date. While future effective dating is not allowed on most transactions, you can specify a future effective date on some transactions.

To generate a money order, in the Money Order Amount field, enter the amount of the money order (Length: 8 numeric). In the Serial Number field, enter the serial number of the money order (Length: 14 numeric). Then, click the right arrow to add the money order to the list box. You can enter a maximum of 15 money orders on one transaction.

If your credit union uses Forms Management, the serial number you enter must appear in the forms inventory for your drawer location. The serial number must also fall with the range of acceptable serial numbers as specified in the Serial Number Control Variance field on the Form Information window. From time-to-time, you may need to override a sequence of forms due to variance warnings. If the serial number does not fall within the specified range, you must select the Override check box. After adding a money order to the list box, you can double-click the form in the list box to add the Override text next to the form. A second double-click will remove the Override text next to the form in the list box.

Use the fields in the Transaction Area to complete the money order purchase. A From/To Difference amount will appear in the grid heading until the From and To amounts are equal.

The Money Order Transaction Area lets you generate money orders for a member.

| Column Heading | Description |

|---|---|

|

In the From Product column, select the payment method (checks received, cash received, share account, share draft account, or loan). |

|

|

Enter the cash, check, or transfer amount that will be used to purchase the money orders, including decimal. Length: 10 numeric If you selected cash, the Cash Received dialog box will pop up automatically when the cursor is in the From Amount column. You can also access the Cash Received dialog box by clicking the CR button in the transaction area grid. You can activate the Cash Received dialog box on the User Profile – Popups tab. If you selected check, the Check Log dialog box will pop up automatically when the cursor is in the From Amount column. You can also access the Check Log dialog box by clicking the CL button in the transaction area grid. You can activate the Check Log dialog box on the User Profile – Popups tab. Type d or D in the From Amount column to populate the field with the default amount defined for the product on the Product Code Information window. This shortcut will work for any product code that has a default amount greater than 0.00 regardless of the master code. |

|

|

If you selected a share account that supports Reg D activity, you can type Y in the Functions column to increment the Period-to-Date Reg D Txns counter on the Shares - Activity tab. |

|

|

Select the MO Money Order Purchase product. |

|

|

The total amount of the money order(s). Length: 10 numeric. Type d or D in the To Amount column to populate the field with the default amount defined for the product on the Product Code Information window. This shortcut will work for any product code that has a default amount greater than 0.00 regardless of the master code. The From/To Difference field provides a running total of the remaining funds left to deposit. |

|

|

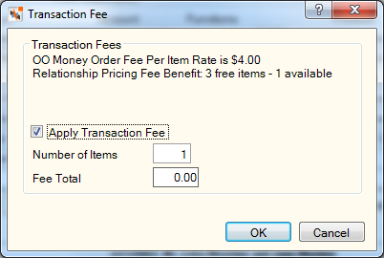

If the To Product is a money order or traveler's check, you can assess a fee for the money order or traveler's checks by typing Y in the Function column. Click the ... button to open the Transaction Fee dialog box. The Transaction Fee dialog box will display additional fee benefit information for those members included in a Relationship Pricing plan. For the Number of Items Free fee benefit, the information includes the total number of free items allowed by the member’s Relationship Pricing plan and the remaining number of free items available for the current transaction. The Fee Total field will reflect the correct fee amount based on the number of free items remaining and the number of items being purchased. Select the Apply Transaction Fee check box. In the Number of Items field, enter the number of traveler's checks or money orders to assess the fee on. Then, click OK.

|

When the total amount of the From Side product codes equals the total amount of the To Side product codes, click Submit to complete the transaction.

If the Message Line Indicator check box is selected on the Product Code Information window for the product code, the Resolution Message dialog box will appear automatically. You can enter a message up to 24 alphanumeric characters long. A resolution message explains the source of funds received or disbursed in an unusual way. For example, actual cash found in the lobby and turned in by a member. You would deposit the funds to a miscellaneous account using a special product code. The Product Code Resolution window allows the credit union accounting department to reconcile activity associated with a resolution message. The accounting department will use the Product Code Resolution window to transfer the funds from the miscellaneous product code to the appropriate general ledger account.

Click New to clear the Transaction Area and generate a new money order.

The member account listing appears on the Overview tab, Transactions tab, and Adjustments tab.

The Check Information group box displays the check hold information for any checks received.

| Field | Description |

|---|---|

|

The amount of local check funds to be held for the specified local hold days. The local check amount is determined using the following calculation: CHECK AMT - NON-LOCAL AMT - NO HOLD AMT = LOCAL CHECK HOLD AMT. Length: 12 numeric including decimal |

|

|

The number of days to hold the amount of the check deposit considered as local funds. If blank, this field will default to the number of days specified in the Local field in the Holds section on the Credit Union Profile - Teller tab. Length: 2 numeric |

|

|

The number of checks to be held for the specified local hold days. Length: 2 numeric |

|

|

The amount of on-us check funds. |

|

|

The number of on-us checks. |

|

|

The amount of exception check funds to be held for the specified exception hold days. Refunds are not allowed on amounts held as exception funds. Length: 12 numeric including decimal Keyword: NL |

|

|

The number of days to hold the amount of the check deposit considered as exception funds. This field will default to the number of days specified in the Exception field in the Holds section on the Credit Union Profile - Teller tab. Length: 2 numeric |

|

|

The number of checks to be held for the specified exception hold days. Length: 2 numeric |

The batch number, batch sequence, transaction amount, cash received and cash disbursed for the transaction prints on the last three lines of member's receipt. You must use the Product Code Information window to change the description or default values of a product code. You must perform the Transaction Definition window to add, change, or delete product codes for the Money Orders tab.

The general ledger effects of the Money Orders tab depend on the combination of From and To product codes and the master type associated with the product code.

From Side

| Master Type | Balancing and Close Effect |

|---|---|

|

CC |

Debit Product Code GL Credit 739200 |

|

CK |

Debit Product Code GL Credit 739200 |

|

GI |

Debit Product Code GL Credit 739200 |

|

GO |

Debit Product Code GL Credit 739200 |

|

GOMO |

Debit Product Code GL Credit 739200 |

|

MI |

Debit Share Type GL Credit 739200 |

|

ML |

Debit Loan Type GL Credit 739200 |

|

MS |

Debit Share Type GL Credit 739200 |

To Side

| Master Type | Balancing and Close Effect |

|---|---|

|

CC |

Debit 739200 Credit Product Code GL |

|

CK |

Debit 739200 Credit Product Code GL |

|

GI |

Debit 739200 Credit Product Code GL |

|

GO |

Debit 739200 Credit Product Code GL |

|

GOMO |

Debit 739200 Credit Product Code GL |

|

MS |

Debit 739200 Credit Share Type GL |

none

The teller balancing effects are as follows:

- Increases the Teller Batch Total field on the Balancing and Close tab by the amount of the transaction.

- Increases the Amount field on the Balancing and Close tab by the amount of the transaction for any product code with Display and Balance in the Balancing Report field on the Product Code Information window.

- Increases the Amount field on the Balancing and Close tab by the amount of the transaction for any product code with Display Only in the Balancing Report field on the Product Code Information window.

On Teller Administration Expanded, the Money Orders tab updates the Balancing and Close tab based on the master type associated with the product code:

From Side

| Master Type | Balancing and Close Effect |

|---|---|

|

CC |

Increase Cash Received |

|

CK |

Increase Checks for Deposit |

|

GI |

None |

|

GO |

None |

|

GOMO |

None |

|

MI |

None |

|

ML |

None |

|

MS |

None |

To Side

| Master Type | Balancing and Close Effect |

|---|---|

|

CC |

Increase Cash Disbursed |

|

CK |

None |

|

GI |

None |

|

GO |

None |

|

GOMO |

None |

|

MS |

None |

On Teller Administration Basic, the Money Orders tab updates the Balancing and Close tab based on the master type associated with the product code:

From Side

| Master Type | Balancing and Close Effect |

|---|---|

|

CC |

Update Cash Received |

|

CK |

Update Checks Received |

|

GI |

Update Transfers\JV |

|

GO |

Update Transfers\JV |

|

MI |

Update Transfers\JV |

|

ML |

Update Transfers\JV |

|

MS |

Update Transfers\JV |

To Side

| Master Type | Balancing and Close Effect |

|---|---|

|

GI |

Update Tlr-Type/Other or Other Receipts Note: If the general ledger account for the money order or money order fee product appears in the Teller Sales section on the Credit Union Profile - Accounting tab, the Money Orders tab will update the Tlr-Type 1 through Other fields. Otherwise the Money Orders tab will update the Other Receipts field. |

|

GOMO |

Update Tlr-Type/Other or Other Receipts Note: If the general ledger account for the money order or money order fee product appears in the Teller Sales section on the Credit Union Profile - Accounting tab, the Money Orders tab will update the Tlr-Type 1 through Other fields. Otherwise the Money Orders tab will update the Other Receipts field. |

For same-day correction, perform the Reversals - Same-Day Reversals tab.

If you added a new share draft account when performing the Money Orders tab and then wish to reverse the transaction, you must perform the following steps in the order shown:

- Use the Reversals - Same-Day Reversals tab to reverse transaction code 244.

- Use the Reversals - Same-Day Reversals tab to reverse transaction code ALM.

If you do not perform the reversals in this order, the message SUBSEQUENT ACTIVITY FOR THIS ACCOUNT MUST BE REVERSED appears.

For a prior-day correction, based on the product codes, perform a combination of the following transactions:

- Adjustments – Share Deposit from General Ledger tab

- Adjustments – Share Withdrawal to General Ledger tab

- Adjustments – Loan Payment from General Ledger tab

- Adjustments – Loan Advance tab

- Basic Journal Voucher window

Portico Host: ALM