Identifying Non-Member CTR Matches

CTR will use the following non-member identifiers to look for matches to aggregate transaction totals to the threshold amount.

- Last name and date of birth

- Last name, ID type, ID issued by and identification number and ID

- Date of birth, ID type, ID issued by and identification number

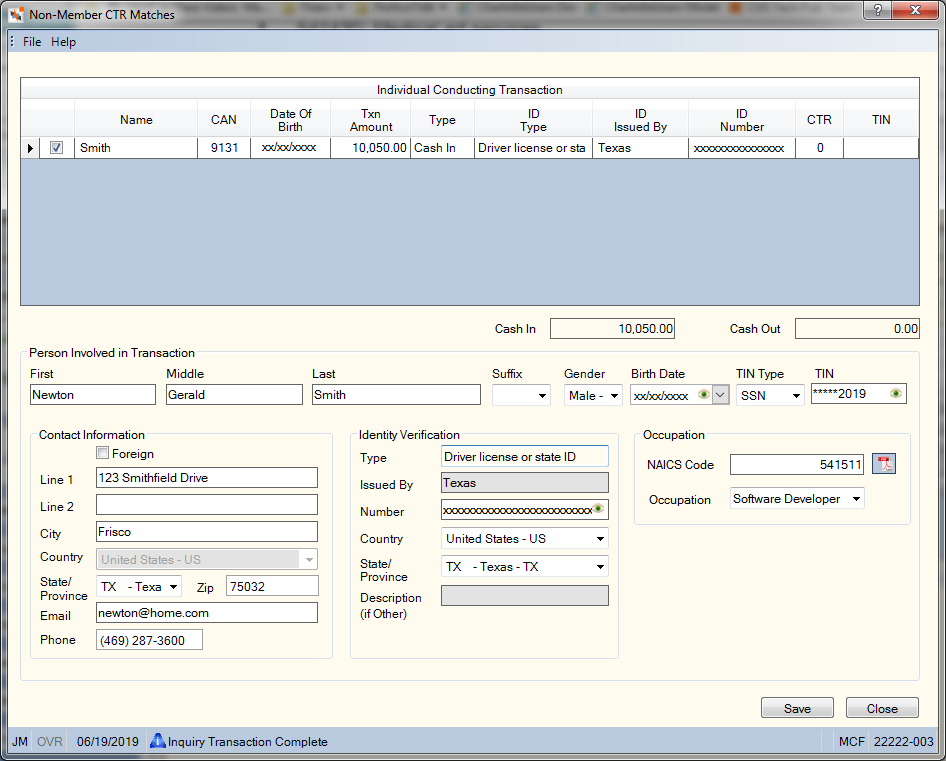

When a match is identified, the Non-Member CTR Matches dialog box will appear.

How do I? and Field Help

The Individual Conducting Transaction List grid displays the matches to the non-member identifiers.

| Column Heading | Description |

|---|---|

| unlabeled | Select the valid matches by selecting the check boxes next to the correct individuals. |

|

Name |

The last name of the individual who conducted the transaction being reported on the CTR report. |

| CAN | The CAN assigned to the transaction. |

| Date of Birth | The birth date of the individual conducting the transaction being reported on the CTR report. Portico masks birthdates. |

| Txn Amount | The amount of the transaction. |

| ID Type | The type of ID. The valid values are: Driver license or state ID, Passport, Alien registration, or Other. |

| ID Issued By |

The state or entity that issued the ID. Length: 17 alphanumeric |

| ID Number |

The ID number or taxpayer ID number of the individual. Portico masks driver license numbers and taxpayer IDs. Length: 17 alphanumeric |

| CTR |

The system-assigned CTR number. Length: 9 numeric |

|

TIN |

The taxpayer ID number of the individual who performed the financial transaction. This can be the Social Security Number (SSN), Employer Identification Number (EIN), or Individual Taxpayer Identification Number (ITIN). |

Below the grid, the Cash In field indicates the amount of cash deposited, and the Cash Out field indicates the amount of cash withdrawn.

Select the valid matches by selecting the check boxes next to the correct individual. If multiple individuals are selected, the information for the first individual selected will appear below the grid. If the individual is including in an existing CTR, the information from the CTR will appear below the grid.

To add the demographic information, complete the following information:

| Field | Description |

|---|---|

|

Enter the first name of the individual selected as the individual who conducted the transaction being reported on the CTR report. Length: 15 alphanumeric |

|

|

Enter the middle name of the individual selected as the individual who conducted the transaction being reported on the CTR report. Length: 35 alphanumeric |

|

|

Enter the last name of the individual selected as the individual who conducted the transaction being reported on the CTR report. Length: 20 alphanumeric |

|

|

Enter the suffix to the name listed, e.g. Jr., Sr., PhD. This field can be customized on the Customized Field - Update window. |

|

|

From the drop-down list, select the gender of the individual (F-Female or M-Male). If not an individual, leave the field blank or select B-Business, C-Corporation, D-Doing Business As, O-Organization, or U-Unknown. |

|

|

The birth date of the individual selected as the individual who conducted the transaction being reported on the CTR report. Click the down arrow to select the birth date from the pop-up calendar or enter the date in MM/DD/YYYY format. The Birth Date field is only required if the Gender field is Male or Female. Portico masks birthdates. You can click inside the field to show the birthdate. When you tab out of the field, the birthdate is masked. The birthdate will remain unmasked as long as the field has focus. Portico logs each time a user clicks inside a field to view a birthdate in the View Sensitive Data Audit report. |

|

|

The tax ID type: SSN, EIN or ITIN. |

|

|

The taxpayer ID number of the individual who performed the financial transaction. This can be the Social Security Number (SSN), Employer Identification Number (EIN), or Individual Taxpayer Identification Number (ITIN). Portico partially masks taxpayer ID numbers. If you are assigned to the Portico – User Can View/Maintain TIN security group or a credit union-defined security group with the Portico – User Can View TIN permission or the Portico – User Can Maintain TIN permission, an eye indicator will appear within the field to indicate that you have permission to view the taxpayer ID number. You can click inside the field to show the taxpayer ID. When you tab out of the field, the taxpayer ID will be masked. The taxpayer ID will remain unmasked as long as the field has focus. Length: 9 numeric |

|

|

Select this check box if the address is foreign. |

|

|

Enter line 1 of the primary address for the individual selected as the individual who conducted the transaction being reported on the CTR report. This field cannot contain all blanks. Length: 50 alphanumeric |

|

|

Enter line 2 of the primary address for the individual selected as the individual who conducted the transaction being reported on the CTR report. Length: 50 alphanumeric |

|

|

Enter the city where the individual resides. Length: 50 alphanumeric |

|

|

If the Foreign check box is checked, select the foreign country from the Country drop-down list. |

|

|

Click the down arrow to select the correct state abbreviation from the drop-down list. If Canada or Mexico is selected from the Country drop-down list, the State/Province drop-down list will include all province codes for Canada and Mexico. |

|

|

Enter the postal ZIP Code for the address listed. For domestic addresses, the ZIP code must be either 5 or 9 digits. For foreign addresses, the ZIP code can be up to 10 characters. If the Foreign check box is not selected:

If the Foreign check box is selected:

Length: 9 numeric (10 alphanumeric if the Foreign check box is selected.) |

|

|

Enter the individual's email address. Length: 50 characters |

|

|

Enter the complete phone number including area code for the individual. Length: 10 numeric |

|

|

Click the down arrow to select the ID type. The valid values are: Driver license or state ID, Passport, Alien registration, or Other. |

|

|

Enter the state or entity that issued the ID. Length: 17 alphanumeric |

|

|

Enter the ID number of the individual. Portico masks driver license numbers. You can click inside the field to show the driver license number. When you tab out of the field, the driver license number will be masked. The driver's license number will remain unmasked as long as the field has focus. Portico will log each time a user clicks inside a field to view a driver license number in the View Sensitive Data Audit report. Length: 17 alphanumeric |

|

|

If the ID is foreign, select the foreign country from the Country drop-down list. The system default for the Country field is US – United States of America. If Canada or Mexico is selected from the Country drop-down list, the State/Province drop-down list will include all province codes for Canada and Mexico. |

|

|

Click the down arrow to select the correct state abbreviation for the ID from the drop-down list. If Canada or Mexico is selected from the Country drop-down list, the State/Province drop-down list will include all province codes for Canada and Mexico. |

|

|

Enter the description of the ID. Length: 17 alphanumeric |

|

|

Enter the North American Industry Classification Source Code. Click the PDF link next to the NAICS Code field to view the list of acceptable NAICS codes. If you used the Industry Classification field on the Ownership Information tab prior to the November 2012 release, the field value from the Industry Classification field will appear in the NAICS Code field. This information is included in the transmission to AML Compliance Manager. Length: 6 numeric |

|

|

Enter the occupation of the individual selected as the individual who conducted the transaction being reported on the CTR report. This field can be customized using the Customized Fields window. The custom field value will be reported on the CTR sent to the BSA website. Length: 25 alphanumeric |

Click Save to identify the selected individual(s) as the individual(s) who performed the financial transaction. When all the transaction totals meet the threshold amount, the CTR process will begin.