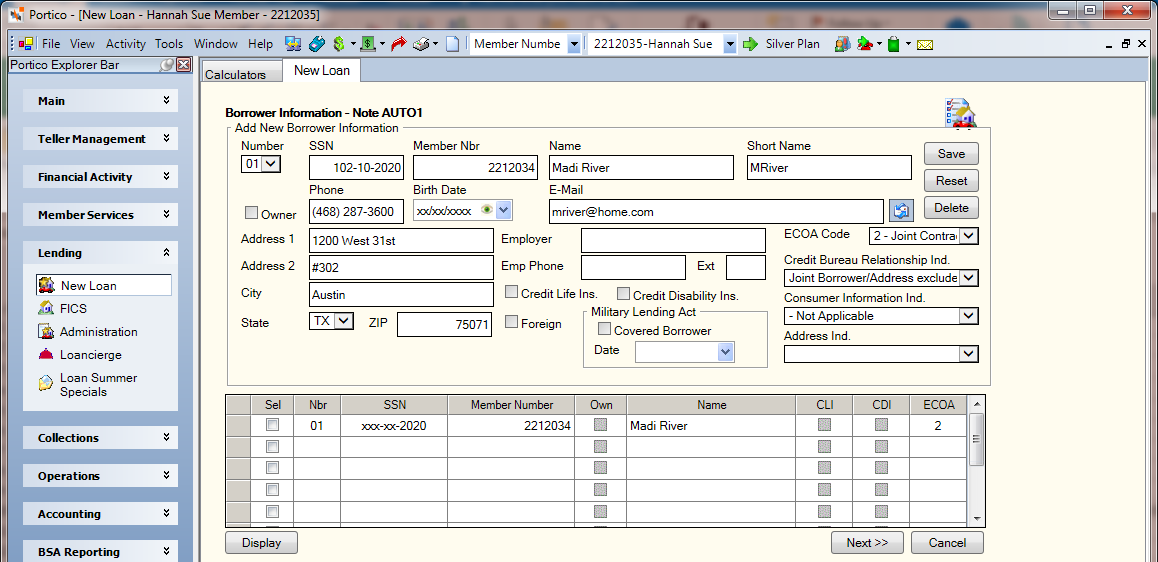

Adding Borrower Information

The New Loan - Borrower Information tab lets you add borrower information on a new loan. To access the New Loan - Borrower Information tab, select the Borrower Information check box on the New Loan - Additional Information tab.

How do I? and Field Help

Complete the following fields in the Add New Borrower group box to add a new borrower to the loan.

Any co-borrower that you intend to report to the credit bureau should be added first. Co-borrowers that you do not intend to report should be at the end of the list.

|

Click the Number down arrow to assign a number to the borrower. Valid values are 1-10 Length: 2 numeric |

|||||||||||

|

The Social Security number of the borrower. While this field is required, it is used for informational purposes only. If you do not know the borrower SSN, you can type all nines in this field. All zeros is not a valid number. When you click Save, Portico partially masks taxpayer ID numbers. If you are assigned to the Portico – User Can View/Maintain TIN security group or a credit union-defined security group with the Portico – User Can View TIN permission or the Portico – User Can Maintain TIN permission, an eye indicator will appear within the field to indicate that you have permission to view the taxpayer ID number. You can click inside the field to show the taxpayer ID. When you tab out of the field, the taxpayer ID will be masked. The taxpayer ID will remain unmasked as long as the field has focus. Length: 9 numeric Keyword: CS |

|||||||||||

|

The name of the borrower. Length: 25 alphanumeric Keyword: CN |

|||||||||||

|

Line 1 of the borrower's street address. Length: 24 alphanumeric Keyword: A1 |

|||||||||||

|

Line 2 of the borrower's street address. If the Foreign check box is selected, the foreign city's name must reside in the Address 2 field and the foreign country's name must reside in the City field. Enter the foreign country code in the State field. For Canada, enter the province code in the State field. Length: 24 alphanumeric Keyword: A2 |

|||||||||||

|

The city where the borrower resides. If the Foreign check box is selected, the foreign city's name must reside in the Address 2 field and the foreign country's name must reside in the City field. Enter the foreign country code in the State field. For Canada, enter the province code in the State field. Length: 18 alphanumeric Keyword: AC |

|||||||||||

|

Click the State down arrow to select the state where the borrower resides. If the Foreign check box is selected, the foreign city's name must reside in the Address 2 field and the foreign country's name must reside in the City field. Enter the foreign country code in the State field. For Canada, enter the province code in the State field. Keyword: AS |

|||||||||||

|

The postal ZIP Code for the address listed. For domestic addresses, the ZIP code must be either 5 or 9 digits. For foreign addresses, the ZIP code can be up to 10 characters. If the Address is Foreign check box is not selected:

If the Address is Foreign check box is selected:

Length: 9 numeric (10 alphanumeric if the Address is Foreign check box is selected.) Keyword: ZP Reporting Analytics for Primary Member Address: MBR Zip Code Dash (Located in Member Information/Member Base subject and Month-end Information/Member Month-end/ME Member Base subject) |

|||||||||||

|

Select the Foreign check box if the borrower’s address is located in a foreign country. If the Foreign check box is selected, the foreign city's name must reside in the Address 2 field and the foreign country's name must reside in the City field. Enter the foreign country code in the State field. For Canada, enter the province code in the State field. Keyword: FA |

|||||||||||

|

Select the Owner check box if the borrower is the primary owner of the loan. When the Owner check box is selected, the ECOA Code field will be disabled indicating that Portico will use the ECOA Code defined at the loan level. On the Portico host, a blank ECOA Code field is interpreted as the value 0; however, this does not indicate that the borrower is omitted from credit bureau reporting, since the ECOA code defined at the loan level is used for reporting. To indicate an owner of the loan on the New Loan Borrower dialog box, the Alternate Address check box must be selected in the Options section on the Credit Union Profile – Credit Union tab. If not selected, the member associated with the loan is the account owner. Use caution when selecting this check box as it affects insurance calculations, credit bureau reporting, delinquency notices, and collections. Keyword: OW |

|||||||||||

|

The borrower’s account number if the borrower is a member of the credit union. This field is used for informational purposes only. Length: 12 numeric Keyword: CA |

|||||||||||

|

The borrower’s first and second initials followed by the last name. An unknown initial is indicated by a blank in that position. The Short Name field is required and cannot contain all blanks if the Owner check box is selected. Length: 20 alphanumeric Keyword: SN |

|||||||||||

|

The home phone number of the borrower. Length: 10 numeric Keyword: CP |

|||||||||||

|

Click the Birth Date down arrow to select the borrower’s birth date from the pop-up calendar or enter the date in MM/DD/YYYY format. Portico masks birthdates. You can click inside the field to show the birthdate. When you tab out of the field, the birthdate is masked. The birthdate will remain unmasked as long as the field has focus. Portico logs each time a user clicks inside a field to view a birthdate in the View Sensitive Data Audit report. The birth date of the owner of the loan if the Owner check box is selected. The birth date is a required field if the Credit Disability Insurance check box or Credit Life Insurance check box is selected for a borrower record. This will indicate the birth date for a co-borrower of the loan that is covered by insurance. Keyword: DB |

|||||||||||

|

The name of borrower's employer. Length: 25 alphanumeric Keyword: EN |

|||||||||||

|

The borrower’s work phone number. Length: 10 numeric Keyword: EP |

|||||||||||

|

The borrower’s work extension. Length: 4 numeric Keyword: EE |

|||||||||||

|

If the borrower is covered by credit life insurance (CLI), select the Credit Life Insurance check box. If selected, a valid birth date and short name are required. This check box can only be selected for the borrower if the borrower is not flagged as owner of the loan and either: 1) the loan is coded for joint to single to none coverage, or 2) the loan is coded for single co-borrower insurance. Keyword: LI |

|||||||||||

|

If the borrower is covered by credit disability insurance (CDI), select the Credit Disability Insurance check box. If selected, a valid birth date and short name are required. This check box can only be selected for the borrower if the borrower is not flagged as owner of the loan and either: 1) the loan is coded for joint to single to none coverage, or 2) the loan is coded for single co-borrower insurance. Keyword: DI |

|||||||||||

|

The ECOA code that indicates how a borrower is reported to the credit bureau. When the Owner check box is not selected, Portico will default the ECOA Code field based on the ECOA code defined at the loan level:

You can accept the default values listed in the table above or you can change the borrower ECOA code to any of the following valid values: 0 - Omit from Credit Bureau reporting. 1 - Individual (not available when adding a new borrower when booking a new loan in Portico) 2 - Joint Contractual Liability 3 - Authorized User. If selected, you must enter the borrower birth date. 5 - Co-maker or Guarantor 7 - Maker (co-maker liable if maker defaults) T - Terminated (not available when adding a new borrower) W - Commercial / Business. Be sure to set the Address Indicator to B if W is selected. (not available when booking a new loan in Portico) X - Deceased (not available when adding a new borrower) Z - Delete Customer (not available when adding a new borrower) If the ECOA Code field is T, X or Z, the borrower will be reported to the credit bureau one last time before no longer being reported. A blank ECOA Code field is interpreted as the value 0 - Omit from Credit Bureau reporting on the Portico host. Keyword: EC Reporting Analytics: Borrower ECOA Code ( Loan folder > Co-Borrower query subject and Month-end Information > Loan Month-End > ME Co-Borrower query subject) |

|||||||||||

|

Click the down arrow to specify the information that will be reported to the credit bureau for the borrower. The valid options are: Blank – Only allowed and required when the Owner check box is selected. 1 - Joint Borrower/Address excluded. Report the borrower name and Social Security number (default) 2 - Non-spouse or unknown relationship/different address. Report the borrower name, Social Security number, and address. Used when the borrower is a non-spouse or unknown relationship. 3 - Spouse only/different address. Report the borrower name, Social Security number, and address. Used when the borrower is a spouse who resides at a different address. |

|||||||||||

|

Click the down arrow to select the bankruptcy status reported to the credit bureau for the borrower. The valid options are: Blank - Not Applicable - System default A - Petition for Chapter 7 Bankruptcy B - Petition for Chapter 11 Bankruptcy C - Petition for Chapter 12 Bankruptcy D - Petition for Chapter 13 Bankruptcy E - Discharged through Bankruptcy Chapter 7 F - Discharged through Bankruptcy Chapter 11 G - Discharged through Bankruptcy Chapter 12 H - Discharged through Bankruptcy Chapter 13 Q - Removes Bankruptcy Indicator previously reported (A through P) R - Reaffirmation of Debt S - Removes Reaffirmation of Debt and Reaffirmation of Debt Rescinded Indicators (R,V,2A) previously reported T - Credit Grantor Cannot Locate Consumer U - Consumer Now Located (removes previously reported T indicator) V - Chapter 7 Reaffirmation of Debt Rescinded 2A - Lease Assumption I - Chapter 7 Bankruptcy Dismissed (obsolete) J - Chapter 11 Bankruptcy Dismissed (obsolete) K - Chapter 12 Bankruptcy Dismissed (obsolete) L - Chapter 13 Bankruptcy Dismissed (obsolete) M - Chapter 7 Bankruptcy Withdrawn (obsolete) N - Chapter 11 Bankruptcy Withdrawn (obsolete) O - Chapter 12 Bankruptcy Withdrawn (obsolete) P - Chapter 13 Bankruptcy Withdrawn (obsolete) Consumer Information Indicator values Q, S, and U are not intended to be reported to the credit bureau on a recurring basis. After they are sent to the credit bureau, Portico will change the Consumer Information Indicator field to blank. Keyword: CI |

|||||||||||

|

Click the down arrow to select the information to be sent to the credit bureau regarding the borrower's address. Blank is the system default. The valid values are: B – Business Address – not consumer’s residence C – Confirmed/verified address. If C – Confirmed/verified address is selected, the field should be changed back to blank after being reported to the credit bureau. D – Data reporter’s default address M – Military address N – Not confirmed address P – Bill Payer Service – not consumer’s residence S – Secondary Address U – Non-deliverable address/Returned mail Y – Known to be address of primary consumer Blank – No value is reported to the credit bureau. System default Portico will enter the value selected in the Address Indicator field on the Metro II transmission. The AI column on the Credit Bureau Transmission Report 350 will display the address indicator. This option supports the Identity Theft Red Flags and Address Discrepancies Under the Fair and Accurate Credit Transactions Act of 2003 (known as the Red Flag Rule) which requires a consumer reporting agency (CRA) to provide the user of a consumer report “a notice of address discrepancy” if the address provided by the user is “substantially different” from the address the CRA has on the consumer. The Address Indicator field on the Metro II transmission enables you to report a confirmed or verified address to the credit bureau. Reporting Analytics: Metro2 Address Ind (Co_Borrower subject in the Loan folder and the ME Co_Borrower subject in the Month-end Information\Loan Month-end folder) |

|||||||||||

|

Select the Covered Borrower check box to indicate that the loan borrower has been verified as a covered borrower under the Military Lending Act (MLA). Reporting Analytics: MLA Covered Co-Borrower Flag in Loan – Co-Borrower and Month-end Information – Loan Month-end – ME Co-Borrower |

|||||||||||

|

Click the Date down arrow to select a date from the pop-up calendar indicating when the Covered Borrower check box was selected. You can also specify a date when the borrower or member has been verified as not a covered borrower under the Military Lending Act (MLA) and the Covered Borrower check box is cleared or not selected. Reporting Analytics: MLA Covered Co-Borrower Date in Loan – Co-Borrower and Month-end Information – Loan Month-end – ME Co-Borrower |

Click Save to add the borrower information to the grid.

| Column Heading | Description |

|---|---|

|

To delete a borrower, select the check box next to the borrower and click Delete. To update a borrower, select the check box next to the borrower and click Display. |

|

|

Nbr |

The credit union-assigned number associated with the borrower. To view the complete taxpayer ID number, users must be assigned to the Portico – User Can View/Maintain TIN security group or a credit union-defined security group with the Portico – User Can View TIN permission. Valid values are 1-10 |

|

SSN |

The Social Security number of the borrower. Portico partially masks taxpayer ID numbers. Length: 9 numeric |

|

Member Number |

The borrower’s account number if the borrower is a member of the credit union. Length: 12 numeric |

|

Own |

If selected, the borrower is the primary owner of the loan. If not selected, the member associated with the loan is the account owner. Keyword: OW |

|

Name |

The name of the borrower. Length: 25 alphanumeric |

|

CLI |

If selected, the borrower is covered by credit life insurance (CLI). This check box can only be selected for the borrower if the borrower is not flagged as owner of the loan and either: 1) the loan is coded for joint to single to none coverage, or 2) the loan is coded for single co-borrower insurance. |

|

CDI |

If selected, the borrower is covered by credit disability insurance (CDI). This check box can only be selected for the borrower if the borrower is not flagged as owner of the loan and either: 1) the loan is coded for joint to single to none coverage, or 2) the loan is coded for single co-borrower insurance. |

|

Cr Rptg |

The ECOA code that indicates how a borrower is reported to the credit bureau. If the Owner check box is selected on the Loan Borrowers/References dialog box, the ECOA column will be blank to indicate that the ECOA Code at the loan level will be used for credit bureau reporting. When the Owner check box is not selected, the borrower ECOA code can be any of the following valid values:0 - Omit from Credit Bureau reporting. 1 - Individual (not available when adding a new borrower when booking a new loan in Portico)2 - Joint Contractual Liability3 - Authorized User. If selected, you must enter the borrower birth date.5 - Co-maker or Guarantor7 - Maker (co-maker liable if maker defaults)T - Terminated (not available when adding a new borrower)W - Commercial / Business. Be sure to set the Address Indicator to B if W is selected. (not available when booking a new loan in Portico)X - Deceased (not available when adding a new borrower)Z - Delete Customer (not available when adding a new borrower)If the ECOA Code field is T, X or Z, the borrower will be reported to the credit bureau one last time before no longer being reported. A blank ECOA Code field is interpreted as the value 0 - Omit from Credit Bureau reporting on the Portico host.Keyword: EC |

Click Reset to clear the fields in the Add New Borrower Information group box and start again. You can add a maximum of 10 borrowers per loan.

Click Next to continue setting up the loan. Click Cancel to stop setting up the loan.

none

- Non-Financial Transaction Register 030 (if maintained)

- Non-Financial Transactions on Delinquent Loans Report 032 (if maintained)

- Non-Financial Transaction Register - Employee Report 036 (if maintained)

- Delinquency Notices Report 440

- Delinquency Snap-Out Mailers Report 441

If the CO-MAKER NOTICE OPTION field on the 440 Report Rules specifies S or Y, the system will produce delinquency notices to be sent to the co-borrower. The system will produce a notice for each co-borrower appearing on the Loans – Borrowers/References tab. The co-borrower's name and address will print on the notice.

To correct a borrower's information on the same day, use the Reversals - Same Day Reversals tab. For a prior-day correction, access the Loan Borrowers/References dialog box and correct the information.

Portico Host: 60D