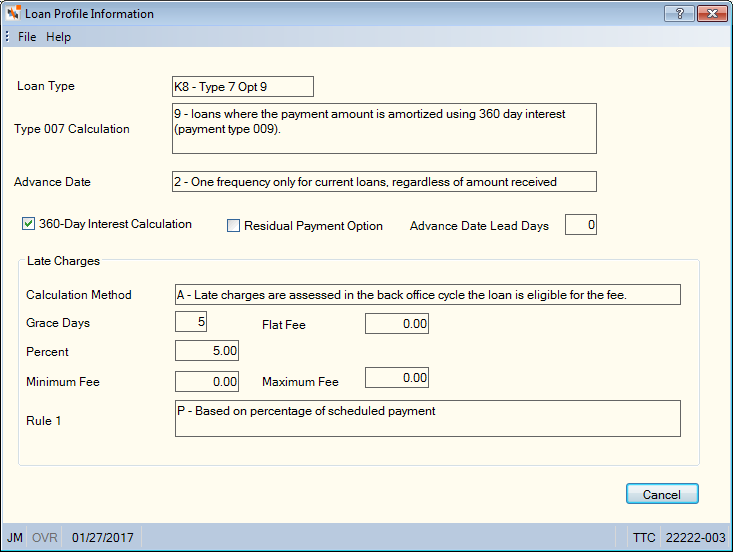

Viewing Loan Profile Information

The Loan Profile Information dialog box displays the loan profile options defines for the loan type. To display the Loan Profile Information dialog box, click the Loan Profile Information icon button on the Payment Entry Details dialog box.

How do I? and Field Help

The following fields appear on the Loan Profile Information dialog box.

| Field | Description | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

|

The loan type. |

|||||||||||

|

The option used to calculate the payment amount for payment entry (payment type 007) loans. The valid values are: P - The scheduled payment amount equals the accrued interest from the interest paid to date to the first of the month, any unpaid interest (remaining amount in FCCBNC, if any) plus a percentage of the outstanding loan balance. The Type 007 Percent field indicates the percentage used to calculate the principal portion of the payment amount. F - The scheduled payment amount equals the accrued interest from the interest paid to date to the first of the month, any unpaid interest (remaining amount in FCCBNC, if any) plus a flat amount designated in the Type 007 Flat Amount field which goes to principal. If the flat amount is 0.00, the payment will be interest only. . If the Type 007 Calculation field is F, then the New Loan - Split Rates/Skip Payments/Recalculation/Home Equity/Interest Plus tab will appear during new loan set up for Payment Type 007 (Interest Plus) loans only. B - The scheduled payment amount will be equal to the greater of either the accrued interest from the interest paid to date to the first of the month, any unpaid interest plus a percentage of the outstanding loan balance (option P) or the accrued interest from the interest paid to date to the first of the month, any unpaid interest plus a flat amount (option F). The Type 007 Percent field indicates the percentage used to calculate the principal portion of the payment amount. The default flat amount used to calculate the payment amount is specified in the Type 007 Flat Amount field. If the Type 007 Calculation field is B, then the New Loan - Split Rates/Skip Payments/Recalculation/Home Equity/Interest Plus tab will appear during new loan set up for Payment Type 007 (Interest Plus) loans only. The Type 007 Percent field indicates the percentage used to calculate the principal portion of the payment amount. The default flat amount used to calculate the payment amount is specified in the Type 007 Flat Amount field. 1 - Scheduled payment amount is specified by the credit union (payment type 001). Valid with both 360 and 365 day interest calculations. 2 - Scheduled payment amount is a percentage of the loan balance (payment type 002). 3 - Scheduled payment amount is based on a Balance/Payment Table (payment type 003). 6 - Scheduled payment amount is amortized using 365 day interest, based on truth in lending calculation (payment type 006). 9 - Scheduled payment amount is amortized using 360 day interest based on truth in lending calculation, ARM only (payment type 009). N - Payment type 007 not used. System default for non-payment type 007 loans. (Portico Host: 961 Transaction CALC OPT field) |

|||||||||||

|

The Advance Date field indicates if the system should advance the loan's due date by the number of complete scheduled payments received, or just advance the due date by one frequency. For 365-day interest loan types, the value in the Advance Date field determines when Portico will attempt to collect deferred late charges. Late charges will be collected automatically only after a loan is no longer delinquent and funds are not applied towards the advancing of the due date. The valid values are:

(Portico Host: 961 Transaction - ADV DATE field) |

|||||||||||

|

If selected, the monthly interest loan calculation is based on 360-day year. This calculation is mainly used for mortgage loans and adjustable rate mortgages. The monthly interest calculation is allowed only on payment types 001, 009, and 007 with calculation options 1 or 9. This check box must be selected for type 009 loans and type 007 loans with calculation option 9. The advance date option must be 2 and the loan must be due monthly on the 1st of each month. Loan advances, par accum, and monthly add-on insurance are not permitted. GL entries must be used to make principal only payments. Partial principal only payments are not permitted on 360-day loans. If the principal only payment is less than the scheduled monthly payment amount, a system edit will indicate that a partial payment is not allowed. Principal-only payments are allowed if the principal payment is equal to or greater than the scheduled monthly payment amount. Use caution when applying principal-only payments to 360-day loans. Interest is NOT calculated and stored when the principal payment is applied; therefore, when the next regular payment is applied, interest is calculated on the lower balance causing your credit union to lose some interest income. (Portico Host: 961 Transaction - 360 INT field 1) |

|||||||||||

|

If selected, the credit union supports residual loans (balloon loan). This option allows the final payment amount and date to be specified. If this check box is selected, the Rate Option field on the Loan Profiles - Rate Information tab must be N. (Portico Host: 961 Transaction - RESIDUAL field 1) |

|||||||||||

|

The number of days used in conjunction with the effective date of the loan payment transaction to determine if the due date can be advanced. For loan types with advance date option 4. The valid values are: 00 – 31 Length: 2 numeric (Portico Host: 961 Transaction - LD field) Reporting Analytics: Advance Date Lead Days (Loan Processing subject in CU Rules folder) |

|||||||||||

|

Indicates when late charges are calculated. The valid values are: N - Late charges are not supported. System default. P - Late charges are calculated during payment application A - Late charges are assessed in the back-office cycle the loan is eligible for the fee Note: Payment type 007 loan types with calculation options of 1, 2, 3, 6 or 9 must use option A. Payment type 007 loan types with calculation options of B, F and P may use options P or A. (Portico Host: 962 Transaction - CALC MTH field 2) |

|||||||||||

|

The number of grace days a loan can be delinquent before late charges will be assessed. Valid grace days can be 0 through 99. |

|||||||||||

|

The flat fee assessed on payments to delinquent loans. The late charge amount can be 0 through 999.99. |

|||||||||||

|

The percentage used in late charge calculations. The control amount as determined by Rule 1 or Rule 2 is multiplied by the percentage to determine the late charge amount. The percentage can be 0 through 100.00. Example: 005.00 equals 5 percent. |

|||||||||||

|

Indicates if variable late charges are supported. This field determines the amount used as the base in the late charge calculation. When rules 1 and 2 are both used, the late charges from the calculations are compared against each other. The late charge selected is then based on the Rule Option field. The valid options are: N - Option not used. System default. The valid options supported by Calculation Method P are: P - The late charge is based on a percentage of the scheduled payment amount. If the scheduled payment amount includes escrow and the One Late Fee Per Delinquent Payment check box is not selected, the late charge will be calculated using only the principal and interest portion of the payment. If the One Late Fee Per Delinquent Payment check box is selected, the late charge will be calculated using the principal, interest, and escrow portion of the payment. A - The late charge is based on a percentage of the transaction amount being applied to the loan. Not valid with payment type 007. T - The late charge is based on a percentage of the delinquent amount of the loan. Not valid with payment type 007. After the late charge is calculated based on the delinquent amount, the following checks and calculations take place:

I - The late charge is based on a percentage of the interest due from the interest-paid date up to the due date (does not include FCCBNC). Not valid with payment type 007. D - The late charge is based on a percentage of the interest due from the interest-paid date up to the current effective date (includes FCCBNC). Not valid with payment type 007. X - The late charge is based on a percentage of the transaction amount when the transaction amount is less than the scheduled payment amount. The late charge is based on a percentage of the scheduled payment amount when the transaction amount is equal to or greater than the scheduled payment amount. Portico uses the Late Charges Paid To Date field on the Loans - General tab. S - The late charge is based on a percentage of the loan amount past due. The late charge date from the Loans - General tab is used to determine how many payments are overdue. Escrow is included in the calculation of the loan amount past due when the loan supports escrow. When the loan due date is not current then the following can occur when a payment is applied: If the late charge date is less than or equal to the due date, then the partial payment accumulator will be considered when the loan amount past due is calculated. If the late charge date is greater than the due date, then the partial payment accumulator is not considered when the loan amount past due is calculated. When using late charge method S and the loan frequency is 0, par accum is always used in the online calculation of the late charge amount. Also, if multiple partial payments are applied online, Portico will always take a late charge due to the late charge date not being advanced. When using late charge method S and the delinquency method is B, the system uses the Late Charges Paid To Date field on the Loans - General tab to calculate the amount past due. W - The late charge is calculated according to the Wisconsin state criteria. Late charges are calculated as a percentage of the unpaid portion of the overdue payment. Payments made within the grace days of a due date will be applied towards the current payment, then the delinquent payment. Thus, if a partial payment is made on a current payment then the payment becomes delinquent, the late charge will be based on the portion of the payment that has not been applied. The loan maturity date will be used so that no late charge will be calculated and taken for the final loan due date or any payments thereafter. If the loan maturity date is blank for a loan, a late charge will always be calculated if the loan meets the criteria. When using late charge method W and the delinquency method is B, the system does not use the Loans - Amortization tab to calculate the amount past due or the delinquency amount. When using late charge method W and the loan frequency is 0, a late charge will not be calculated and collected because the loan due date should be equal to the loan maturity date and late charges are calculated and collected on payments applied on or after the maturity date. When the payment amount includes escrow, the late charge will be calculated on the installment portion of the payment (principal and interest amounts) only. Portico will calculate the late fee using the value obtained by subtracting the escrow amount from the payment amount. To use late charge calculation rule W with a 360-day interest loan type, the loan type must be setup with payment type 007 and calculation method A (assessed late charges). The valid options supported by Calculation Method A are: P - The late charge is based on a percentage of the scheduled payment amount. If the scheduled payment amount includes escrow and the One Late Fee Per Delinquent Payment check box is not selected, the late charge will be calculated using only the principal and interest portion of the payment. If the One Late Fee Per Delinquent Payment check box is selected, the late charge will be calculated using the principal, interest, and escrow portion of the payment. X - The late charge is based on a percentage of the transaction amount when the transaction amount is less than the scheduled payment amount. If the scheduled payment amount includes escrow and the One Late Fee Per Delinquent Payment check box is not selected, the late charge will be based on a percentage of the scheduled payment amount (principal and interest only) when the transaction amount is equal to or greater than the scheduled payment amount. If the One Late Fee Per Delinquent Payment check box is selected, the late charge will be based on a percentage of the scheduled payment amount (principal, interest, and escrow). S - The late charge is based on a percentage of the loan amount past due. W - The late charge is calculated according to the Wisconsin state criteria (Portico Host: 962 Transaction - RULE 1 field) |

|||||||||||

|

The minimum late charge amount assessed on variable late charges. This amount is used when the calculated late charge is less than the minimum amount. Valid amounts are 0.00 through 999.99. If zero, a late charge comparison is not performed on this field. |

|||||||||||

|

The maximum late charge amount assessed on variable late charges. This amount is used when the calculated late charge is greater than the maximum amount. Valid amounts are 0.00 through 99999.99. If zero, a late charge comparison is not performed on this field. |