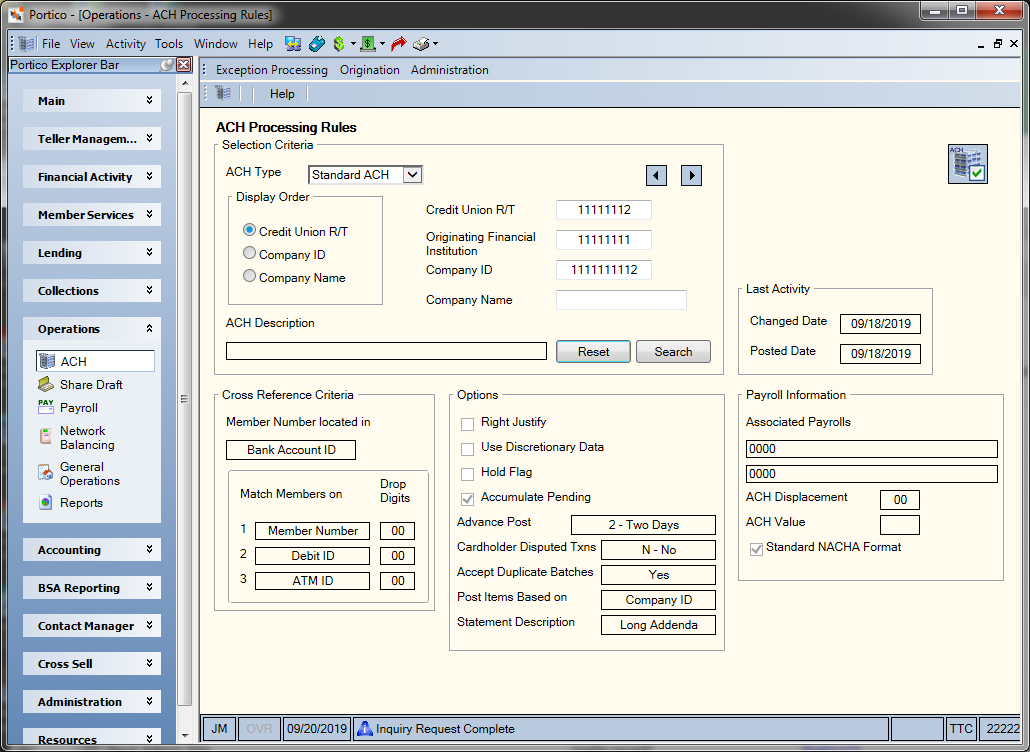

ACH Processing Rules

Portico Client Services will set up the ACH Processing Rules window. The ACH table on the ACH Processing Rules window ensures the correct posting of ACH items and reduces the number of rejected batches.

To set up an ACH Payroll, you must set up a Payroll Posting Summary window for the same payroll number on the corresponding ACH Processing Rules window.

To view the ACH Processing Rules window, in the Operations menu on the Portico Explorer Bar, click ACH. On the ACH top menu bar, click Administration, then click ACH Processing Rules.

How do I? and Field Help

You can use the Selection Criteria group box to display an existing ACH table. Click the ACH Type down arrow to indicate the type of ACH entry. The valid options are: Standard ACH or Origination. (Keyword: AT)

In the Display Order group box, click the order in which the system will display the ACH tables. The valid options are:

- Click the Credit Union R/T option to display by routing and transit number. Then, enter the beginning routing and transit number in the Credit Union R/T field (Length: 8 numeric/Keyword: RT).

- Click the Company ID option to display by company ID. Then, enter the beginning company ID in the Company ID field (Length: 10 alphanumeric/Keyword: CI).

- Click the Company Name option to display by company name. Then, enter the beginning company name in the Company Name field (Length: 16 alphanumeric/Keyword: CN).

Click Search. Click the left and right arrows to scroll through the ACH tables. Click Reset to clear the fields in the Selection Criteria group box.

The Last Activity group box displays the date the ACH table was last changed, or the date ACH items were last posted using the ACH table.

To add an ACH table, Portico Services will complete the following information:

In the Selection Criteria group box...

| Field | Description |

|---|---|

|

ACH Type |

Click the down arrow to indicate the type of ACH entry. The valid options are: Standard ACH or Origination. Keyword: AT |

|

Credit Union R/T |

The credit union's routing and transit number. If you do not specify a routing and transit number, the system will default to the routing and transit number specified in the R/T Number field in the ACH section on the Credit Union Profile - ACH/Payroll tab. If your credit union has more than one routing and transit number, the system will display the lowest R/T regardless of the routing and transit number specified in the R/T Number field in the ACH section on the Credit Union Profile - ACH/Payroll tab. Length: 8 numeric Keyword: RT (CR for 462 Txn) |

|

The routing and transit number of the originating financial institution for an ACH transaction. You can leave this field blank if posting by company name and/or company ID. If left blank, Portico will populate the field with zeroes. Length: 8 numeric Keyword: OR |

|

|

Company ID |

The unique company ID of the originator of the ACH transaction. The originator can be the credit union or the company sending the ACH item. For ACH scheduled transfers, you can leave this field blank if posting by company name and/or OFI. On the ACH Processing Options window, enter zeroes in this field if posting by company name or batch description. Length: 10 alphanumeric Keyword: CI |

|

Company Name |

The name of the originating financial institution as it should appear at the receiving institution. The company name, OFI, and/or company ID can be used as the criteria for posting ACH. The company name can be used in addition to the OFI and/or company ID to post ACH or in place of the OFI and/or company ID. You can leave this field blank if posting by company ID and/or OFI. To post by company name only on the Member Transfer File Information dialog box, specify the company name in this field. The company name must be an exact match to the company name appearing on the ACH file. Leave the Originating Financial Institution and Company ID fields blank. On the ACH Processing Options window:

Length: 16 alphanumeric Keyword: CN |

|

The description of the ACH table. For straight ACH, Portico recommends entering Default Table as the description. For ACH Origination, Portico recommends entering ACH Origination. Changes to this field do not update the C010 Transaction or the ACH Processing Rules window. Length: 40 alphanumeric Keyword: DE |

Identifying the Member

The following options indicate how credit union members will be identified on the ACH file.

The Member Number located in field indicates where the member identifier is located on the ACH file. The valid options are: Bank Account ID and Individual ID.

The Match Members on fields indicate the selection criteria for identifying credit union members on the incoming ACH file. The valid values are:

- ATM ID (A)

- Debit ID (B) - for ATM Debit Card Processing

- Member Number (C)

- Share Draft ID (D)

- EFT ID (E) - for ATM Debit Card Processing

- Social Security Number (N)

- Secondary ID (S) and third ID on the Contact Information tab

- Online Banking ID - for Cardlytics cash back rewards

These fields allow you to specify up to three different options. The system will search for a match of the first selection; then for the second if no match found; and then for the third if no match found. This field works in conjunction with the Drop Digits field and Right Justify check box.

If the Match Members On field is Share Draft ID (D), you can post to multiple share draft accounts based on the share draft ID on the Shares - Draft Info tab. The ACH share draft transaction will post to the share type that matches the share draft ID on the member's Shares - Draft Info tab. The ACH transaction code must be a share draft transcode and the batch must be posted by share draft ID (Match Members On field is Share Draft ID (D)).

Processors can send transactions using either the member's debit ID (10 digits) found on the Debit Card Maintenance dialog box or the full card number, which would include the ISO number for ATM transactions or the BIN for debit transactions.

To use the debit ID option to post transactions, the following options must be selected for the C010 Transaction: The Match Members On field must specify Debit ID (B) . The Member Number Located field can be Bank Account ID and Individual ID. The displacement specified in the Drop Digits field indicates where the Member Number Located field begins. The system will process the transactions in the same manner that ATM transactions are processed.

The EFT ID options applies to the full card number. For ATM cards, this is the ISO number for your credit union and the 10-digit ATM ID. For debit cards, the full card number is the BIN for your credit union and the 10-digit debit ID. To use the EFT ID option to post transactions, the following options must be selected for the C010 Transactions: The Match Members On field must specify EFT ID (E). The Member Number Located field will can be Bank Account ID and Individual ID. The displacement specified in the Drop Digits field indicates where the 10-digit ATM or Debit ID begins and not at the start of the full card number. The Right Justify check box must be selected for EFT ID processing. The system will verify the ISO or BIN to be that of your credit union and identify the method by which the member number will be checked (ATM or Debit). After this verification, the system will process the transactions as scheduled.

The Drop Digits field indicates the number of digits the system should ignore in the Bank Account ID or Individual ID field on the incoming ACH file before determining the member's account number (Length: 2 numeric). If 00 appears in this field, the system will read all the digits in the Bank Account ID or Individual ID field.

If the Right Justify check box is selected, Portico moves the data to the right of the 17-digit Bank Account Number field and adds leading zeros (e.g. member number 1234567: 0 0) The following chart shows the common displacement values to be used when this check box is selected:

| Match Members On | Length | Drop Digits for Individual ID | Drop Digits for Bank Account # |

|---|---|---|---|

| Member Number | 12 | 3 | 5 |

| Secondary ID | 9 | 6 | 8 |

| Social Security | 9 | 6 | 8 |

| Share Draft ID | 10 | 4 | 6 |

| ATM ID | 10 | 5 | 7 |

The following check boxes and fields in the Options group provide additional ACH file processing options:

| Field | Description |

|---|---|

|

If selected, Portico will use the discretionary data field on the incoming ACH file. |

|

|

If selected, Portico will hold the incoming ACH file. The system will not process any of the items on the file until Portico Customer Service releases the hold using the C012 Transaction. The C012 Transaction is an internal transaction and cannot be viewed by credit unions. |

|

|

If selected, Portico will display pending ACH items processed through this ACH table on the Account Information - Overview tab. The Display ACH Pending check box must be selected in ACH section on the Credit Union Profile - ACH/Payroll tab. |

|

|

Portico provides the option to post items 3 or more days in advance of the effective date; however, NACHA regulations limit advance posting to up to 2 days in advance of the effective date. If the Advance Post field is 2 - Two Days, Portico will post the ACH credit items when they are received if the effective date of the ACH batch is within two days of the current date. The system will change the effective date to the current date. Therefore, the effective date of the batch will be different from the date reflected on the FedACH Advice or the settlement bank statement. ACH debit items will not post in advance, but rather based on the item's settlement date. |

|

|

Indicates the posting option used with Fiserv Card Services Full-Service Debit Call Center to automatically post disputed credit amounts to your members’ accounts. Fiserv Card Services will transmit a daily batch debit card dispute transaction posting file that will be processed in the Portico back-office cycle. You can choose to automatically post the disputed transactions or just report the disputed transactions. The valid options are:

|

|

|

Indicates if the system should override the edit that automatically rejects duplicate batches. A duplicate batch is determined if the files have the same OFI, batch total, and effective date. The valid options are:

|

|

|

Indicates if the system will post the ACH items based on company name or batch description. The valid options are:

Portico requires that any alpha characters in the company name or batch description fields must be in all capital letters on the incoming file if the Post Items Based On field is Company Name or Batch Description. Lower case letters will not match to the ACH Processing Rules window. |

|

|

Indicates where the system will find the information on the incoming ACH file that will be used for the description on the member's statement. The valid options are: Batch Header, Short Addenda, Long Addenda (recommended for ATM/Debit), and ATM (not recommended). |

The Payroll Information group box provides additional options for processing ACH payroll.

| Field | Description |

|---|---|

|

The payroll number the system will use to post incoming ACH batch. The payroll numbers must be right justified. Example, payroll number 101 would be 0101. If two payroll numbers are specified, the system will include all items with the ACH transaction code for shares on the first payroll. The second payroll will include all items with the ACH transaction code for share drafts. The system will post the payroll based on the information on the on the member's Member Payroll Maintenance dialog box. |

|

|

Indicates how you want the system to split a batch into ACH and ACH payrolls. This value indicates the position in the ACH file to look for the value specified in the ACH Value field. For example, if the ACH Displacement field is 03 and the ACH Value field is 7, the system looks for value 7 in position 3 of the ACH file, and recognizes the item is a debit and does not need a payroll number associated. If value 7 is found in position 3, ACH credits will be payroll-associated and ACH debits will not be payroll-associated. If an OFI sends debits and credits on the same ACH payroll file, the system will use the ACH Displacement, ACH Value, and Associated Payrolls fields to process the ACH debits as straight ACH and ACH credits as ACH payroll. |

|

|

Indicates how you want the system to split a batch into ACH and ACH payrolls. This value indicates the value to look for in the position designated by the ACH Displacement field. If an OFI sends debits and credits on the same ACH payroll file, the system will use the ACH Displacement, ACH Value, and Associated Payrolls fields to process the ACH debits as straight ACH and ACH credits as ACH payroll. |

|

|

If selected, ACH records received for NACHA-defined SEC Codes will be in the NACHA standard format. System default. |

Portico Host: 484