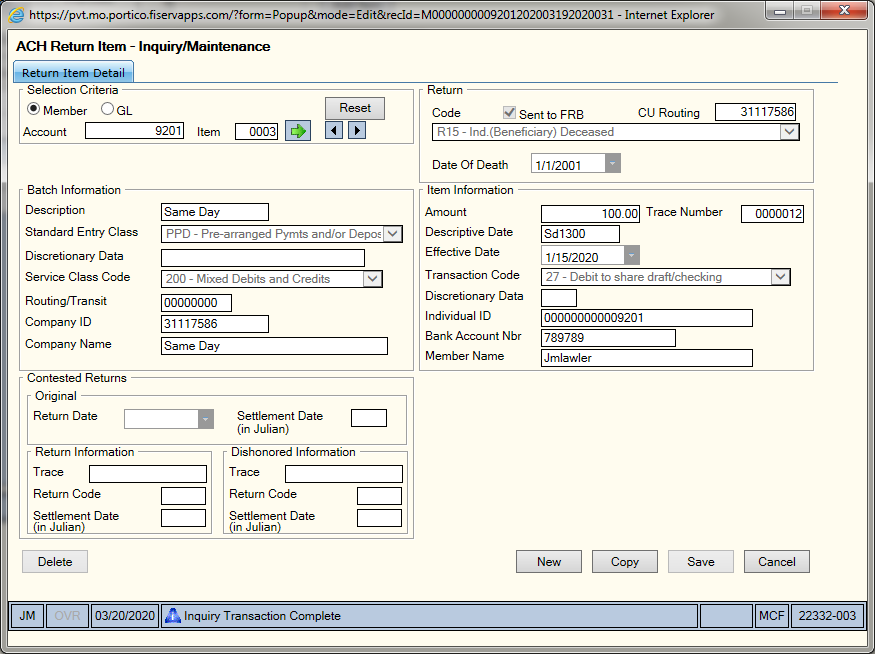

ACH Return Item - New

The ACH Return Item - New dialog box allows you to automatically return an ACH item.

To use the ACH Return Item - New dialog box, the Returns check box must be selected on the Credit Union Profile – ACH/Payroll tab and you must be set up as an ACH originator with your Federal Reserve Bank.

To access the ACH Return Item - New dialog box, on the Portico Explorer Bar, click ACH in the Operations menu. On the ACH top menu bar, click Exception Processing, then click ACH Return Items to review existing items. Click Add Item on the ACH Return Items window to display the ACH Return Item - New dialog box.

How do I? and Field Help

All return items are scheduled for delivery to the Federal Reserve Bank at 5:00 p.m. CST, Monday thru Friday.

Click Reset to clear the selection criteria. Click the left and right arrow to scroll through the ACH items.

Using the 178 and 170 Reports, complete the following information to add an ACH return item.

| Field | Description |

|---|---|

|

Click the Member option if the ACH item is for a member account. Click the GL option if the ACH item is for a general ledger account number. |

|

|

The member number or general ledger account number associated with the ACH item. Length: 12 numeric for member number or 6 numeric for general ledger account number Keyword: AN |

|

|

The branch number of the general ledger account. Length: 3 numeric |

|

|

The number of ACH record spaces available for this application. If a member or general ledger account has more than one return the item count will be incremented for each new record added. Length: 5 numeric |

|

|

The credit union's routing and transit number. If you do not specify a routing and transit number, the system will default to the routing and transit number specified in the R/T Number field in the ACH section on the Credit Union Profile - ACH/Payroll tab. If your credit union has more than one routing and transit number, the system will display the lowest R/T regardless of the routing and transit number specified in the R/T Number field in the ACH section on the Credit Union Profile - ACH/Payroll tab. Length: 8 numeric Keyword: RT (CR for 462 Txn) |

|

|

Click the down arrow to select the return code. (Found on the 170 Report.) |

|

|

The credit union-defined reason for returning the ACH item. If you use return code R17, Portico will automatically enter QUESTIONABLE in the Reason for Return field. For the IRS Refund Return Opt-In Program, NACHA recommends entering one of the following reasons: 17: Name Mismatch 18: ID Theft 19: Questionable Refund You can sign up for the IRS Refund Return Opt-In Program on the NACHA website at: https://www.nacha.org/content/additional-ach-programs-and-information. Length: 44 alphanumeric characters (34 characters for IAT transactions) |

|

| For return codes R14 and R15, the deceased date from the Contact Information tab will automatically appear in the Date of Death field. | |

|

Select this check box if the item is a cross border item. Keyword: CB |

|

|

The description of the items in the batch. The description will appear on the member's statement. Length: 10 alphanumeric Keyword: DE |

|

|

The type of items in the batch. The valid options are: ACK - ACH Payment Acknowledgment ADV - Automated Account Advices ARC - Accounts Receivable Entry ATX - Financial EDI Acknowledgment BOC - Back Office Conversion CCD - Corporate Credit or Debit CIE - Customer Initiated Entries COR - Automated Notification of Change CTP - Corporate Trade Payment CTX - Corporate Trade Exchange DNE - Death Notification Entries ENR - Automatic Enrollment Entry IAT - International ACH Transaction MTE - Machine Transfer Exchange POP - Point of Purchase Entry POS - Point of Sale PPD - Pre-arranged Payments and/or Deposits RCK - Represented Check Entry TEL - Telephone Initiated Entry TRC - Truncated Entries TRX - Truncated Entries Exchange WEB - Internet Initiated XCK - Destroyed Check Entry Length: 3 alphanumeric Keyword: SE Found on the 178 Report. |

|

|

The batch discretionary data. This information can be used to enable special handling of ACH items in the batch, as defined by the originating and the receiving financial institutions. Length: 20 alphanumeric Keyword: BD Found on the 178 Report. |

|

|

The service class code for the batch which the item is in. The valid options are: 200 - ACH Entries Mixed Debits and Credits 220 - ACH Credits only 225 - ACH Debits only 280 - ACH Automated Accounting Advices

This information also appears in the ACH Received in Order of Transmission section of the 170 Report. Length : 3 alphanumeric Keyword: SC |

|

|

The routing and transit number of the originating financial institution for an ACH transaction. Length: 8 numeric Keyword: OR Found on the 170 Report. |

|

|

The unique company ID of the originator of the ACH transaction. The originator can be the credit union or the company sending the ACH item. For ACH scheduled transfers, you can leave this field blank if posting by company name and/or OFI. On the ACH Processing Options window, enter zeroes in this field if posting by company name or batch description. Length: 10 alphanumeric Keyword: CI Found on the 178 Report. |

|

|

The name of the originating financial institution as it should appear at the receiving institution. The company name, OFI, and/or company ID can be used as the criteria for posting ACH. The company name can be used in addition to the OFI and/or company ID to post ACH or in place of the OFI and/or company ID. You can leave this field blank if posting by company ID and/or OFI. To post by company name only on the Member Transfer File Information dialog box, specify the company name in this field. The company name must be an exact match to the company name appearing on the ACH file. Leave the Originating Financial Institution and Company ID fields blank. On the ACH Processing Options window:

Length: 16 alphanumeric Keyword: CN Found on the 178 Report. |

|

|

Click the down arrow to select the date the ACH item was originally returned to the originator from the pop-up calendar or enter the date in MM/DD/YYYY format. Found on the 174 Report. Required with Return Reason Code R71 - R74. Keyword: OD |

|

|

The original settlement date of the original ACH item before it was returned. The settlement date is the date when there was an exchange of funds with respect to an entry on the books of the Federal Reserve Bank. Enter the 3-digit Julian date found on the 178 Report. Required with Return Reason Code R71 - R74 Timely Original Return. Length: 3 numeric Keyword: OS |

|

|

The trace number that uniquely identifies each dishonored return item within a file. Found on the 173 Report under the heading RETURN TRACE. Length: 15 alphanumeric Keyword: RT |

|

|

The return reason code when the credit union originally returned the entry. Refer to the 173 Report. Length: 3 alphanumeric Keyword: RR |

|

|

The settlement date of the ACH return item. The settlement date is the date when there was an exchange of funds with respect to an entry on the books of the Federal Reserve Bank. Enter the 3-digit Julian date found on the 173 Report under the heading RETURN STL DTE. Length: 3 numeric Keyword: RS |

|

|

The trace number that uniquely identifies each dishonored return item within a file. Found on the 173 Report 173 under the heading TRACE NUMBER. Length: 15 alphanumeric Keyword: DT |

|

|

The dishonored return reason code from the originator. Found on the 173 Report under the heading RTN CODE. Length: 3 alphanumeric Keyword: DR |

|

|

The settlement date of the ACH dishonored return item. The settlement date is the date when there was an exchange of funds with respect to an entry on the books of the Federal Reserve Bank. Enter the 3-digit Julian date found on the 178 Report. Length: 3 numeric Keyword: DS |

|

|

The amount of this ACH transaction. A valid ACH transaction amount can be 0 through 99,999,999.99. Length: 11 numeric including decimal Keyword: AM If the Transaction Code field is 22, 27, 32, 37, 42, 47, or 52, the Amount field cannot be zero. If the Transaction Code field is 23, 28, 33, 38, 43, 48, or 53, the Amount field must be zero or greater. If the Transaction Code field is 24, 34, 44, or 54, the Amount field must be zero. Found on the 170 Report. |

|

|

The trace number assigned by the originating institution. Length: 7 alphanumeric Keyword: TR Found on the 170 Report. Only the last 7 digits (including any leading zeros) of the trace number on the 170 Report should be entered. |

|

|

The ACH item descriptive date. Length: 6 numeric in MM/DD/YY format Keyword: DD Found on the 178 Report. |

|

|

Click the down arrow to select the date on which settlement should occur from the pop-up calendar or enter the date in MM/DD/YYYY format. (Found on the 178 Report.) Keyword: ED |

|

|

Click the down arrow to select the required NACHA transaction code specified on the item received. (Found on the 170 Report.) The system will convert the incoming ACH transaction code to the appropriate transaction code. Valid options are: 05 - Loan Advance 22 - Credit to share draft/checking - valid for micro-entries, valid receiving transaction for same-day outgoing ACH credit item 23 - Prenote or ENR of credit to share draft checking 24 - Acknowledgment to share draft/checking 27 - Debit to share draft/checking - valid for micro-entries, valid back-office transaction for Person-to-Person (P2P) credit transactions and same-day outgoing ACH debit items. 28 - Prenote of debit to share draft/checking - valid receiving transaction for micro-entries, frequency must be Request, and effective date must be 3 business days in the future. 32 - Credit to shares/savings - valid for micro-entries, valid receiving transaction for same-day outgoing ACH credit item 33 - Prenote or ENR of credit to shares/savings 34 - Acknowledgment to shares/savings 37 - Debit to shares/savings - valid for micro-entries, valid back-office transaction for Person-to-Person (P2P) credit transactions and same-day outgoing ACH debit items. 38 - Prenote of debit to shares/savings - valid receiving transaction for micro-entries, frequency must be Request, and effective date must be 3 business days in the future. 42 - Automated general ledger deposit (credit) - valid receiving transaction for same-day outgoing ACH credit item 43 - Prenotification of general ledger credit authorization 47 - Automated general ledger payment (debit) - valid back-office transaction for same-day outgoing ACH debit items. 48 - Prenotification of general ledger debit authorization 52 - Automated loan account deposit (credit) - valid receiving transaction for same-day outgoing ACH credit item 53 - Prenotification of loan account credit authorization 54 - Acknowledgment to loan 55 - Debit to loan (reversal only) Length: 2 numeric Keyword: TC |

|

|

The discretionary data (DD) code as specified on the ACH file and is used to additionally qualify an ACH item. This field will be blank if there is not a DD code on the ACH file. If the item is a point-of-sale (POS) transaction that you are returning, you must specify a card transaction type code in this field even if the item was sent to Fiserv without a discretionary data code. If you do not, the Federal Reserve Bank will reject the item with an R26 - Mandatory Field Error. The valid card transaction code types are: 01 - Purchase of goods or services 02 - Cash 03 - Return reversal 11 - Purchase reversal 12 - Cash reversal 13 - Return 21 - Adjustment 99 - Miscellaneous transaction Length: 2 alphanumeric Keyword: ID |

|

|

The individual identification number that is the accounting number by which the receiver is known to the originator. For incoming Person-to-Person (P2P) transactions using the code ‘WEB,’ the sender’s name will appear in the Individual ID field on the incoming transaction. To help your members determine where a transaction originated, Portico will move the name from the Individual ID field to the Statement Description field in the member's financial transaction history. Length : 22 alphanumeric Keyword: II Found on the 170 Report. |

|

|

The bank account number for the ACH item. Length: 17 alphanumeric Keyword: BI Found on the 170 Report. |

|

|

The receiving account holder's name. A name must be entered in this field for Standard Entry Class code WEB . For Standard Entry Class code ENR, use the following format when typing the name of the person receiving the benefits: First Name - Characters 1-7 Last Name - Characters 8-22 For example, type Jonathon Member as JONATHOMEMBER and type Julie Member as JULIE MEMBER. Federal requirements dictate that the last name must always begin in position 8. If the receiver of benefits is a company (representative payee indicator = B), enter the company name starting in position 1. Length: 22 alphanumeric Keyword: NM Found on the 170 Report. |

|

|

The foreign exchange conversion methodology applied to a cross-border item. The valid values are: FV - Fixed to variable exchange type. VF - Variable to fixed exchange type. FF - Fixed to fixed exchange type. The Foreign Exchange Reference field must be spaces.) Length: 2 alphabetic Keyword: EI |

|

|

The foreign exchange rate used to execute the foreign exchange conversion of a cross-border item or a reference to the foreign exchange transaction. Length: 15 alphabetic Keyword: ER |

|

|

The receiving ID used to identify the cross border item. Length: 11 alphanumeric Keyword: FR |

|

|

The amount for which the item was originated in the foreign currency. If the Cross Border check box is selected, this field cannot be blank. Length: 18 numeric Keyword: FP |

|

|

The contents of the Foreign Exchange Reference field. The valid options are:

Keyword: EC |

|

|

The original ISO currency code for the foreign exchange item. Length: 3 alphabetic Keyword: OC |

|

|

The destination ISO currency code for the foreign exchange item. Length: 3 alphabetic Keyword: DC |

|

|

The ISO destination country code for the foreign exchange item. Length: 2 alphabetic Keyword: CC |

Click Save/Add to the save the ACH return item. Click Cancel to cancel your changes and close the dialog box.

Click New to clear the fields and add a new ACH return item.

Click Copy to create a new ACH return item using the information from an existing item.

To stop a return, access the ACH Exception Items window for the account number involved in the ACH transaction. Click the Return Code down arrow and select blank. Click Save. The record will remain on the system, but it will not be processed by the system.

Processing a Contested Dishonored Return

If a return is rejected by the Federal Reserve Bank, the Dallas Federal Reserve Bank notifies Portico and the Federal Reserve Bank sends the dishonored returns back to you.

The dishonored return appears on your ACH System Origination Posting/Exception Report 173 and the adjustment in the totals appears on your FedACH Advice. The Federal Reserve Bank will notify you and you must research the problem. Part of the research involves contacting the Originating Financial Institution (OFI) to determine if they will accept this item as a return and if so, what code to use. If you do not contact the OFI, the item may be rejected again. The 173 Report lists ACH Origination items and ACH rejected returns and notifications of change (NOC).

You can contest dishonored returns using the ACH Return Item - New dialog box, eliminating the need to submit manual paper returns to the Federal Reserve.

Using the 173, 174 and 178 Reports, complete the following steps to contest a dishonored return.

- In the Original group box, click the Return Date down arrow to select the date the ACH item was originally returned to the originator from the pop-up calendar or enter the date in MM/DD/YYYY format. Found on the 174 Report. Required with Return Reason Code R71 – R74.

- In the Settlement Date field, enter the original settlement date of the original ACH item before it was returned. The settlement date is the date when there was an exchange of funds with respect to an entry on the books of the Federal Reserve Bank. Enter the 3-digit Julian date found on the 178 Report. Required with Return Reason Code R71 – R74 Timely Original Return.

- In the Return Information group box, enter the trace number in the Trace field. Found on the 173 Report under the heading RETURN TRACE.

- In the Return Code field, enter the return reason code when the credit union originally returned the entry. Refer to the 173 Report.

- In the Settlement Date field, enter the settlement date of the ACH return item. The settlement date is the date when there was an exchange of funds with respect to an entry on the books of the Federal Reserve Bank. Enter the 3-digit Julian date found on the 173 Report under the heading RETURN STL DTE.

- In the Dishonored Information group box, enter the trace number that uniquely identifies each dishonored return item within a file in the Trace field. Found on the 173 Report 173 under the heading TRACE NUMBER.

- In the Return Code field, enter the dishonored return reason code from the originator. Found on the 173 Report under the heading RTN CODE.

- In the Settlement Date field, enter the settlement date of the ACH dishonored return item. The settlement date is the date when there was an exchange of funds with respect to an entry on the books of the Federal Reserve Bank. Enter the 3-digit Julian date found on the 178 Report.

- Click Save.

none

- ACH System Posting/Exception Report 170

- ACH System Outbound Return Items Report 174

Portico Host: 462