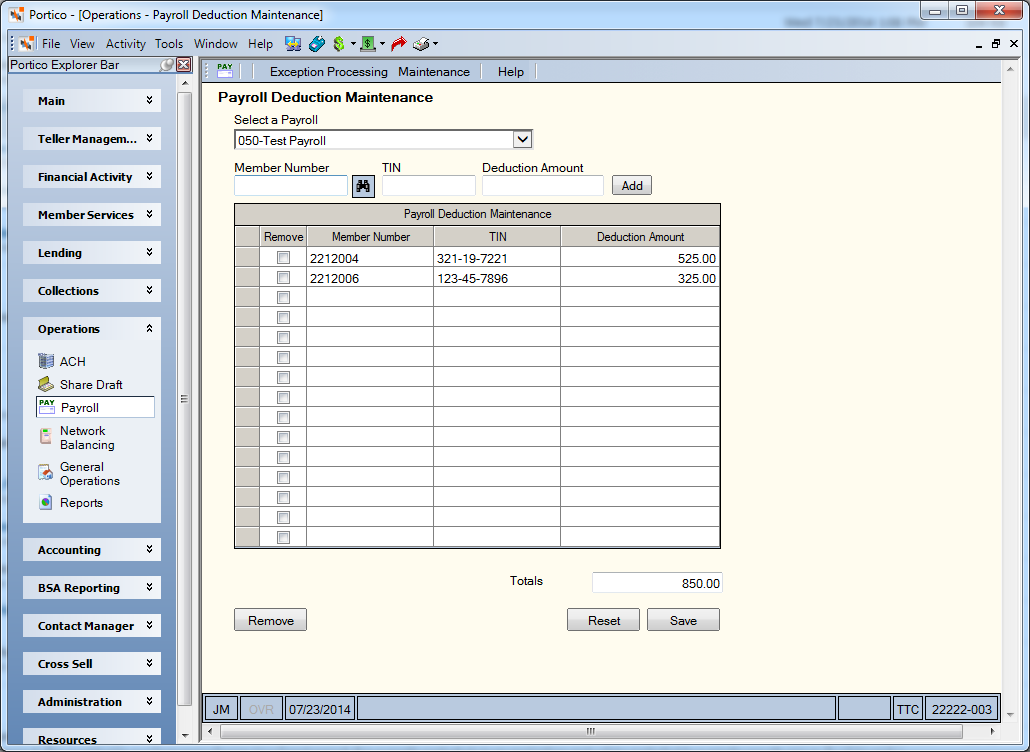

Adding Payroll Deductions for Multiple Members

The Payroll Deduction Maintenance window lets you set up payroll deductions for multiple members. The deduction amount entered will update the Payroll Group Details window. To use the Payroll Deduction Maintenance window, the Multiple Member Maintenance check box must be selected on the Credit Union Profile – ACH/Payroll tab.

To access the Payroll Deduction Maintenance window, on the Portico Explorer Bar, click Payroll in the Operations menu. On the Payroll top menu bar, click Maintenance, then click Payroll Deduction Maintenance.

How do I? and Field Help

Click the Select a Payroll down arrow to select the payroll number. The Payroll Deduction Maintenance grid displays the member number, taxpayer ID number and amount for each deduction associated with the payroll.

Complete the following steps to add a member record to the Payroll Deduction Maintenance grid.

- Enter the member number in the Member Number field (Length: 12 numeric). If necessary, click the member lookup button to display the Member Search dialog box and locate the member.

- In the TIN field, enter the member’s taxpayer ID number (Length: 9 numeric).

- In the Deduction Amount field, enter the total payroll amount from the sponsor for the member (Length: 8 numeric including decimal / Keyword: PA). If the member is not on the current payroll, this is the amount that was last posted. If the member is on the current payroll, but receives a zero dollar amount, the system will change this field to 0.00. If a negative amount is received for the member and the Post Negative Amounts check box is selected on the payroll's Payroll Posting Summary window, a minus sign will appear after the payroll amount.

- Click Add to add a member record to the Payroll Deduction Maintenance grid.

As deduction amounts are entered, the system will keep a running total for the selected payroll to verify against the sponsor’s list. Once the payroll number is changed, the running total is reset to zero.

Click Save to save the payroll deduction. To modify a member’s deduction amount, enter the amount in the Deduction Amount field as needed and click Save. The system will automatically update the Payroll Group Details window with the deduction amount.

Click Reset to clear the grid and start again without saving.

: none

: The following information prints on an audit printer: payroll number, effective date, short name, account number, start and stop amounts, and an exception code or the message TRANSACTION COMPLETE. If the teller enters invalid information, one of the following exception codes prints on the audit printer:

- Invalid Payroll

- Invalid Amount

- Dormant Member

Portico Host: 444