Changing Dividend Check Options

For more information about Dividends, see Dividends.

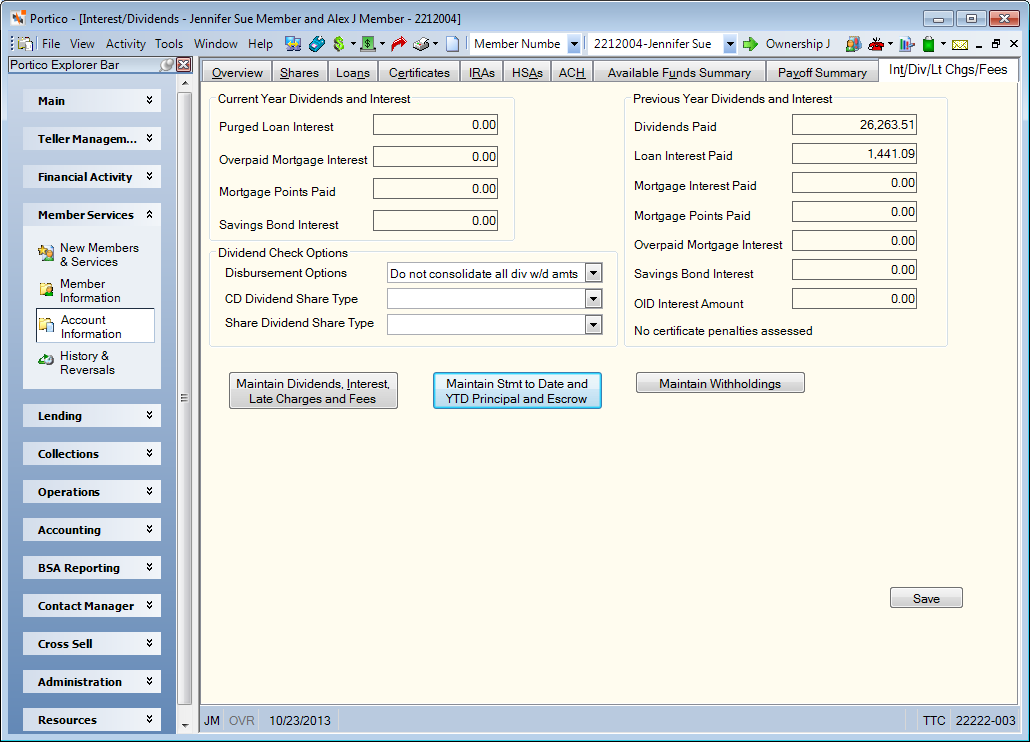

The Interest/Div/Lt Chrgs/Fees tab lists the dividend check options associated with this member. To access the Interest/Div/Lt Chgs/Fees tab, under Member Services on the Portico Explorer Bar, click Account Information. The Overview tab appears on top. Click the Interest/Div/Lt Chgs/Fees tab. Locate the member using the search tool on the top menu bar. Select the down arrow to select the search method, then enter the search criteria. Select the green arrow or press ENTER to locate the member.

How do I? and Field Help

The Current Year Dividends and Interest group box displays the following information:

| Field | Description |

|---|---|

|

The amount of loan interest purged for the current year. |

|

|

The mortgage interest amount overpaid for the current year. |

|

|

The amount of mortgage points paid for the current year. |

|

|

The amount of interest earned on savings bonds for the current year. |

The Previous Year Dividends and Interest group box displays the following information:

To update the dividend check options, complete the following steps:

- Click the Dividend Disbursement Consolidation Methods down arrow to select how the system will consolidate multiple dividend withdrawal amounts for this member (Keyword: DC). The dividends must be paid to the accounts on the same effective date. The Supported check box must be selected in the Dividend By Check section on the Credit Union Profile - Shares tab. The valid values are:

- Y - Consolidate all div w/d amts into 1 check. Consolidate all IRA and non-IRA dividend withdrawal amounts into one check. The individual dividend amounts, the associated share types, and the certificate numbers will print on the check stub.

- N - Do not consolidate all div w/d amts into 1 check. Do not consolidate the dividend withdrawal amounts into one check. System default.

- I - Consolidate all IRA div w/d amts into 1 check. Consolidate all IRA dividend withdrawal amounts into one check. The individual dividend amounts, the associated share types and the certificate numbers will print on the check stub.

- R - Consolidate all non-IRA div w/d amts into 1 check. Consolidate all non-IRA dividend withdrawal amounts into one check. The individual dividend amounts, the associated share types, and the certificate numbers will print on the check stub.

- B - Two sep checks – 1 for IRA div. 1 for non-IRA div. Consolidate all non-IRA dividend withdrawal amounts into one check, and consolidate all IRA dividends into one check. The member will receive two separate checks, one for IRA dividends and one for non-IRA dividends.

- Click the Share Type for CD Dividend Check Fee down arrow to select the share type to be assessed the certificate dividend check fee (Keyword: FE). The system will debit the share type for the dividend check withdrawal fee each time a check is produced for a certificate interest amount. This field must contain a valid share type if WS appears in the Share Type for Dividend Check Fee field. You must specify a share type, not a certificate type.

- Click the Share Type for Dividend Check Fee down arrow to select the share type to be assessed the dividend withdrawal check fee (Keyword: CF). The system will debit the share type for the dividend check withdrawal fee. You must specify the fee amount in the Withdrawal Fee field and the fee general ledger account in the Fee GL Account field in the Dividend by Check section on the Credit Union Profile – Shares tab. The valid options are:

- Blank - Member is excluded from fees. System default. The system will not assess a fee even if a fee amount appears in the Withdrawal Fee field in the Dividend by Check section on the Credit Union Profile – Shares tab.

- 01 - 99 - Valid share type. The system will debit this share type for the fee amount each time a dividend check is produced, regardless of the account from which the dividend was withdrawn.

- WS - Withdrawal share type. The system will debit the share type from which the dividend was withdrawn each time a dividend check is produced. If the system withdraws the fee amount from the member's IRA account, the IRA withdrawal code is 9999. If you specify WS and the member has a certificate with an interest payment code of K, you must select a valid share type in the Share Type for CD Dividend Check Fee field because the system will not take a fee from a certificate. If Y - Consolidate all div w/d amts into 1 check appears in the Dividend Disbursement Consolidation Methods field, you cannot select WS.

- Click Save to save the dividend check options.

Click Maintain Dividends, Interest, Late Charges and Fees to display the Dividends, Interest, Late Charges and Fees Maintenance dialog box.

Click Maintain Stmt to Date and YTD Principal and Escrow to display the Principal and Escrow - Maintenance dialog box.

Click Maintain Withholdings to display the Withholding Maintenance dialog box.

To access the Interest/Div/Lt Chgs/Fees tab, users must be assigned to the following security groups or you can add the following permissions to a credit union-defined security group using the Security Group Permissions – Update window.

| Permissions | Security Groups |

|---|---|

|

MbrInfo - (Account Info) Interest/Dividends - Tab - View Only |

Teller - Basic Teller - Advanced Member Services - User |

|

MbrInfo - (Account Info) Interest/Dividends - Tab - Maintain |

Member Services - User |

Portico Host: 145, MINQ (146)