Maintaining the Loan Interest Rate

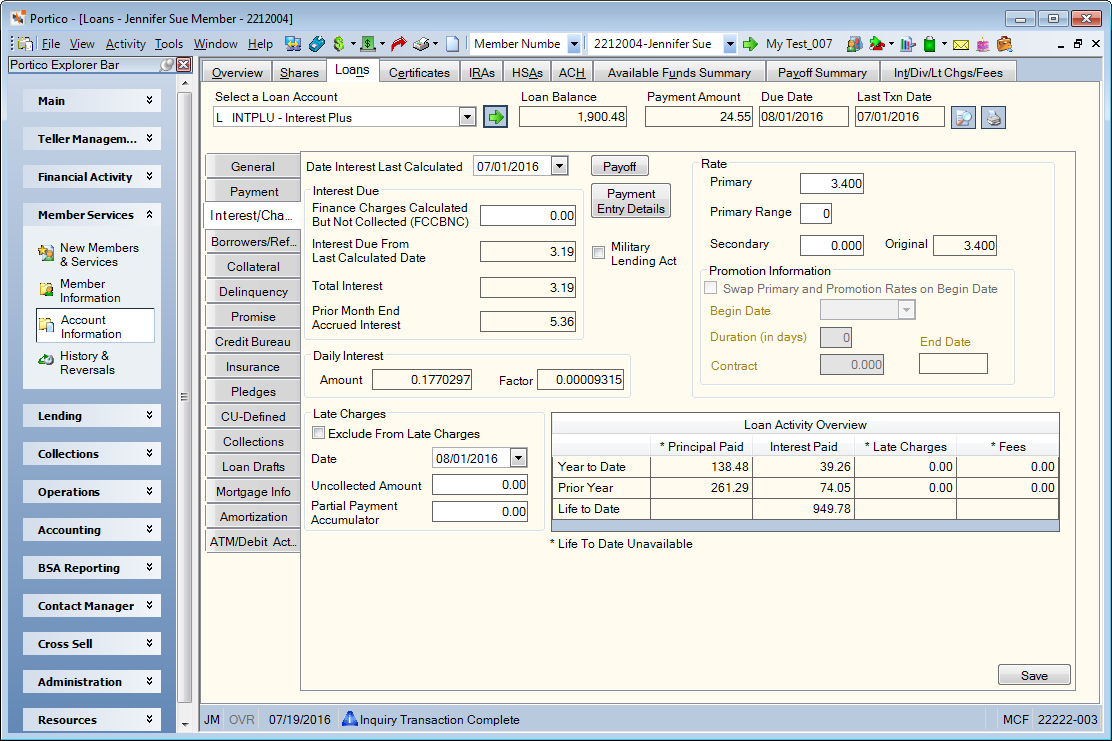

The Loans – Interest/Charges tab lets you maintain the interest rate on the loan and review the interest calculated, late charges, and fees. To access the Interest/Charges tab, under Member Services on the Portico Explorer Bar, click Account Information. The Overview tab appears on top. Click the Loans tab. Locate the member using the search tool on the top menu bar. Select the down arrow to select the search method, then enter the search criteria. Select the green arrow or press ENTER to locate the member.

Click the Select a Loan Account down arrow to select the loan note number and description. Then, click the green arrow. The General tab appears on top. Click the Interest/Charges tab.

How do I? and Field Help

The following fields provide information regarding the interest due on the loan:

| Field | Description |

|---|---|

|

The date interest was last calculated on the loan. The interest is calculated to the date listed; it does not include the date. Click the down arrow to select the date from the pop-up calendar or enter the date in MM/DD/YYYY format. Changes to this field can impact delinquency calculations. This field is not used to calculate interest on 360-interest loans. For 360-day interest loans, the date when a payment was made appears in this field. Keyword: ID |

|

|

The amount of finance charges calculated, but not collected. FCCBNC is updated when a loan advance or rate change is completed. Length: 8 numeric including decimal Keyword: FC |

|

|

The amount of interest due on the loan from the last calculated date. |

|

|

The total interest assessed on the loan. |

|

|

The month-end accrued loan interest. The amount in the Prior Month End Accrued Interest field is updated at month-end using the following calculations: For 360 day interest loans…

For 365 day (simple) interest loans…

Reporting Analytics: ME Accrued Interest (Loan Base subject in the Loan folder and the ME Loan Base subject in the Month-end Information\Loan Month-end folder) |

|

|

The primary interest rate used to calculate the amount of interest due on the loan. Interest due is based on the loan principal for a specified time period. The interest rate can be equal to or greater than zero, but must be less than 36.500. The value must be 0.00 for loans that support 360-day interest. Any change to this field can impact loan calculations or delinquency. To report manual rate changes on loans, a history entry will be created when the Primary field is changed. The effective date of the rate change will be the date in the Date Interest Last Calculated field. Length: 6 numeric including decimal Keyword: IR Reporting Analytics: Annual Rate 1 and Daily Loan Rate (Loan Base subject in Loan folder and ME Loan Base subject in Month-end Information\Loan Month-end folder) |

|

|

The amount of the principal loan balance that the primary interest rate applies to. This amount is used to calculate interest due on split interest loans. The primary range can be zero through 999. The Primary Range field is whole dollars expressed in hundreds. If greater than zero, the Secondary field must be entered. Length: 3 numeric expressed in hundreds (e.g. 005 = $500.00) Keyword: P1 or BP |

|

|

The secondary rate used when calculating the interest due on split interest loans. The secondary rate is used on the principal loan balance in excess of the primary range. The interest rate can be equal to or greater than zero, but must be less than 36.500. Any change to this field can impact loan calculations or delinquency. This field is required if the Primary Range field is greater than zero. Length: 6 numeric including decimal Keyword: 2R |

|

|

The original interest rate on the loan. |

|

|

The daily interest amount assessed on the loan. |

|

|

The daily interest factor used to calculate the interest due on the principal of the loan for a specified time period. |

Promotional Rates

Portico lets you set up a promotional interest rate for a loan using the Promotion Information group box, if the loan type supports promotional rates. After a credit union-defined duration, the loan interest rate will automatically change to a credit union-defined contract loan rate.

The Swap Primary and Promotion Rates on Begin Date check box indicates if Portico should automatically change the loan interest rate to the promotional interest rate at the start of the promotion period.

| Select the check box to: | Do not select the check box if: |

|---|---|

|

Start the promotional rate on the current date or a date in the future. The promotional interest rate was not offered at loan origination. |

Start the promotional rate on the current date. It cannot be a future date. |

|

Use the current rate on the loan after the promotion. For example, the current rate is 3.5% and the promotional rate is 1.9%. The Primary field would be 3.5% and the Promotion field would be 1.9%. After the promotional period, the loan goes back to the current rate of 3.5%. |

Use the current rate or a different rate on the loan after the promotion. For example, the current rate is 3.5%, the promotional rate is 1.9%, and the after-promotional rate is 4.0%. You would enter 1.9% in the Primary field and 4.0% in the Contract field. After the promotional period, the loan rate automatically changes to the rate of 4.0%. |

|

Have back-office calculate and store uncollected interest at the current rate and update the interest paid to date before changing to the promotional rate. |

Manually calculate uncollected interest and update the interest paid to date before the promotion period start date. |

Complete the following steps based on whether you select the Swap Primary and Promotion Rates on Begin Date check box:

| Selected | Not selected |

|---|---|

Portico will automatically change the rate on the loan twice:

Before any automatic rate change occurs, Portico will automatically calculate the unpaid interest at the current rate, add the calculated amount to the value in the Finance Charges Calculated But Not Collected (FCCBNC) field and update the Date Interest Last Calculated field. |

Portico will automatically change the rate on the loan once:

Prior to the promotional period begin date, you must manually calculate any uncollected interest at the old rate, add the amount to the Finance Charges Calculated But Not Collected (FCCBNC) field and update the Date Interest Last Calculated field. |

Promotional Rates Field Help

| Field | Description |

|---|---|

|

Indicates if Portico should automatically change the loan interest rate to the promotional interest rate at the start of the promotion period. If selected, the Contract field name automatically changes to Promotion. Keyword: TF Reporting Analytics: Promo Rate Change Type (Loan Base subject in Loan folder and ME Loan Base subject in Month-end Information\Loan Month-end folder) |

|

|

Click the Begin Date down arrow to select the date that the promotional interest rate should begin from the pop-up calendar. When the Swap Primary and Promotion Rates on Begin Date check box is selected:

When the Swap Primary and Promotion Rates on Begin Date check box is not selected:

Keyword: TB Reporting Analytics: Promo Start Date (Loan Base subject in Loan folder and ME Loan Base subject in Month-end Information\Loan Month-end folder) |

|

|

The number of calendar days the promotional interest rate should be in effect. Portico will calculate an end date using the formula: [begin date + duration (in days) – 1]. If the Swap Primary and Promotion Rates on Begin Date check box is selected, the Duration (in days) field must be greater than 2. Note: Loan advances will not be permitted on loans with a promotional interest rate in effect and a Duration (in days) field greater than zero. Loan charge off and loan type changes will be permitted when the Duration (in days) field is greater than zero if the new loan type supports promotional interest rates. The Duration (in days) field must be zero to perform a loan type change or loan charge off to a loan type that does not support promotional interest rates. Length: 4 numeric Keyword: TT Reporting Analytics: Promo Duration (Loan Base subject in Loan folder and ME Loan Base subject in Month-end Information\Loan Month-end folder) |

|

|

The interest rate assessed on the loan based on whether the Swap Primary and Promotion Rates on Begin Date check box is selected. Valid values are 0.000 through 36.499. Any maximum and minimum interest rate limits specified on the Loan Profiles – Rate Information tab for the loan type also apply to the Contract field. If the Swap Primary and Promotion Rates on Begin Date check box is selected:

If the Swap Primary and Promotion Rates on Begin Date check box is selected:

Length: 6 digits including decimal Keyword: TR Reporting Analytics: Contract Annual Loan Rate, Contract Daily Loan Rate, Promo Annual Loan Rate, Promo Daily Loan Rate (Loan Base subject in Loan folder and ME Loan Base subject in Month-end Information\Loan Month-end folder) |

|

|

The date that the promotional interest rate will change to the contract interest rate. The end date is calculated using the begin date and the duration (in days) of the promotion [End Date = Begin Date + Duration (in days) - 1]. Reporting Analytics: Promo End Date (Loan Base subject in Loan folder and ME Loan Base subject in Month-end Information\Loan Month-end folder) |

Rate changes using the Loan Adjustable Rate Mortgage/Variable Rate Change window are not permitted for loan types supporting promotional interest rates.

The following fields in the Late Charges group box support late charges on the loan:

| Field | Description |

|---|---|

|

Select this check box to exclude the loan from late charges. Keyword: LX |

|

|

The date that late charges have been calculated up to and/or collected up to. For loan types where the Late Charges Calculation Method field is set to A - Late charges are assessed in the back-office cycle the loan is eligible for the fee and the Defer Late Charges check box is selected or is not selected, on the Loan Profiles - Collections/Late Charges tab, this field indicates the date that late charges have been calculated and collected up to, or calculated up to and stored for collection at a later time. Click the down arrow to select the date from the pop-up calendar or enter the date in MM/DD/YYYY format. The date selected should correspond with the loan payment due date for the loan. For loan types where the Late Charges Calculation Method field is set to P - Late charges are calculated and collected a payment application, this date is used when the One Late Fee Per Delinquent Payment check box is selected, the Rule 1 field is S, or the Rule 1 field is W, on the Loan Profiles - Collections/Late Charges tab. Portico will check the date to determine if a late charge was already assessed and collected or assessed and deferred, based on the Defer Late Charges check box on the Loan Profiles - Collections/Late Charges tab. When the One Late Fee Per Delinquent Payment check box is not selected, or the Rule 1 field is not S or W, this field indicates the next payment due date. When the Rule 1 field is S, the late charge date is used to determine how many payments are overdue. When the loan due date is not current, then the following can occur when a payment is applied: 1) If the late charge date is less than or equal to the due date, then the partial payment accumulator will be considered when the loan amount past due is calculated. 2) If the late charge date is greater than the due date, then the partial payment accumulator is not considered when the loan amount past due is calculated. When the Rule 1 field is W, the late charge date is used to determine the last payment period in which a payment was applied. The date then determines if a late charge is to be calculated and collected. When a payment is applied, if the late charge date is within the current payment period, a late charge may not be calculated and collected, even if a loan's due date is delinquent. The One Late Fee Per Delinquent Payment check box is not valid for payment type 007 loans. Keyword: LD |

|

|

When the Defer Late Charges check box is selected on the Loan Profiles - Collections/Late Charges tab, this field indicates the total amount of late charges that have been deferred on the loan. This field is updated by Portico when the late charge for a loan type is deferred at the time of the loan payment. When the Late Charges Calculation Method field on the Loan Profiles - Collections/Late Charges tab is set to A - Late charges are assessed in the back-office cycle the loan is eligible for the fee, this field indicates the total amount of late charges that have been assessed on the loan. This field is updated by Portico when the late charge for a payment type 7 loan type is assessed in the back-office cycle the loan is eligible for the fee. Loans that have late charges assessed in the back-office cycle may also have late charges deferred when a payment is applied. When the Rule 1 field on the Loan Profiles - Collections/Late Charges tab is W - Wisconsin late charges, this field indicates the total amount of late charges that were calculated but not collected when a payment was applied. This amount, plus any newly calculated late charges, will automatically be collected if enough funds are paid with the next applied payment. Length: 8 numeric including decimal Keyword: DL Reporting Analytics: Uncollected Late Charge (Loan Base subject in Loan folder and ME Loan Base subject in Month-end Information\Loan Month-end folder) |

|

|

The amount of late charges included in a partial payment on the loan. For Late Charge Method W, Wisconsin Late Charges, this amount indicates the partial payment that has been applied within the designated grace days corresponding with the late charge date on the loan. Length: 9 numeric including decimal Keyword: LC |

Click Save to save your changes Portico.

Click Payoff to open the Loan Payoff dialog box to calculate a loan payoff for loans with 360-day or 365-day interest.

Click Payment Entry Details to display the Payment Entry Details dialog box.

Click Adjustable Rate Information to open the Adjustable Rate Information dialog box and maintain adjustable rate information for adjustable rate loans types with payment type 009 and variable rate loan types with rate option D.

Select the Military Lending Act check box if the loan should comply with the Military Lending Act. (Keyword: ML/Reporting Analytics: Military Lending Act - Loan Base subject in Loan folder and ME Loan Base subject in Month-end Information\Loan Month-end folder) The Military APR Report 689 provides the MAPR for eligible open-end loans. To appear on the 689 Report, the open-end loan must have the Military Lending Act check box selected, and the loan must be reported on a combined statement (390 Report) or a loan billing statement (462 Report).

A loan will not have the MAPR calculated, even when the Military Lending Act check box is selected and the loan is open-end, under the following conditions:

- The open-end loan is closed. A loan will be considered closed and excluded from the 689 Report if:

- the loan has a zero balance for the entire reporting period

- the last financial transaction date (Last Txn Date field) on the loan is less than the beginning date for the current reporting period

- the Credit Limit field is 0.00 on the Loans - General tab

- The open-end loan is reported on a loan mortgage statement (472 Report). The Statement Print field is M on the Loan Profiles – Account Information tab.

- The Statement Print field is N on the Loan Profiles – Account Information tab for the loan type associated with the open-end loan.

The Loan Activity Overview grid displays the following information:

| Column Heading | Description |

|---|---|

|

The total principal paid for the calendar year. The total will be updated as payments are applied to the loan. Only current year principal applied will be reported. The total will be rolled to the Prior YTD Principal column when the year end totals are reset. This total can be maintained on the Principal and Escrow - Maintenance dialog box. Reporting Analytics: Principal YTD (Loan Base subject in Loan folder and ME Loan Base subject in Month-end Information\Loan Month-end folder) |

|

|

The total principal paid for the prior calendar year. The total from the Year to Date Principal column will be rolled to the Prior Year Principal column when the year end totals are reset. This total cannot be maintained and is not updated by the payment process. Reporting Analytics: Principal Prev Year (Loan Base subject in Loan folder and ME Loan Base subject in Month-end Information\Loan Month-end folder) |

|

|

The total amount of interest paid on this loan during the current calendar year. This amount does not include interest due (FCCBNC). Length: 10 numeric including decimal |

|

|

The interest assessed on the loan for the prior year. |

|

|

The life-to-date interest assessed on the loan. |

|

|

The year-to-date late charges assessed on the loan. |

|

|

The late charges assessed on the loan for the prior year. |

|

|

The life -to-date late charges assessed on the loan. |

|

|

The year-to-date fees assessed on the loan. |

|

|

The fees assessed on the loan for the prior year. |

|

|

The life-to-date fees assessed on the loan. |

- Any maintenance to the fields on the Loan – Interest/Charges tab will appear on the History - Non-Financial History tab and the Non-Financial Transaction Register Report 030/032/036.

- Military APR Report 689

Loan Base subject in Loan folder and ME Loan Base subject in Month-end Information\Loan Month-end folder

Portico Host: 642