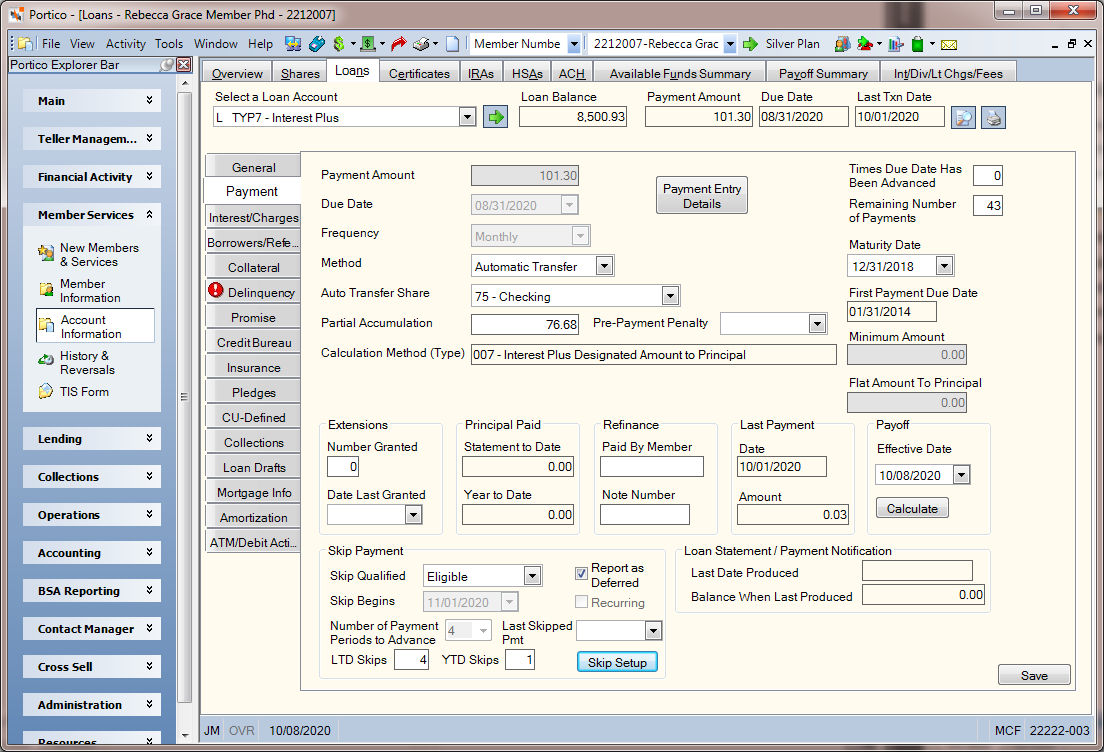

Reviewing Payment Information and Skipping Payments

The Loans – Payment tab displays the payment information for the loan and lets you calculate the payoff amount for the loan.

To access the Payment tab, under Member Services on the Portico Explorer Bar, click Account Information. The Overview tab appears on top. Click the Loans tab. Locate the member using the search tool on the top menu bar. Select the down arrow to select the search method, then enter the search criteria. Select the green arrow or press ENTER to locate the member.

Select the Select a Loan Account down arrow to select the loan note number and description. Then, select the green arrow. The General tab appears on top. Select the Payment tab.

How do I? and Field Help

The following information is found on the Payment tab.

| Field | Description | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

The scheduled payment amount on the loan. Changes to this field can impact delinquency calculations. Length: 9 numeric including decimal Keyword: SP |

|||||||||||||||||

|

Click the down arrow to select the date the first scheduled payment is due from the pop-up calendar or enter the date in MM/DD/YYYY format. The date is advanced when a full payment is made against the loan. The Frequency field determines the next payment due date. On monthly (360 day) interest loans, the Due Date field must be on the first day of the month. Changes to this field can impact delinquency calculations. If you access the Truth-In-Lending dialog box for an existing loan, the due date from the Loans - Payment tab will appear in this field. Keyword: PD |

|||||||||||||||||

|

Click the down arrow to indicate the payment time interval on the loan. On monthly (360 day) interest loans, the frequency field must be Monthly. The valid options are: 0 - Term or one time payment 1 - Weekly 3 - Bi-weekly 5 - Semi-monthly 6 - Semi-annually 7 - Monthly - system default on a new loan 8 - Annually 9 - Quarterly Weekly and Bi-weekly are not valid for a loan type with payment type 007 and calculation options of B, F or P. Single Pmt / Term is not valid for all payment type 007 loans. Changes to this field can impact delinquency calculations. Keyword: PF |

|||||||||||||||||

|

Click the down arrow to indicate the method of payment for the loan. The system default is specified on the Credit Union Profile - Loans tab. The valid options are: C - Cash P - Payroll deduction. System default. S - Payroll deduction. The New Loan - Payroll Information tab appears automatically if a payroll record exists for the member and you did not specify a new payroll number in the Payroll Number field or a share type in the Shares field. The New Loan - Payroll Information tab appears even if the frequency of the loan payment and the payroll are not the same. A - Automatic transfer. The Supported field in the Auto Transfer section on the Credit Union Profile - Loans tab must specify Y. The default value for the Method of Pmt field is specified in the Payment Method field on the Credit Union Profile - Loans tab. Keyword: PI Security Permission: Loans - Field - Method - Maintain Security Groups: Lending - Manager and Lending - Officer |

|||||||||||||||||

|

Select the down arrow to select the share account from which the loan payment will be transferred. The Method field must be Automatic Transfer for a transfer to occur. Payment transfers occur on the loan's due date during the back-office cycle. For insufficient funds, payment transfers will be attempted daily until the loan is current. Partial payments are transferred except on monthly interest loans. Keyword: PS |

|||||||||||||||||

|

The amount received which was less than the scheduled payment. Partial payment amounts do not advance the next payment due date. If the Advance Date field is 1 or 2 on the Loan Profiles - Account Information tab, and a full payment is accumulated, Portico will clear the Partial Accumulation field and advance the payment due date. If the Advance Date field is 3 or 4, and a full payment is accumulated, Portico will clear the Partial Accumulation field and advance the payment due date if the loan is delinquent or the due date is current (less than the paid-ahead stop date). Portico will only update the Partial Accumulation field if the loan is delinquent after the payment is made or the amount received is less than the scheduled payment amount when the loan is current. When the loan is paid ahead and a partial payment is applied, the Partial Accumulation field will not be updated. When a full or partial payment is applied to a loan that is paid ahead and the Partial Accumulation field is greater than zero, the Partial Accumulation field will be cleared and the payment due date will not advance. The date will be eligible to advance when the due date is less than the paid ahead stop date. If the Clear Partial Accumulator check box is selected on the Loan Profiles - Account Information tab for the loan type, Portico will change the Partial Accumulation field to zero when a back-office loan advance occurs for the member and the loan payment type is 002, 003, or 006. Length: 9 numeric including decimal Keyword: PP |

|||||||||||||||||

|

If your credit union includes a prepayment penalty in your loan disclosure documents, you can enter the prepayment penalty date in the Pre-Payment Penalty Date field. Click the down arrow to select the date from the pop-up calendar or enter the date in MM/DD/YYYY format. If the loan is paid off or transferred before this date, you can manually calculate the penalty amount, and then assess the member a fee using the Adjustments tab. You can use the Pre-Payment Penalty Date field on any loan type. You can use prepayment penalties to help cover your loan booking costs when a member transfers a new loan to another institution in search of a lower interest rate. You can use Reporting Analytics to help you identify loans paid off or transferred before the prepayment penalty date. This date determines if a prepayment penalty disclosure should be printed on the mortgage loan statement (472 Report), and if a penalty clause should be printed on the Initial ARM Disclosure notice (467 Report) and Recurring ARM Disclosure notice (468 Report). On the ARM disclosure notices, the prepayment penalty clause reads: Keep in mind that if you pay off your loan, refinance or sell your home before (date), you could be charged a penalty. Contact (credit union name) at the telephone number or (email address) below for more information, such as the maximum amount of the penalty you could be charged. If the Pre-Payment Penalty Date field is blank, the system will print NONE on the ARM disclosure notices. Reporting Analytics: Prepay Penalty Date (Misc Loan Record subject in Loan folder and ME Misc Loan Record subject in Month-end Information\Loan Month-end folder) |

|||||||||||||||||

|

The loan payment calculation method. The valid values are:

|

|||||||||||||||||

|

The number of times the payment due date has been changed to a future date. The number can range from zero through 9. The value resets to 0 after 9. Length: 1 numeric Keyword: EX |

|||||||||||||||||

|

The number of scheduled payments remaining to pay off the loan. This field is automatically reduced for each full payment made. Length: 3 numeric Keyword: NP |

|||||||||||||||||

|

The maturity date of the loan, indicating when the loan should be paid off. For those loan types using Late Charge Method W, Wisconsin Late Charges, the maturity date will be used so that no late charges will be calculated and taken for the final loan due date or any payments thereafter. Select the down arrow to select the maturity date from the pop-up calendar or enter the date in MM/DD/YYYY format. Keyword: MD |

|||||||||||||||||

|

Amortization Date |

The should-be due date for a loan with Delinquency Method B or the original first payment due date of a loan with Delinquency Method D. For new Method B loans, this is the same date specified in the DueDate field. The system uses the Amortization Date field to calculate payment amortization based on the payment frequency of the loan. When the amortization date equals the system date, the system calculates the next should-be payment information for the loan and advances the date in this field based on the payment frequency. The should-be payment information appears on the Amortization Schedule dialog box with the code AMO the morning after the next back-office cycle. For new Method D loans, this is the first payment date of the loan. This date will remain the same for the life of the loan. For existing Method D loans that are changed to Method B, this is the same date specified in the DueDate field. The system updates this field as amortization occurs. For existing Method D loans that are not changed to Method B, this is the same date specified in the Original Date field on the General tab. On Method D loans with payment type 009, this is the same date specified in the Original Date field on the General tab, which is the first payment due date for a payment type 009 loan. This date must be the first day of the month for loans with 360-day interest calculation. |

||||||||||||||||

|

The original first payment due date defined when the loan was booked. |

|||||||||||||||||

|

The minimum scheduled payment allowed for payment type 002, 003, and 006 loans. Length: 8 numeric including decimal Keyword: MP |

|||||||||||||||||

|

The Flat Amount to Principal field is used during recalculation to determine the scheduled payment amount for the loan for payment type 007 loans (interest plus). When the Type 007 Calculations field on the Loan Profiles - Recalculations tab is F or B, Portico will use the value in the Flat Amount to Principal field to determine the scheduled payment amount. The amount specified in the Flat Amount to Principal field overrides the default amount specified in the Type 007 Flat Amount field on the Loan Profiles - Recalculations tab. For loan types with the Type 007 Calculations field on the Loan Profiles - Recalculations tab set to F, and 0.00 is entered in the Flat Amount to Principal field, the loan payment calculated at month end will be interest only, that is the accrued interest from the interest paid to date to the first of the month plus any unpaid interest (remaining amount in FCCBNC, if any). For loan types with the Type 007 Calculations field on the Loan Profiles - Recalculations tab set to F, and an amount greater than 0.00 is entered in the Flat Amount to Principal field, the scheduled payment amount will be the accrued interest from the interest paid to date to the first of the month plus any unpaid interest (remaining amount in FCCBNC, if any) plus the flat amount. For loan types with the Type 007 Calculations field on the Loan Profiles - Recalculations tab set to B, the scheduled payment amount will be the greater between the payment calculated with the flat amount or the amount calculated with the percent listed in the Type 007 Percent field on the Loan Profiles - Recalculations tab. Length: 9 numeric including decimal Keyword: PT |

Extensions

The following fields provide information regarding the payment extensions on the loan.

| Field | Description |

|---|---|

|

The number of extensions granted to this loan. This field must be manually maintained. The value can range from 0 to 99. Length: 2 numeric |

|

|

The last date a payment extension was granted. Select the down arrow to select the extension date from the pop-up calendar or enter the date in MM/DD/YYYY format. |

Principal Paid

The following fields provide information regarding the principal paid on the loan.

| Field | Description |

|---|---|

|

The total principal paid for the statement period-to-date. The total will be updated as payments are applied to the loan. Only payments applied during the current billing cycle will be reflected in the total. The total will be cleared to zero when the loan is reported on the statement. This total can be maintained on the Principal and Escrow - Maintenance dialog box. Reporting Analytics: Principal Curr Period (Loan folder > Loan Base query subject and Month-end Information > Loan Month-End > ME Loan Base query subject) |

|

|

The total principal paid for the calendar year. The total will be updated as payments are applied to the loan. Only current year principal applied will be reported. The total will be rolled to the Prior Year Principal totals when the year end totals are reset. This total can be maintained on the Principal and Escrow - Maintenance dialog box. Reporting Analytics: Principal YTD (Loan folder > Loan Base query subject and Month-end Information > Loan Month-End > ME Loan Base query subject) |

Refinance

The following fields provide information regarding the loan that was paid off through refinancing.

| Field | Description |

|---|---|

|

The member number associated with the loan that paid off this loan through refinancing. Length: 12 numeric |

|

|

The note number of the loan that paid off this loan through refinancing Length: 6 alphanumeric |

Last Payment

The following fields provide information regarding the last payment on the loan.

| Field | Description |

|---|---|

|

The last date a payment was made on the loan. |

|

|

The amount of the last payment made on the loan. |

Select Save to save your changes.

Select the balloon payment button to display the Residual Payment Information dialog box.

Select the Payroll Information icon button to display the Payroll Information dialog box.

Select the Transfer File icon to display the Member Transfer Summary dialog box.

Select the Payment Entry Details button to display the Payment Entry Details dialog box.

Loan Payoff

To calculate the payoff amount on the loan, in the Payoff group box, select the Payoff Effective Date down arrow to select an effective date for the loan payoff calculation from the pop-up calendar or enter the date in MM/DD/YYYY format. Then, select Calculate. The Loan Payoff dialog box appears with the total payoff amount.

Standard Skip Payment

Skip Payment allows you to offer a skip payment option on both new and existing loans at the member level. Loan calculations will be based on skip date and skip counter, whether it is a recurring or one-time skip. Complete the following fields to set up a recurring or one-time skip payment.

- In the Skip Payment group box, select the Skip Begins down arrow to select the date the system will begin to skip payments from the pop-up calendar or enter the date in MM/DD/YYYY format. Portico will automatically advance the skip date to next year.

- Select the Number of Payment Periods to Advance down arrow to select the number of payments that will be skipped.

-

Select the Report as Deferred checkbox to report skip payment loans as deferred in the credit bureau transmission. Portico will use the Skip Begins field, Number of Payment Periods to Advance field and Last Skipped Pmt field to determine the beginning and ending dates of the deferral period and report the appropriate information in the credit bureau transmission.

- Select the Recurring checkbox if the skip payment is recurring.

Portico will calculate loan amounts based on skip the payment information. If the Recurring checkbox is selected, Portico will calculate amounts based on a skip payment occurring on the same date each year. If the Recurring checkbox is not selected, Portico will calculate amounts based on a skip payment occurring only once. To skip December 15th payment, if the November payment has not been posted, enter the skip date of 1215. If the November payment has been posted, you must manually change the due date to January 15th. The skip date cannot be in the past or February 29th of any year. The skip date automatically advances one year when the due date is advanced and the Recurring checkbox is selected. The skip date and skip counter will automatically be reset to zeros when the due date is advanced and the Recurring checkbox is not selected.

To skip a payment made via payroll distributions, on the Member Payroll Maintenance dialog box, enter the number of payroll posting cycles to skip for this distribution in the Skip field and the date the system will begin skipping the distribution in the Start Date field.

To skip a payment made via Transfer File, on the Member Transfer File Information dialog box, change the Post Date field and Effective Date field to the next date that the transfer should occur.

If the payment being skipped is the current payment due on the loan, then you must change the Due Date field on the Loans - Payment tab to the next date a payment will be due. On the Loan – General tab, update the Late Charges Date field to the next date a payment will be due.

When the system skips a payment, the next payment due date will be advanced by the number of payments in the skip counter when a loan payment advances the due date to or after the skip date. The due date is not advanced by the number of skips if the loan is delinquent at the time of payment. The due date will be advanced by the number of skips once the loan becomes current. Use the Reversals – Same Day Reversals tab to reverse skip payment processing.

Enhanced Skip Payment

Enhanced Skip Payment lets you set up multiple skip payment records for a loan. You can schedule single or recurring skip payments for the current due date or a future date. Portico will block back-office loan payments, including payments made via Transfer File, ACH, and payroll. Using a customized criteria to identify member loans that qualify for skip payment processing, you can offer qualifying members the opportunity to choose from a single skip payment or a recurring, seasonal skip payment, such as summer skip payments for teachers. Plus, a per skip fee option helps you cover the processing costs associated with skip payment processing. When enhanced skip payment is activated for your credit union, Portico Customer Service will select the Enhanced Skip Payment checkbox on the Credit Union Profile - Loans tab.

The daily Skip Payments Report 687 lists all skip payments created and processed, and any fees charged for the skip payments. You can choose to collect fees when the skip payment record is set up or when the skip payment is processed. The 687 Report Rules let you define the skip payment fee amount and general ledger account that will receive the fees.

The Skip Payment Qualifications Report 688 lets you define a criteria to identify which member loans are eligible for enhanced skip payment processing. When the report runs, Portico will identify the qualifying loans and list them on the 688 Report. The Portico – Reports – User Can Maintain 688 Report security permission included the Lending – Administrator security group allows you to maintain the report rules/member loan criteria.

When the 668 Report runs, Portico will identify the qualifying loans by changing the Skip Qualified field to Eligible on the Loans - Payment tab (Keyword: SE/Reporting Analytics: Skip Eligible Ind - Located in Loan/Loan Base subject and Loan Month-end/Month-end Information/ME Loan Base subject).

If the Skip Qualified field is Eligible, you can begin setting up skip payment records for the loan. The loan will be reviewed each time the qualification routine is executed.

If the Skip Qualified field is Review, the loan did not meet the criteria to be Eligible, but the loan will be reviewed again, the next time the qualification routine is executed. Skip payment records cannot be created if the Skip Qualified field is Review.

You can choose to manually qualify a loan for enhanced skip payment processing by changing the Skip Qualified field to Include. This option allows you set up skip payments regardless of whether the loan qualifies. Portico will not review the loan when the qualification routine is executed.

If the Skip Qualified field is Eligible or Include, you can select the Skip Setup button to display the Skip Payment Setup dialog box. The Skip Payment Setup dialog box lets you setup multiple skip payments (up to five separate records) for various times of the year for a particular loan. You can also select a fee for the skip payment and define which share account in which the fee will be charged.

You can also choose to exclude some member loans from enhanced skip payment processing. Changing the Skip Qualified field to Exclude will exclude these loans from being reviewed when the qualification routine is executed. If the loan has existing skip payment records, the Skip Qualified field cannot be changed from Eligible to Review or Exclude.

Enhanced skip payment cannot be used with credit cards, escrow loans, annual frequency loans, and term frequency loans. In some cases. these loans may be marked eligible for skip payment processing, but a warning message will appear if you attempt to set up a skip payment record for these types of loans.

Some of the fields in the Skip Payment group box are used by both standard skip payment and enhanced skip payment.

| Field | Description |

|---|---|

|

The date the system will begin to skip payments. The next payment due date will be advanced by the number of payments in the skip counter when a loan payment advances the due date to or after this date. For standard Skip Payment, select the down arrow to select a date from the pop-up calendar or enter the date in MM/DD/YYYY format. For example, to skip the December 15 payment: If the November payment has not been posted, then enter the skip date of 1215. If the November payment has already been posted, the due date field is changed to January 15. For Enhanced Skip Payment, this field will reflect the date in the Skip Begins column on the Skip Payment Setup dialog box. The skip date cannot be in the past or 02/29 of any year. The skip date automatically advances one year when the due date is advanced and the Recurring checkbox is selected. The skip date and skip counter will automatically be reset to zeros when the due date is advanced and the Recurring checkbox is not selected. The due date is not advanced by the number of skips if the loan is delinquent at the time of payment. The due date will be advanced by the number of skips once the loan becomes current. Changes to this field can impact delinquency calculations, proceed with caution. Skip payments are not valid for a loan with an associated escrow account. Keyword: SK Reporting Analytics: Skip Payment Date 1 (Loan folder > Loan Base query subject and Month-end Information > Loan Month-End > ME Loan Base query subject) |

|

|

Select the Report as Deferred checkbox to report skip payment loans as deferred in the credit bureau transmission. Portico will use the Skip Begins field, Number of Payment Periods to Advance field and Last Skipped Pmt field to determine the beginning and ending dates of the deferral period and report the appropriate information in the credit bureau transmission. System default is selected (Y), but only impacts credit bureau reporting if you complete the Skip Begins field, Number of Payment Periods to Advance field and Last Skipped Pmt field. Keyword: CS (642TN MBR LOAN;CS y where TN is the teller number, MBR is member number, and LOAN is the note number) Reporting Analytics: Report Skip as Deferred (Loan folder > Loan Base query subject and Month-end Information > Loan Month-End > ME Loan Base query subject) |

|

|

For standard Skip Payment, select this checkbox if the skip payment is recurring. For Enhanced Skip Payment, this checkbox will reflect the Recurring checkbox on the Skip Payment Setup dialog box. Keyword: SR Reporting Analytics: Skip Recurring Flag 1 (Loan folder > Loan Base query subject and Month-end Information > Loan Month-End > ME Loan Base query subject) |

|

|

For standard Skip Payment, select the down arrow to select the number of payments that will be skipped. This advancement occurs when the next payment due date equals or exceeds the skip date. The loan skip counter can range from zero through 99. The maximum number of skips is based on the loan payment frequency. The guidelines are: 0 - Term: 00 (no skips allowed) 1 - Weekly: 51 maximum skips 3 - Biweekly: 25 maximum skips 5 - Semimonthly: 23 maximum skips 6 - Semiannually: 01 maximum skips 7 - Monthly: 11 maximum skips 8 - Annually: 00 (no skips allowed) 9 - Quarterly: 03 maximum skips Skip payments are not valid for a loan with an associated escrow account. For Enhanced Skip Payment, this field will reflect the value in the Payments to Advance column on the Skip Payment Setup dialog box. Skipped payroll distributions do not increment this counter. Keyword: SC Reporting Analytics: Skip Number of Payments 1 (Loan folder > Loan Base query subject and Month-end Information > Loan Month-End > ME Loan Base query subject) |

|

|

The last payment due date that was skipped on the loan. This field appears if the credit union has activated Enhanced Skip Payment. Portico calculates last skipped payment date at the time the skip payment is processed, and is used to block back-office loan payments, including payments made via Transfer File, ACH Origination, and payroll. For example, if the current date is 5/15/2015 and the Last Skipped Pmt field is 6/15/2015, Portico will block back-office loan payments through 6/15/2015. The Last Skipped Pmt field can be manually updated. Be careful when modifying this field as it can alter the skip time-frame and may prevent Portico from blocking the correct back-office loan payments. Keyword: SD Reporting Analytics: Skip Payment End Date (Loan folder > Loan Base query subject and Month-end Information > Loan Month-End > ME Loan Base query subject) |

|

|

The number of loan payment due dates skipped life-to-date. This field appears if the credit union has activated Enhanced Skip Payment. Length: 4 numeric Keyword: SL Reporting Analytics: Skip LTD Count (Loan folder > Loan Base query subject and Month-end Information > Loan Month-End > ME Loan Base query subject) |

|

|

The number of loan payment due dates skipped year-to-date. This field appears if the credit union has activated Enhanced Skip Payment. Length: 3 numeric Keyword: SY Reporting Analytics: Skip YTD Count (Loan folder > Loan Base query subject and Month-end Information > Loan Month-End > ME Loan Base query subject) |

The Loan Statement/Payment Notification group box contains the last statement date and balance when the statement was produced.

| Field | Description |

|---|---|

|

The last date that a loan billing statement or mortgage loan statement was produced. The Statement Print field will be S or M on the Loan Profiles - Account Information tab. Spaces in this field will indicate the loan type does not receive loan billing statements or mortgage loan statements. When the Exclude from Loan Statement checkbox is selected on the Loans - General tab, the Last Date Produced field will display the date the statement would have been produced. Portico will continue to track the loan details to ensure that if the Exclude from Loan Statement checkbox is changed to not selected, the first statement produced will have the correct values and report the previous statement period only. Reporting Analytics: Loan Stmt Date (Loan folder > Loan Base query subject and Month-end Information > Loan Month-End > ME Loan Base query subject) |

|

|

The balance the last time a loan billing statement or mortgage loan statement was produced. This field will contain a value only if the loan has been set up to receive loan billing statements or mortgage loan statements. When the Exclude from Loan Statement checkbox is selected on the Loans - General tab, the Balance When Last Produced field will display the loan balance on the date the statement would have been produced. Portico will continue to track the loan details to ensure that if the Exclude from Loan Statement checkbox is changed to not selected, the first statement produced will have the correct values and report the previous statement period only. Length: 15 numeric Reporting Analytics: Loan Stmt Amount (Loan folder > Loan Base query subject and Month-end Information > Loan Month-End > ME Loan Base query subject) |

General Ledger Effects: none | Related Reports: Non-Financial Transaction Register Report 030 (if maintained)

To reverse the transaction on the same day, perform the Reversals - Same Day Reversals tab.

For a prior-day correction, perform the Reversals - Prior Day Loan Reversal tab or update the Loans – Amortization tab.

Portico Host: 642, LINQ (683)