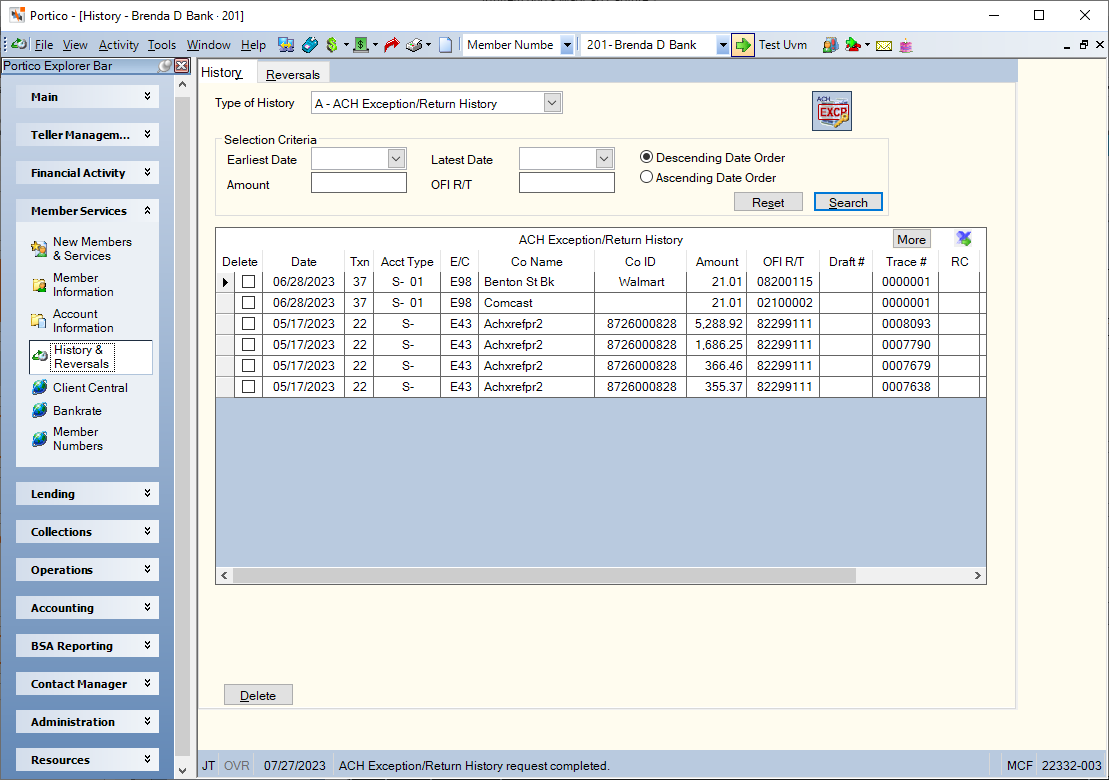

ACH Exception/Return History

The ACH Exception/Return History tab displays a member's rejected ACH items and/or returned items for the past 200 days. Returned items appearing on the ACH Exception Items window also will appear on the History – ACH NSF/Return History tab. An ACH item appears on the ACH Exception/Return History tab if the return code entered on the ACH Exception Items window is either a Federal Reserve return code or a paid code of NEG, UNC, or MIS. ACH contested return codes R71-R76 and any other returns manually added using the ACH Return Item - New dialog box will not appear on the ACH Exception/Return History tab. These items will only appear on the 174 Report.

You can perform the following actions on the ACH NSF/Return History tab:

- Delete an ACH reject record

- Search by amount, range or dates, or specific date

To review ACH exception/return history, , under Member Services on the Portico Explorer Bar, select History/Reversals. The History tab appears on top. Locate the member using the search tool on the top menu bar. Select the down arrow to select the search method, then enter the search criteria. Select the green arrow or press ENTER to locate the member. On the History tab, select the Type of History down arrow and select A-ACH Exception/Return History. Select Search. The results appear in the ACH Exception/Return History grid.

How do I? and Field Help

To refine your search criteria...

- To specify a date range, select the Earliest Date down arrow to select the beginning date from the pop-up calendar or enter the date in MM/DD/YYYY format. Then, select the Latest Date down arrow to select the ending date from the pop-up calendar or enter the date in MM/DD/YYYY format.

- In the Amount field, enter the amount of the ACH item.

- In the OFI R/T field, enter the routing and transit number of the originating financial institution (OFI).

- Select the Descending Date Order option to sort the history in descending date order. Select the Ascending Date Order option to sort the history in ascending date order.

Select the Exception Codes icon button to display the return and exception codes found in the history.

The ACH Exception/Return History grid displays a member’s past ACH exception/return activity.

| Column Heading | Description |

|---|---|

|

Select the Delete checkbox and select Delete to the delete the ACH NSF/return item. |

|

|

The date the ACH item was rejected and appeared on the 170 Report and ACH Exception Items window. |

|

|

The NACHA transaction code associated with the ACH item. The system will convert the incoming ACH transaction code to the appropriate transaction code. Valid options are: 05 - Loan Advance 22 - Credit to share draft/checking - valid for micro-entries, valid receiving transaction for same-day outgoing ACH credit item 23 - Prenote or ENR of credit to share draft checking 24 - Acknowledgment to share draft/checking 27 - Debit to share draft/checking - valid for micro-entries, valid back-office transaction for Person-to-Person (P2P) credit transactions and same-day outgoing ACH debit items. 28 - Prenote of debit to share draft/checking - valid receiving transaction for micro-entries, frequency must be Request, and effective date must be 3 business days in the future. 32 - Credit to shares/savings - valid for micro-entries, valid receiving transaction for same-day outgoing ACH credit item 33 - Prenote or ENR of credit to shares/savings 34 - Acknowledgment to shares/savings 37 - Debit to shares/savings - valid for micro-entries, valid back-office transaction for Person-to-Person (P2P) credit transactions and same-day outgoing ACH debit items. 38 - Prenote of debit to shares/savings - valid receiving transaction for micro-entries, frequency must be Request, and effective date must be 3 business days in the future. 42 - Automated general ledger deposit (credit) - valid receiving transaction for same-day outgoing ACH credit item 43 - Prenotification of general ledger credit authorization 47 - Automated general ledger payment (debit) - valid back-office transaction for same-day outgoing ACH debit items. 48 - Prenotification of general ledger debit authorization 52 - Automated loan account deposit (credit) - valid receiving transaction for same-day outgoing ACH credit item 53 - Prenotification of loan account credit authorization 54 - Acknowledgment to loan 55 - Debit to loan (reversal only) Length: 2 numeric Keyword: TC |

|

|

The type of account associated with the ACH item. |

|

|

The error code associated with the ACH exception/return item. |

|

|

The name of the originating financial institution as it should appear at the receiving institution. The company name, OFI, and/or company ID can be used as the criteria for posting ACH. The company name can be used in addition to the OFI and/or company ID to post ACH or in place of the OFI and/or company ID. You can leave this field blank if posting by company ID and/or OFI. To post by company name only on the Member Transfer File Information dialog box, specify the company name in this field. The company name must be an exact match to the company name appearing on the ACH file. Leave the Originating Financial Institution and Company ID fields blank. On the ACH Processing Options window:

Length: 16 alphanumeric Keyword: CN |

|

|

The unique company ID of the originator of the ACH transaction. The originator can be the credit union or the company sending the ACH item. For ACH scheduled transfers, you can leave this field blank if posting by company name and/or OFI. On the ACH Processing Options window, enter zeroes in this field if posting by company name or batch description. Length: 10 alphanumeric Keyword: CI |

|

|

The amount of this ACH transaction. A valid ACH transaction amount can be 0 through 99,999,999.99. Length: 11 numeric including decimal Keyword: AM You can view the available balance after posting the item by moving your mouse over the Amount field. |

|

|

The routing and transit number of the originating financial institution for an ACH transaction. You can leave this field blank if posting by company name and/or company ID. If left blank, Portico will populate the field with zeroes. Length: 8 numeric Keyword: OR |

|

|

The serial number associated with the ACH item. Length: 15 alphanumeric |

|

|

The trace number assigned by the originating institution. Length: 7 alphanumeric Keyword: TR |

|

|

The return code associated with the ACH NSF/Return. Select here to view a list of valid return codes. Keyword: RC |

|

|

The date the ACH exception/return was processed. |

|

|

Indicates if the exception item has been presented before, within the specified number of months defined by the credit union. |

|

|

For represented items, indicates if a fee was assessed the first time. |

Add the ACH-Return History-User Can Delete ACH Return History security permission to a security group to give the users assigned to that security group the ability to delete ACH exception/return history using the Delete checkbox and Delete button. Otherwise, the Delete checkbox and Delete button will not appear. Portico does not recommend deleting items from ACH history.

none

Non-Financial Transaction Register Report 030 (if maintained)

When you delete an ACH record, the system updates the appropriate counter information.

If the member's number is changed using the Member Number Change dialog box, the system displays the message MEMBER NUMBER NOT FOUND on the old ACH Exception/Return History tab. You can access the new ACH Exception/Return History tab immediately, but the history will not appear until after the next back-office cycle. The message MEMBER NUMBER CHANGED FROM XXXXXXXXX on MMDDYY appears on the old ACH Exception/Return History tab.

If you have deleted an ACH record in error, you can use the Reversals - Same-Day Reversals By CAN tab to correct it on the same day. If you deleted an ACH record in error on a prior day, you cannot correct the information.

Portico Host: 289