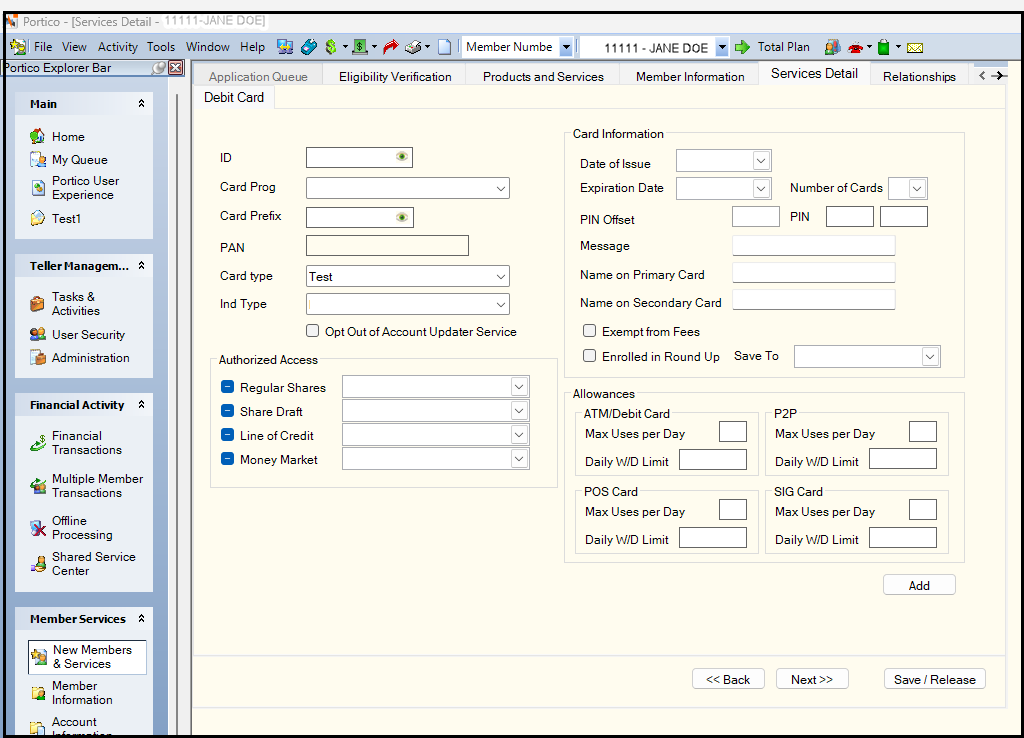

Services Detail: New Debit ID

The Debit ID tab lets you set up a debit ID for the member.

How do I? and Field Help

Complete the following information to set up a new debit ID.

| Field | Description |

|---|---|

|

Enter the new ATM or debit ID. If the card program has been set up with the Auto Assign EFT ID checkbox selected on the EFT ID Processing Rules tab, you can enter 0 (zero) in the Account ID field and Portico will automatically generate the ATM or debit ID. The 10-digit ATM or debit ID is embossed and encoded on the member's ATM or debit card. The system uses the value entered in the Checked Digit field on the EFT ID Processing Rules tab to calculate the check digit in the tenth position of the ATM or debit ID. Portico partially masks ATM and debit ID numbers when they appear on the same window as the PAN number. You can click inside the field to show the ATM or debit ID. When you tab out of the field, the ATM or debit ID will be masked. The ATM or debit ID will remain unmasked as long as the field has focus.Portico will log each time a user clicks inside a field to view an ATM or debit ID in the View Sensitive Data Audit report. The Portico – User Can View PAN security permission is not required to view an ATM or debit ID. Length: 10 numeric Keyword: CI |

|

|

Enter the International Standards Organization (ISO) number for the ATM card. The number specified in this field overrides the card prefix specified in the Card Prefix field on the Credit Union Profile - Self-Service tab. For a debit card, enter the Banking International Number (BIN) for the debit card. The number specified in this field overrides the BIN specified in the Card Prefix BIN field on the EFT Processing Rules tab. Portico partially masks the card prefix or BIN when it is longer than 6 digits. To view the complete card prefix or BIN, users must be assigned to the Portico – User Can View PAN security group or to a credit union-defined security group with the Portico – User Can View PAN permission. You can click inside the field to show the card prefix or BIN. When you tab out of the field, the card prefix or BIN will be masked. The card prefix or BIN will remain unmasked as long as the field has focus.Portico will log each time a user clicks inside a field to view a card prefix or BIN in the View Sensitive Data Audit report. Length: 9 numeric Keyword: PR |

|

|

Enter the credit union-defined card program as specified on the EFT Processing Rules tab. For example, GOLD - for Visa Gold Debit Card or ATM - for Standard ATM Card program. Each card program can have a specific set of default values assigned that you can use for setting up a new cardholder ID. You can customize this field using the Customized Field - Update window. |

|

|

Indicate the type of ATM card or credit/debit card. You can customize this field using the Customized Field - Update window. Values used by Fiserv include, but are not limited to the following:

Keyword: CT or TY |

|

|

Indicate if the card is an ATM or debit card. You can customize this field using the Customized Field - Update window. The valid options are: 8 - Debit Card (VISA or MasterCard) 1 - ATM Keyword: IT |

|

|

You can honor a member's request to opt out of the Account Updater Service by selecting this checkbox. If a cardholder has requested, and has been provided with, a new account in an effort to terminate a recurring billing relationship, no updated information about this new account should be provided through the Account Updater Service. Close the old card, and issue a replacement card that has opted out of the service by selecting the Opt Out of Account Updater Service checkbox. This notifies the network that the old card is closed and prevents all merchants from obtaining the new card information from the Account Updater Service. Portico will not populate the Prior Card Number and Prior Expiration Date fields on the ATM/Debit Card Maintenance dialog box. You can select the Opt Out of Account Updater Service checkbox before selecting Save to add the new card ID during the Replace Card process. If a Card Management window does not exist for the BIN (card prefix), the BIN (card prefix) is not eligible for the Account Updater Service, or your credit union does not use Fiserv Card Services, the Account Updater Service group box does not appear on the ATM/Debit Card Maintenance dialog box, and the Opt Out of Account Updater Service checkbox does not appear on the ATM and Debit Card tabs in New Members & Services. Keyword: AU |

The PAN field indicates the member primary account number for this ATM/Debit ID. The first nine digits are the card prefix and the last ten digits are the ATM/Debit ID. All digits of the PAN number will be masked except for the first 6 digits and last 4 digits of the number. To view the complete PAN number, users must be assigned to the Portico – User Can View PAN security group or to a credit union-defined security group with the Portico – User Can View PAN permission. You can click inside the field to show the complete PAN number. When you tab out of the field, the PAN number will be masked. The PAN number will remain unmasked as long as the field has focus. Portico will log each time a user clicks inside a field to view a PAN number in the View Sensitive Data Audit report.

In the Card Information group box, complete the following information:

| Field | Description |

|---|---|

|

Select the down arrow to choose the date you added the ATM ID or debit ID to the system from the pop-up calendar or enter a date in MM/DD/YYYY format. If left blank, Portico uses the system date. Keyword: ID |

|

|

The expiration date of the ATM or debit card. The card expires on the last day of the specified month. The default date 204912 indicates an unexpiring card. Select the down arrow to choose a date from the pop-up calendar or enter a date in MM/DD/YYYY format. Use the default date for debit cards. Keyword: XD |

|

|

The vendor and type of ATM or debit card. The first character indicates the ATM or debit card vendor. The valid vendor option is: L - Personix (formerly La Mirada). The second and third characters indicate the ATM or debit card type. The valid options are: 01 - Regular ATM card 02-09 - Alternate ATM card System default is based on the first entry in the Card Type field on the 035 Report Rules. The Vendor field appears if you select the Issue Cards checkbox on the Credit Union Profile - Self-Service tab. Length: 3 alphanumeric Keyword: TY |

|

|

Select the down arrow to choose the number of ATM cards or debit cards. Keywords: C1-C5 |

|

|

Enter the offset value used in calculating the PIN. The value must be zero or greater. You do not need to keep the PIN Offset on Portico. Your EFT vendor (for example, Fiserv Card Services) handles the PIN verification on transactions. If your credit union uses MVFE, Remote Card Management, Integrated Desktop, or FIS Authorization Processor (FIS AP) to update the Card Management System, you could enter the PIN Offset in Portico and Portico would send the new PIN Offset to Fiserv Card Services to update the PIN (there are devices that re-pin a card and calculate the PIN Offset to enter into Portico). For MVFE, Remote Card Management, and FIS Authorization Processor (FIS AP), the new PIN would not take effect until the next day when Fiserv Card Services or CO-OP processes the batch file. If your credit union does not use MVFE, Remote Card Management, Integrated Desktop, or FIS Authorization Processor (FIS AP) then the PIN Offset on Portico is informational only. Length: 4 to 6 numeric (Determined by the PIN Length field on the EFT Processing Rules tab.) Keyword: PO |

|

|

Enter the member-selected personal identification number (PIN). Portico uses the PIN to calculate the value in the PIN Offset field. If you selected the Supported checkbox in the Member Selected PIN group box on the Credit Union Profile - Self-Service tab, you can change the member's PIN by typing a new PIN in this field. The value must be zero or greater. Length: 4 to 6 numeric (Determined by the PIN Length field on the EFT Processing Rules tab.) Keyword: PI |

|

|

Reenter the member-selected personal identification number (PIN) in the Verify field. Length: 4 to 6 numeric (Determined by the PIN Length field on the EFT Processing Rules tab.) |

|

|

If desired, enter a credit union-defined message in the Message field. Length: 20 alphanumeric Keyword: MS |

|

|

The primary owner's full name to be imprinted on the ATM card or Debit card. Portico will default to the name on the Contact Information tab. Length: 23 alphanumeric | Keyword: M1 |

|

|

Enter the name to be imprinted on the second ATM card or Debit card. If you do not specify a name, Portico defaults to the joint owner name on the Contact Information tab. Length: 25 alphanumeric Keyword: M2 |

|

|

Select to exempt the member from the fees specified in the Fees group box on the ATM/Debit Processing Rules tab. Keyword: EF |

|

|

Select to enroll the debit card in the Round Up program. Keyword: RX |

|

|

Select 01 through 99 as the eligible account for the Round Up program. Keyword: RT |

Select Card Options to open the ATM/Debit Card Options dialog box.

Select Issue Card to open the Card Issue dialog box or Issue Card dialog box to order an ATM card or Debit card for the member.

In the Authorized Access and Network Default Accounts group box, complete the following fields to allow ATM transactions or debit card transactions against specific account types.

| Field | Description |

|---|---|

|

Select this checkbox to allow ATM or debit transactions against the regular share account specified. An ATM card or debit card icon appears on the Transactions tab indicating that you permit these financial transactions. Keyword: A1 Select this down arrow to select the share type of the regular share account that you use for network ATM or debit transactions. If this field is blank, the system automatically defaults to 01. Keyword: N1 |

|

|

Select this checkbox to allow ATM or debit transactions against the share draft account specified. An ATM or debit card icon appears on the Transactions tab indicating that you permit these financial transactions. Keyword: A2 Select this down arrow to choose the share type of the share draft account that you use for network ATM or debit transactions. If this field is blank, the system automatically defaults to 75. Keyword: N2 |

|

|

Select this checkbox to allow ATM or debit transactions against the line of credit loan specified. An ATM or debit card icon appears on the Transactions tab indicating that you permit these financial transactions. Keyword: A3 Select this down arrow to choose the note number of the loan that you can use for network ATM or debit transactions. If you leave this field blank, the system automatically defaults to the note number specified on the EFT Processing Rules tab. Keyword: N3 |

|

|

Select this checkbox to allow ATM or debit transactions against the money market account specified. An ATM or debit card icon appears on the Transactions tab indicating that you permit these financial transactions. Keyword: A4 Select this down arrow to choose the share type of the money market that you use for network ATM or debit transactions. If you leave this field blank, the system automatically defaults to the money market specified on the EFT Processing Rules tab. Keyword: N4 |

In the Allowances group box, you can define the limits for maximum uses per day and the daily withdrawal limit.

| Field | Description |

|---|---|

|

The maximum number of ATM or debit withdrawals (proprietary and on-line networks combined) allowed for the member on a daily basis. Portico compares the number in this field to the number in the ATM field in the Uses Today group box on the ATM/Debit Card Maintenance dialog box. Length: 2 numeric Keyword: MU Security Permissions: MbrInfo – ATM Card – Allowances/Limits – Maintain and MbrInfo – Debit Card – Allowances/Limits – Maintain Security Groups: Teller - Advanced and Member Services - User |

|

|

The maximum amount the member can withdraw using ATM or debit card transactions (proprietary and network combined) daily. Portico automatically defaults to the amount specified in the Daily Withdrawal Limits group box on the EFT Processing Rules tab for the card program. Length: 6 numeric in whole dollar amount Keyword: WL Security Permissions: MbrInfo – ATM Card – Allowances/Limits – Maintain and MbrInfo – Debit Card – Allowances/Limits – Maintain Security Groups: Teller - Advanced and Member Services - User |

|

|

The daily maximum number of points of sale (POS) withdrawals allowed for the member. Portico compares the number in this field to the number in the POS field in the Uses Today group box on the ATM/Debit Card Maintenance dialog box. Length: 3 numeric Keyword: PU Security Permissions: MbrInfo – ATM Card – Allowances/Limits – Maintain and MbrInfo – Debit Card – Allowances/Limits – Maintain Security Groups: Teller - Advanced and Member Services - User |

|

|

The maximum amount the member can withdraw for point of sale (POS) transactions on a daily basis. If this field is blank, Portico automatically defaults to the amount specified in the Daily Withdrawal Limits group box on the EFT Processing Rules tab for the card program. The Signature Based POS field on ATM/Debit Processing Rules tab determines which limits will authorize signature-based POS transactions: POS or Signature POS. Length: 6 numeric in whole dollar amount Keyword: PL Security Permissions: MbrInfo – ATM Card – Allowances/Limits – Maintain and MbrInfo – Debit Card – Allowances/Limits – Maintain Security Groups: Teller - Advanced and Member Services - User |

|

|

The maximum number of P2P (Popmoney) withdrawals allowed for the member daily. Portico compares the number in this field to the number in the P2P field in the Uses Today group box on the ATM/Debit Card Maintenance dialog box. Length: 3 numeric Keyword: 2U Reporting Analytics: P2P Max Number Daily Withdrawals (ATM Base subject and the Debit Base subject in the Self-Service folder and the ME ATM Base subject and the ME Debit Base subject in the Month_end Information\Self Service Month_end folder) Security Permissions: MbrInfo – ATM Card – Allowances/Limits – Maintain and MbrInfo – Debit Card – Allowances/Limits – Maintain Security Groups: Teller - Advanced and Member Services - User |

|

|

The maximum amount the member can withdraw using P2P (Popmoney) transactions on a daily basis. If this field is blank, Portico automatically defaults to the amount specified in the Daily Withdrawal Limits group box on the EFT Processing Rules tab for the card program. Length: 6 numeric in whole dollar amount Keyword: 2L Reporting Analytics: P2P Max Daily Withdrawal Limit (ATM Base subject and the Debit Base subject in the Self Service folder and the ME ATM Base subject and the ME Debit Base subject in the Month_end Information\Self Service Month_end folder) Security Permissions: MbrInfo – ATM Card – Allowances/Limits – Maintain and MbrInfo – Debit Card – Allowances/Limits – Maintain Security Groups: Teller - Advanced and Member Services - User |

|

|

The maximum number of signature points of sale (POS) withdrawals allowed for the member daily. Portico compares the number in this field to the number in the SIG field in the Uses Today group box on the ATM/Debit Card Maintenance dialog box. Length: 3 numeric Keyword: SU Security Permissions: MbrInfo – ATM Card – Allowances/Limits – Maintain and MbrInfo – Debit Card – Allowances/Limits – Maintain Security Groups: Teller - Advanced and Member Services - User |

|

|

The maximum amount the member can withdraw for signature point of sale (POS) transactions daily. If this field is blank, Portico automatically defaults to the amount specified in the Daily Withdrawal Limits group box on the EFT Processing Rules tab for the card program. The Signature Based POS field on the ATM/Debit Processing Rules tab determines which limits authorize signature-based POS transactions: POS or Signature POS. Length: 6 numeric in whole dollar amount Keyword: SL Security Permissions: MbrInfo – ATM Card – Allowances/Limits – Maintain and MbrInfo – Debit Card – Allowances/Limits – Maintain Security Groups: Teller - Advanced and Member Services - User |

Select Add to add the debit ID.

Select Back to move back to the previous tab. Select Next to continue with the next step of the member application.

Select Save/Release to save the application for completion later.