Cashing a Check and Disbursing a Check - Non-Teller Administration

Non-Teller Administration credit unions can use the Transactions - Check Cashing and Teller Cash Adjustment tab to cash a check for a member or non-member, disbursing a check to a member or non-member, and assess a fee for this service.

To access the Transactions - Check Cashing and Teller Cash Adjustment tab, under Financial Activity on the Portico Explorer Bar, click Financial Transactions. The Transactions tab appears on top. Locate the member using the search tool on the top menu bar. Select the down arrow to select the search method, then enter the search criteria. Select the green arrow or press ENTER to locate the member. Enter 0 for a non-member or locate the member using the search tool on the top menu bar.

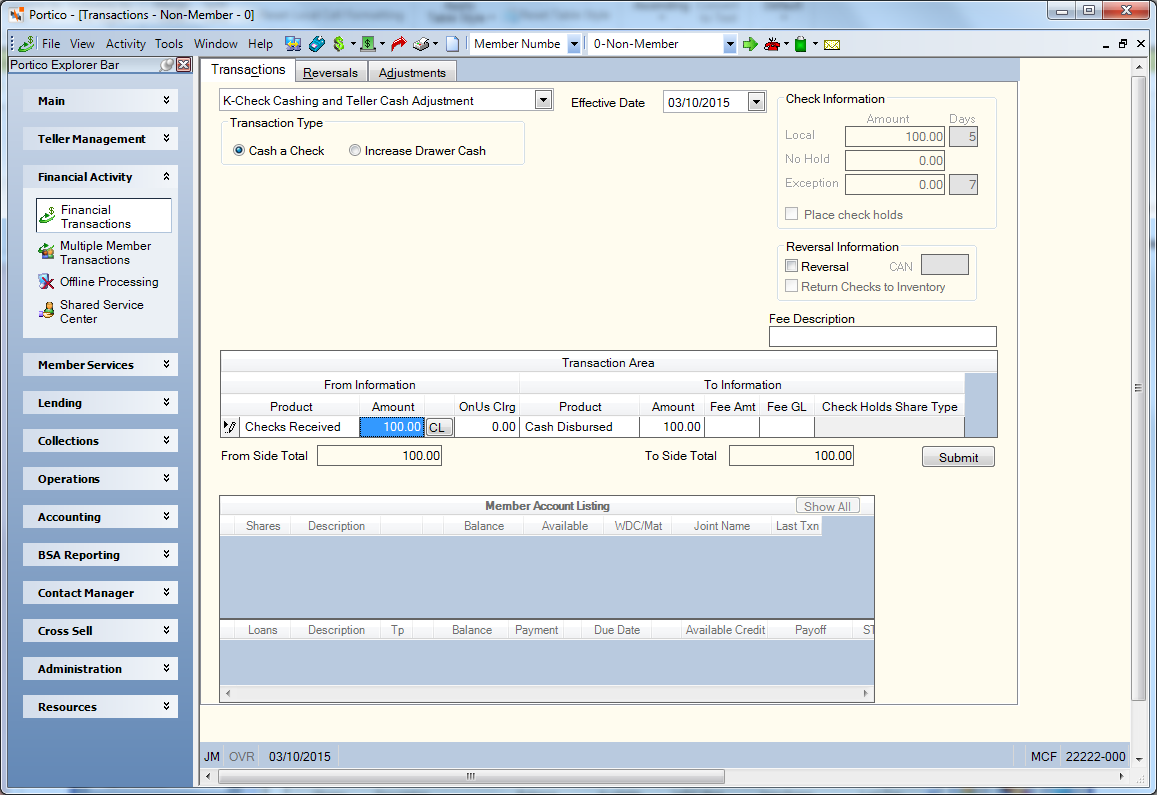

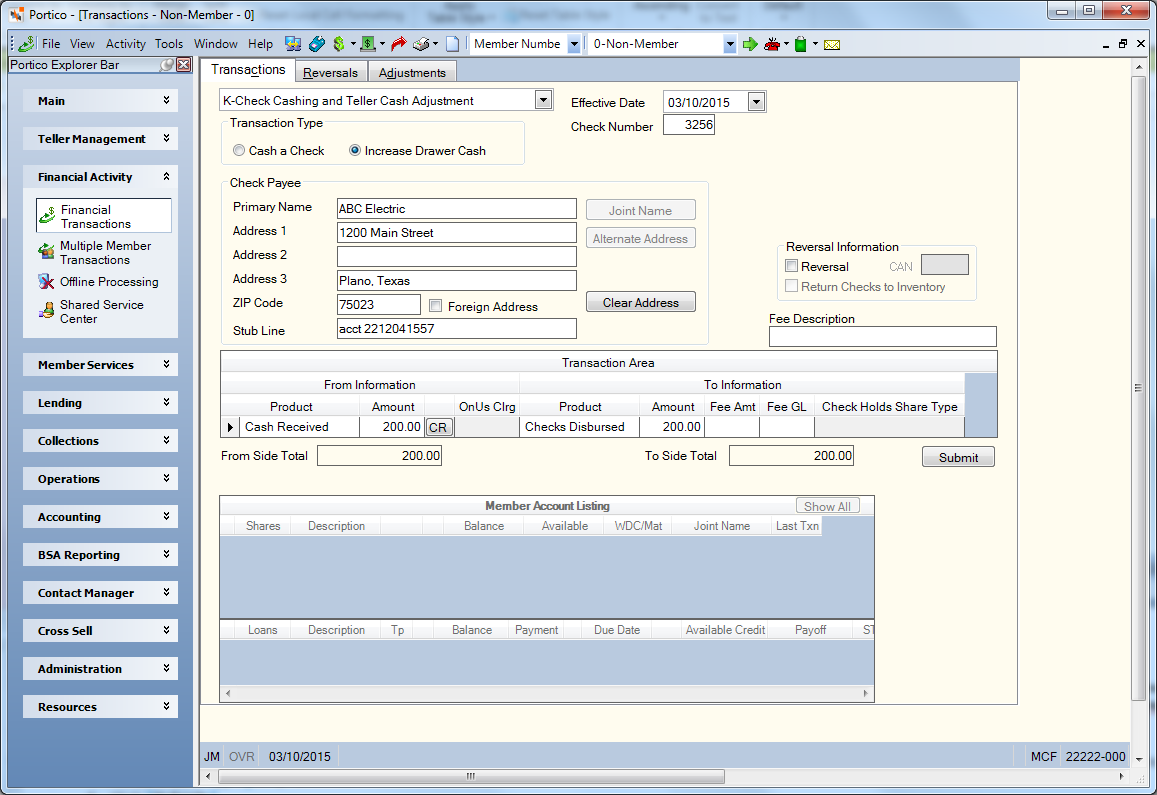

On the Transactions tab, click the down arrow next to the first drop-down box and select K-Check Cashing and Teller Cash Adjustment.

Cash a Check

Increase Drawer Cash

How do I? and Field Help

The Effective Date field will default to today's date. You can change the effective date by clicking the Effective Date down arrow to select a date from the pop-up calendar or entering a date in MM/DD/YYYY format (Keyword: ED). Dividend and interest calculations are based on this effective date. While future effective dating is not allowed on most transactions, you can specify a future effective date on some transactions.

To cash a check, click the Cash a check option to cash a check and disburse the funds using cash for member or non-member (Keyword: CK). The total of the cashed checks per teller is debited and credited to general ledger account 739299 when the teller closes.

To disburse a credit union check, click the Increase Drawer Cash option to receive cash from a member or non-member and disburse a credit union check (Keyword: TL). This option will simultaneously disburse a check and increase the cash in the teller drawer.

If you selected the Increase Drawer Cash option, complete the following additional information:

- If your credit union uses Forms Management or Check Register, you can view the next check number in sequence, or specify a check number in the Check Number field (Length: 6 alphanumeric / Keyword: CN).

- In the Check Payee group box, use the default payee address set up for the member, or enter the name and address of the member. For a credit union member, click Joint Name to change the payee to the joint owner. Click Alternate Address to change the payee address to the member’s alternate address. Click Clear Address to clear the address fields in the Check Payee group box. When used with a member account number, the member's full name prints on the disbursed check. If the Check Format field in the Options section on the Credit Union Profile - Print tab specifies A, the system prints the description, vendor code, general ledger account number, and the general ledger amounts on the check stub.

| Field | Description |

|---|---|

|

Enter the name of the individual or organization receiving the check. The system will print the name specified in this field on the check instead of the name associated with the member number. Length: 32 alphanumeric Keyword: NM If your credit union uses OFAC Processing through ID Verification, the payee name will be sent to ID Verification when a check is disbursed. If there is an OFAC match on the payee name, Portico will respond with Financial Transaction Complete - Possible OFAC Match. |

|

|

Enter the first line of the check recipient's address. Portico will print the information specified in this field on the check instead of the member's address from the Contact Information tab. You can type a second payee name in this field instead of the address. Length: 24 alphanumeric Keyword: A1 |

|

|

Enter the second line of the check recipient's address. Portico will print the information specified in this field on the check instead of the member's address from the Contact Information tab. If the Foreign check box is checked, the foreign city's name must reside in this field. Length: 24 alphanumeric Keyword: A2 |

|

|

Enter the third line of the check recipient's address. Portico will print the information specified in this field on the check instead of the member's address from the Contact Information tab. This field is required if the Foreign check box is checked. On a foreign address, only the first 18 characters are allowed. If the Foreign check box is checked, the maximum field length is 18 alphanumeric. If the Foreign check box is selected, the foreign country's name must reside in the Address Line 3 field. Enter the foreign country code in the Address Line 3 field. field. For Canada, enter the country name and province code in the Address Line 3 field. Length: 20 alphanumeric Keyword: A3 or N2 (The keywords A3 and N2 cannot be used together if you perform the transaction using speed input.) |

|

|

Enter the postal ZIP Code for the address listed. Portico will print the ZIP code specified in this field on the check instead of the member's ZIP code from the Contact Information tab. For domestic addresses, the ZIP code must be either 5 or 9 digits. For foreign addresses, the ZIP code can be up to 10 characters. If the Address is Foreign check box is not selected:

If the Address is Foreign check box is selected:

Length: 9 numeric (10 alphanumeric if the Address is Foreign check box is selected.) Keyword: ZP Reporting Analytics: MBR Zip Code Dash (Located in Member Information/Member Base subject and Month-end Information/Member Month-end/ME Member Base subject) |

|

|

Select this check box if the alternate address is foreign. If the Foreign check box is selected, the foreign city's name must reside in the Address 2 field. In the Address Line 3 field, enter the foreign country code. For Canada, enter the province code in the Address Line 3 field. Keyword: FF |

|

|

Enter a description of the check in the Stub Line field. Length: 40 alphanumeric Keyword: S1 |

Use the Transaction Area to complete the cash or check disbursal. Click New to begin a new transaction.

| Column Heading | Description |

|---|---|

|

From Product |

If the Cash a Check option is selected, Checks Received will appear. If the Increase Drawer Cash option is selected, Cash Received will appear. |

|

If the Cash a Check option is selected, enter the amount of the check to be cashed. If you selected check, the Check Log dialog box will pop up automatically when the cursor is in the From Amount column. You can also access the Check Log dialog box by clicking the CL button in the transaction area grid. You can activate the Check Log dialog box on the User Profile – Popups tab. If the Increase Drawer Cash option is selected, enter the amount of cash that will be added to the teller drawer. If you selected cash, the Cash Received dialog box will pop up automatically when the cursor is in the From Amount column. You can also access the Cash Received dialog box by clicking the CR button in the transaction area grid. You can activate the Cash Received dialog box on the User Profile – Popups tab. Length: 11 numeric including decimal Keyword: CA |

|

|

OnUs Clrg |

f the Cash a Check option is selected, and the check entered on the Check Log dialog box is an on-us check, the on-us check amount will appear. |

|

From Product |

If the Cash a Check option is selected, Cash Disbursed will appear. If the Increase Drawer Cash option is selected, Checks Disbursed will appear. |

|

To Amount |

If the Cash a Check option is selected, enter the amount of cash to be disbursed to the member or non-member. If the Increase Drawer Cash option is selected, enter the amount of the credit union check to be disbursed to the member or non-member. Length: 11 numeric including decimal |

|

Fee Amt |

To assess fee for the transaction, enter the fee amount. In the Fee Description field, enter the description of the fee that will be assessed for the transaction. Length: 40 alphanumeric Keyword: DE |

|

Fee GL |

The general ledger account that will receive the fee amount associated with the transaction |

|

Check Holds Share Type |

The share type in which the check hold will appear for a member |

Portico will calculate the total of the transaction Click Submit to complete the transaction.

Check Holds

You can enter the check and specify the check hold in the Check Log dialog box. If the Automated Check Holds field on the Credit Union Profile - Teller tab is D - Hold is placed where the deposit is being made, you can use the fields in the Check Information group box to indicate the number of days and the amount of check funds to be held.

| Field | Description |

|---|---|

|

The amount of local check funds to be held for the specified local hold days. The local check amount is determined using the following calculation: CHECK AMT - NON-LOCAL AMT - NO HOLD AMT = LOCAL CHECK HOLD AMT. Length: 12 numeric including decimal |

|

|

The number of days to hold the amount of the check deposit considered as local funds. If blank, this field will default to the number of days specified in the Local field in the Holds section on the Credit Union Profile - Teller tab. Length: 2 numeric |

|

|

The amount of check funds not being held. Length: 12 numeric including decimal Keyword: FI |

|

|

The amount of exception check funds to be held for the specified exception hold days. Refunds are not allowed on amounts held as exception funds. Length: 12 numeric including decimal Keyword: NL |

|

|

The number of days to hold the amount of the check deposit considered as exception funds. This field will default to the number of days specified in the Exception field in the Holds section on the Credit Union Profile - Teller tab. Length: 2 numeric |

Reversing a Transaction

To reverse a transaction, select the Reversal check box (Keyword: RV). Then, enter the computer-assigned number of the transaction you are reversing in the CAN field (Length: 5 numeric / Keyword: AN). If the reversal involves a credit union check, enter the check number originally disbursed in the Check Number field to void the check on the Check Register system. If desired, select the Return Checks to Inventory check box to return a reversed credit union check to inventory (Keyword: RI). If selected, the system will return the form to the location of the teller performing the transaction. If the form is part of your inventory, the system will place the form at the beginning of the inventory for the primary location. If not, the system will return the form to the beginning of the alternate location's inventory. The system will then remove the issue (I) record from the forms or check register file. The returned form will become the location's next available form for disbursement. If not selected, the system will not return the form to the location's inventory. The form will appear as a voided (V) item on the Forms Disbursal Journal tab and Check Register Report 900.

The member account listing appears on the Overview tab, Transactions tab, and Adjustments tab.

When you perform a cash disbursal with the Cash a Checkoption selected, the following occurs:

- DEBIT 739299 System-defined GL - checks cashed

- CREDIT 739299 System-defined GL - checks cashed

When you perform a check disbursal with the Increase Teller Cash option selected, the following occurs:

- DEBIT 739200 Teller cash GL account in the teller's branch

- CREDIT 731XXX General ledger account specified on the Open tab

Suspect Member Currency Transaction Report 840 (cash disbursal only)

For checks cashed using a cash disbursal, the Balancing and Close tab reflects the following information:

- Adds the total transaction amount to the Checks Received field, Cash Disbursed field, and the Checks Cashed Count and Amount fields

- Subtracts the total transaction amount from the Currency Balance field

If the Increase Drawer Cash check box is selected, the Balancing and Close tab reflects the following information:

- Adds the transaction amount to the Checks Disbursed field, Currency Balance field, Drawer Balance field, Other Receipts Amount field, Cash Received field, and the Other Disbursements Amount field

When used with a member account number, the member's full name prints on the disbursed check.

Portico Host: 871, 872