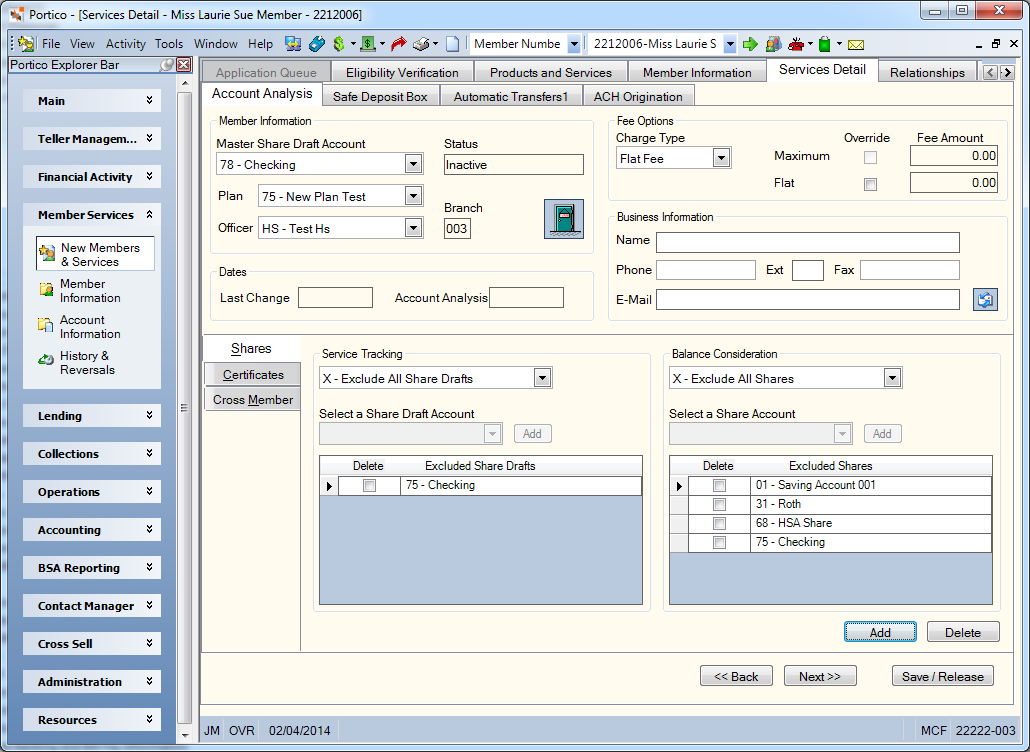

Services Detail: Setting Up Account Analysis

The Account Analysis tab lets you set up and maintain a member's Account Analysis options.

How do I? and Field Help

Complete the following fields to set up the fee options and member information for the member.

Select the Master Share Draft Account down arrow to select the master share draft type for the member's Account Analysis plan. If the member does not have the share draft account select from the Master Share Draft Account dropdown list, you will be prompted to create the account.

If the Social Security number is found in the closed account file, the message Previous account closed by credit union appears. To open the Closed Account File dialog box, select the Closed Account icon button. Then, you can use the Action Type dropdown list to temporarily suspend the cross reference check by changing the Action Type field to Suspend so you can add the new share draft account without deleting and re-adding the closed account record. Portico resets the Action Type field back to Stop during the nightly cycle.

If the ECA does not offset the total costs of services used by the member, and if the charge type is Soft Dollar or Flat Fee, the fees will be deducted from the master share draft account. The master share draft will always be tracked for services and included for balance consideration.

Select the Plan down arrow to select the Account Analysis plan. If the Account Analysis plan or any pricing codes on the Account Analysis plan are changed after month-end processing, the old Account Analysis plan and its pricing codes will be reflected on the Shares – Account Analysis tab and any preliminary report reruns and on the Analysis Statement. The new Account Analysis plan will only apply to current month data.

Select the Officer down arrow to select an Account Analysis officer. The branch associated with the officer automatically appears.

In the Fee Options group box, select the Charge Type down arrow to select Soft Dollar, Flat Fee, or Hard Dollar.

If the Charge Type field is Soft Dollar…

- All event-driven activity is captured for a potential analysis fee.

- Select the Maximum Override checkbox to override the Account Analysis plan default and use the amount entered in the Maximum Fee Amount field. Then, enter the maximum fee allowed in the Maximum Fee Amount field (Length: 6 numeric including decimal). If the total cost of services exceeds the maximum fee allowed, and then the amount in the Maximum Fee Amount field is debited from the member's Account Analysis master share draft account.

- The system will no longer charge hard dollar fees for any included share draft accounts listed in the Service Tracking group box.

If the Charge Type field is Flat Fee…

- All event-driven activity is captured for a potential analysis fee.

- Select the Flat Override checkbox to override the Account Analysis plan default and use the amount entered in the Flat Fee Amount field. Then, enter the flat fee in the Flat Fee Amount field (Length: 6 numeric including decimal). If the calculated earnings credit allowance is less than the total cost of services provided, and then the amount in the Flat Fee Amount field is debited from the member's Account Analysis master share draft account.

- The system will no longer charge hard dollar fees for any included share draft accounts listed in the Service Tracking group box.

If the Charge Type field is Hard Dollar…

- All event-driven activity will be captured through the analysis process to generate an analysis for future reference.

- The member is 'hard dollar' charged at event time for regular fees/services provided through daily Portico processing.

The Charge Type field for a member added to Account Analysis in the current month defaults to Hard Dollar even if Flat Fee or Soft Dollar is specified. Fees will continue to be charged through Flexible Fees or Relationship Pricing until the next month. The overdraft protection fee is the exception to the rule and will continue to hard dollar charge regardless of the member’s Account Analysis indicator.

If the account is a business account, enter the business name, phone number, fax number, and e-mail address in the Business Information group box. The business name will be used on the Account Analysis Statement Report 398 instead of the name that appears on the Contact Information tab.

| Field | Description |

|---|---|

|

The business name of the commercial account. This name will be used on the Account Analysis statement. Length: 40 alphanumeric |

|

|

The business telephone number for the commercial account. Length: 10 numeric |

|

|

The business telephone extension for the commercial account. Length: 4 numeric |

|

|

The fax telephone number for the commercial account. Length: 10 numeric |

|

|

The e-mail address for the business. Select the send button to send an e-mail to the address specified. Length: 50 alphanumeric |

Select Add to add the member to Account Analysis or select Save to update the member's Account Analysis options. When you add a member to Account Analysis, the Status field changes to New to Account Analysis. The Last Change field displays the date a change was last made to this member's Account Analysis settings. The Account Analysis date field displays the date the member was originally set up for Account Analysis.

To delete a member from Account Analysis, select Delete. You cannot delete a member from the system if the member is enrolled in Account Analysis. First delete the member from Account Analysis, then after the back-office cycle has run, delete the member from the system.

Select Close to close the Account Analysis dialog box without saving your changes.

Since the results of Account Analysis processing are based on a true calendar month-to-date process, the system will automatically populate the Account Analysis field in the Date group box with the date the member was added to Account Analysis. The system will also update the Account Analysis indicator on the Overview tab when a member is added to Account Analysis. If a member is new to analysis for the current processing month, the system will not assess fees through analysis for that month. If the member’s Date Joined date on the Contact Information tab and Account Analysis date on the Account Analysis dialog box are the same, the member may be charged for the first month according to the charge type selected.

All closed accounts are automatically removed from the Account Analysis dialog box by the back-office overnight cycle (except where the closed account is the master share draft account). The credit union must manually change the master share draft account to a non-closed account on the Account Analysis dialog box. The 585 Report (exception code 22) will identify that the fee could not be posted because the master share draft account is closed. Due to regulatory requirements, the system automatically closes any accounts that are negative for greater than 45 days. These closed accounts are automatically removed from the Account Analysis dialog box by back-office processing daily.

Shares Tab

The Shares tab on the Account Analysis dialog box lets you designate which of the member’s share draft accounts will be included or excluded for activity tracking for a combined Account Analysis. You can also include or exclude other share account balances in the earnings credit allowance calculation.

- On the Shares tab, select the Service Tracking down arrow to choose whether to include all, exclude all, include specified, or exclude specified share drafts. The master share draft will always be tracked regardless of the option selected.

- I - Include the specified shares drafts for share service tracking

- E - Exclude the specified shares drafts from share service tracking

- A - Include all the member's share drafts for share service tracking. No specific share types can be listed.

- X - Exclude all the member's share drafts from share tracking. No specific share types can be listed. System default.

- If you selected the Include Specified Share Drafts or Exclude Specified Share Drafts option, select the Select a Share Draft Account down arrow to select a share draft account. Then select Add. The share draft account appears in the grid. To delete a share draft account from the grid, select the Delete checkbox next to the account.

- In the Balance Consideration group box, select the down arrow to select include all, exclude all, include specified, or exclude specified shares.

- I - Include the specified shares for share balance consideration

- E - Exclude the specified shares from share balance consideration

- A - Include all the members shares for share balance consideration. No specific share types can be listed.

- X - Exclude all the members shares from share balance consideration. No specific share types can be listed. System default.

- If you selected the Include Specified Shares or Exclude Specified Shares option, select the Select a Share Account down arrow to select a share account. Then select Add. The share account appears in the grid. You can specify up to 22 share accounts to be included or excluded in Account Analysis. The month-end average collected balance(s) will be considered in the calculation of the earnings credit allowance. To delete a share account from the grid, select the Delete checkbox next to the account.

- Select Add. The Status field changes to New to Account Analysis.

When a member is flagged for analysis, the system will start accumulating activity for all of the member’s share draft accounts from the date added. You can select share drafts to be included in the process at any time during the month; however, the data is available only from the Account Analysis date. If the member has not been on Account Analysis for a full month, the average collected balances could be distorted and the accumulations of pricing records will only be from the Account Analysis date until the end of the month. The balances of new share accounts added during the month for existing Account Analysis members reflect the averages as of the date added to the system. If existing certificates or share accounts are added to the list for balance consideration, they reflect averages from the beginning of the month. This also applies for cross members, if the member was already listed but not if the cross member is newly added.

Certificates Tab

The Certificates tab on the Account Analysis dialog box lets you include or exclude the member’s certificate account balances in the earnings credit allowance calculation.

In the Balance Consideration group box, select the down arrow to select include all, exclude all, include specified, or exclude specified certificates.

- I - Include the specified certificates for balance consideration.

- E - Exclude the specified certificates from balance consideration.

- A - Include all the member's certificates for balance consideration. No specific certificates can be listed.

- X - Exclude all the member's certificates from balance consideration. No specific certificates can be listed. System default.

If you selected the Include Specified Certificates or Exclude Specified Certificates option, select the Select a Certificate Account down arrow to select a certificate account. Then select Add. The certificate account appears in the grid. You can specify up to 24 certificate accounts to be included or excluded in Account Analysis. The month-end average collected balance(s) will be considered in the calculation of the earnings credit allowance.

The Balance Consideration grid lists the member's certificate accounts that will be included or excluded in the earnings credit allowance calculation. To delete a certificate account from the grid, select the Delete checkbox next to the account. Select Update or Save.

Cross Member Tab

The Cross Member tab on the Account Analysis dialog box lets you include or exclude the share and certificate account balances of other member’s in the earnings credit allowance calculation. A member may only be added for ECA consideration to one Account Analysis member. If a member is used in a cross-member relationship for analysis, they may not be added to Account Analysis until the cross relationship is deleted.

- Select Add to add a new line to the Included Members grid. In the Member Number field, enter the member number to include. Select the Member Lookup icon to open the Member Search dialog box and locate the member. Then, press ENTER.

- Select the Share Balance Consideration down arrow to select include all, exclude all, include specified, or exclude specified share accounts. If you selected the Include Specified Shares or Exclude Specified Shares option, select the Share Accounts down arrow to select a share account. Then, select Add. You can specify up to 7 share accounts to be included or excluded in Account Analysis. The month-end average collected balance(s) will be considered in the calculation of the earnings credit allowance.

- Select the Certificate Balance Consideration down arrow to select include all, exclude all, include specified, or exclude specified certificate accounts. If you selected the Include Specified Certificates or Exclude Specified Certificates option, select the Certificate Accounts down arrow to select a certificate account. Then, select Add. You can specify up to 5 certificate accounts to be included or excluded in Account Analysis. The month-end average collected balance(s) will be considered in the calculation of the earnings credit allowance.

- Select Update or Save.

To delete a account from the grid, select the Delete checkbox next to the account.

none

Related Reports:

- Account Analysis Transaction Register Report 021

- Non-Financial Transaction Register Report 030 (when a member is set up with Account Analysis or when a member is deleted from Account Analysis)

Portico Host: 1AA

Click Next to continue with the next the step of the application or click Save/Release to save the application for completion at a later date. Click Back to move back to the previous tab.