Depositing Money to a Share Account

For more information about related topics, see IRAs | Share and Share Draft Accounts.

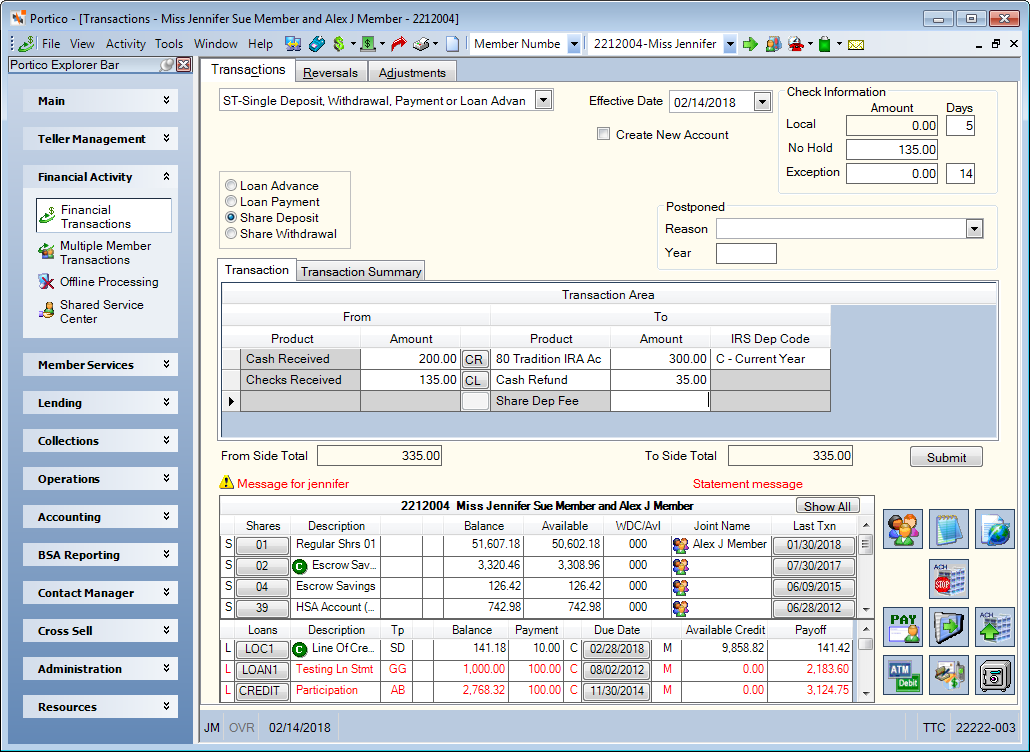

The Single Deposit, Withdrawal, Payment or Loan Advance tab lets you complete loan advances, loan payments, share deposits and share withdrawals for a member.

To access the Single Deposit, Withdrawal, Payment or Loan Advance tab, under Financial Activity on the Portico Explorer Bar, click Financial Transactions. The Transactions tab appears on top. Locate the member using the search tool on the top menu bar. Select the down arrow to select the search method, then enter the search criteria. Select the green arrow or press ENTER to locate the member.

On the Transactions tab, click the down arrow next to the first drop-down box and select ST-Single Deposit, Withdrawal, Payment or Loan Advance.

How do I? and Field Help

To make a share deposit, complete the following steps:

- The Effective Date field will default to today's date. You can change the effective date by clicking the Effective Date down arrow to select a date from the pop-up calendar or entering a date in MM/DD/YYYY format (Keyword: ED). Dividend and interest calculations are based on this effective date. While future effective dating is not allowed on most transactions, you can specify a future effective date on some transactions. The system will allow you to specify an effective date in the past when opening an account. The effective date cannot be less than the last post date of dividends.

- Click the Share Deposit option.

- To create a new account from the deposit, select the Create New Account check box (Keyword: NW).

- If you select IRS deposit code E, you must complete the Postponed Reason field and Postponed Year field.

- From the Postponed Reason drop-down list, select the reason for the postponed contribution. For IRA owners who were affected by a federally declared disaster area, the postponed code is FD. For qualifying Armed Forces members, use the appropriate code for the owners’ area of operations. The valid options are:

EO12744 - Arabian Peninsula

EO13119 – Federal Republic of Yugoslavia

EO13239 - Afghanistan

FD - Federal Designated Disaster Extension Contribution - In the Postponed Year field, enter the original year of the postponed contribution must be entered for each of the postponed contribution types. This cannot be the current year and can only be up to two years in the past. For example, if the current year is 2018, you can enter 2017 or 2016.

- From the Postponed Reason drop-down list, select the reason for the postponed contribution. For IRA owners who were affected by a federally declared disaster area, the postponed code is FD. For qualifying Armed Forces members, use the appropriate code for the owners’ area of operations. The valid options are:

- Use the fields in the Transaction Area to complete the share deposit. A From/To Difference amount will appear in the grid heading until the From and To amounts are equal.

| Column Heading | Description |

|---|---|

|

In the From Product column, select the payment method (checks received, cash received, cross account transfer, share account, share draft account, or loan advance). |

|

|

The amount of cash or checks. Length: 12 numeric If you selected cash, the Cash Received dialog box will pop up automatically when the cursor is in the From Amount column. You can also access the Cash Received dialog box by clicking the CR button in the transaction area grid. You can activate the Cash Received dialog box on the User Profile – Popups tab. If you selected check, the Check Log dialog box will pop up automatically when the cursor is in the From Amount column. You can also access the Check Log dialog box by clicking the CL button in the transaction area grid. You can activate the Check Log dialog box on the User Profile – Popups tab. |

|

|

Select the share type that will receive the deposit. Select the member loan from the List of Member Loans drop-down list. |

|

|

The amount of the deposit. If the amount entered in the To Amount field is less than the amount entered in the From Amount field, the system calculates the refund amount. If you enter an amount in the From Amount field and an amount in the Refund To Amount field, the system calculates the difference in the To Amount field. Length: 12 numeric including decimal Keyword: SA (share amount), CB (cash amount), RA (refund amount) |

|

|

If the funds will be deposited in an IRA, ESA or HSA share account, click the down arrow to select a valid IRS deposit code. Click here to view the valid list of IRS deposit codes. IRA deposits require an override teller ID if the account has reached the maximum contribution limit. If you select deposit code E, you must complete the Postponed Reason field and Postponed Year field. |

|

|

The type of refund to be disbursed. The valid options are: Cash refund. System default. Check refund |

|

|

The amount of the refund due for this transaction. The refund amount may be calculated by the system as the difference between the total of the cash and check amounts, and the total of the transaction and fee amounts. Length: 12 numeric including decimal Keyword: RA Funds deposited through non-local checks are not available for refund. |

|

|

The fee amount to be assessed. The fee description is defined on the Product Code Information window. For withdrawals, the product code used is tied to master code GIH. For deposits, the product code used is tied to master code GIG. Length: 10 numeric including decimal Keyword: FA |

Each time you perform the Single Deposit, Withdrawal, Payment or Loan Advance tab to open a new share account, the system checks the Closed Account File dialog box. If the member's Social Security number on the Contact Information tab matches a number on the Closed Account File dialog box, the message PREVIOUS ACCT CLOSED BY CU appears. You must delete the member information from the Closed Account File dialog box to complete the transaction.

The formula for the share deposit is: Check Amount + Cash Amount =Transaction Amount + Refund Amount +Fee Amount. When the total amount of the From Side product codes equals the total amount of the To Side product codes, click Submit to complete the transaction.

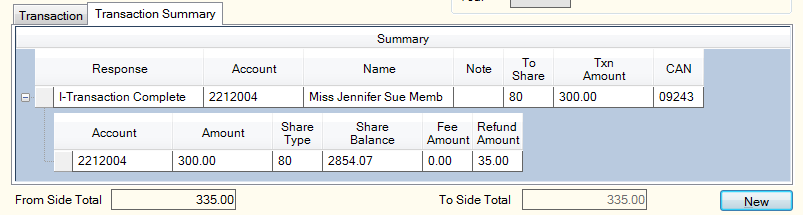

The Transaction Summary tab displays a summary of the share deposit.

The Check Information group box displays the check hold information for any checks received. Select the Print Hold Days on Receipt check box to print the check hold days on the transaction receipt (Keyword: PH).

| Field | Description |

|---|---|

|

The amount of local check funds to be held for the specified local hold days. The local check amount is determined using the following calculation: CHECK AMT - NON-LOCAL AMT - NO HOLD AMT = LOCAL CHECK HOLD AMT. Length: 12 numeric including decimal |

|

|

The number of days to hold the amount of the check deposit considered as local funds. If blank, this field will default to the number of days specified in the Local field in the Holds section on the Credit Union Profile - Teller tab. Length: 2 numeric |

|

|

The amount of check funds not being held. Length: 12 numeric including decimal Keyword: FI |

|

|

The amount of exception check funds to be held for the specified exception hold days. Refunds are not allowed on amounts held as exception funds. Length: 12 numeric including decimal Keyword: NL |

|

|

The number of days to hold the amount of the check deposit considered as exception funds. This field will default to the number of days specified in the Exception field in the Holds section on the Credit Union Profile - Teller tab. Length: 2 numeric |

The member account listing appears on the Overview tab, Transactions tab, and Adjustments tab.

Click New to begin a new transaction.

When creating a new HSA account on the Transactions – Single Deposit, Withdrawal, Payment or Loan Advance tab, a dialog box will appear requiring you to select the HSA coverage type: Self-only, Family, or Cancel. Clicking Cancel will default the HSA coverage type to Family.

Once you have selected the HSA coverage type, Portico will review the deposit amount to determine if adding the amount to the HSA will exceed the self-only or family coverage limit. If the deposit will exceed the contribution limit, an error message will appear.

Cash or Check Deposit to Share

- CREDIT 901XXX Share general ledger account specified in the Share Profiles - Account Information tab

- CREDIT XXXXXX Fee general ledger account

- CREDIT 731XXX Checks disbursed general ledger account specified on the Open tab for the check refund amount

- DEBIT 739200 Teller cash general ledger account for the amount of the deposit

Financial Transaction Register Report 420

The teller balancing effects are as follows:

- Adds the total receipts deposited to shares to the Share Deposits Amount field on the Balancing and Close tab

- Adds the total receipts collected as fees to the Other Receipts Amount field on the Balancing and Close tab

- Adds the amount of cash received to the Cash Received Amount field on the Balancing and Close tab

- Adds the amount of checks received to the Check Received Amount field on the Balancing and Close tab

If the member receives a refund, the Balancing and Close tab reflects the following:

- Adds the check refund amount to the Checks Disbursed Amount field

- Adds the cash refund amount to the Cash Disbursed Amount and Refunds Disbursed Amount fields

To reverse the transaction on the same day, perform the Reversals - Same Day Reversals tab. For a prior-day correction, perform Adjustments - Share Withdrawal from General Ledger tab to reverse the transaction.

Portico Host: Share: 261, 262